[Asia Economy Reporter Oh Hyung-gil] The simplified year-end tax settlement service on Hometax, which allows users to view the necessary proof documents for income and tax deductions, started on the 15th.

Users can also view data or apply/cancel consent for providing dependent family members' data using private certificates such as KakaoTalk, Payco, KB Kookmin Bank, and PASS. However, this service is only available on PC and cannot be used on the mobile Hometax application, so caution is required.

The operating hours for the Hometax simplified year-end tax settlement service are from 6 a.m. to midnight daily. From the 15th to the 25th, when usage is expected to be concentrated, continuous use per session is limited to 30 minutes to prevent system overload.

This year's simplified year-end tax settlement service has added data such as indemnity insurance payments for medical expenses, eyeglass purchase costs paid by credit card (cash receipt), monthly rent paid to public rental housing operators, and donations related to emergency disaster relief funds.

Confirmed data reflecting additional or corrected information from receipt issuing institutions will be provided starting from the 20th.

For deduction items where businesses are not obligated to submit data or obligated institutions have not submitted data, the employee must obtain proof documents directly from the receipt issuing institution and submit them to the company. This includes hearing aids, assistive devices for the disabled, eyeglass purchase costs paid in cash, and pre-school academy fees.

If medical expense data is not found in the simplified service or is inaccurate, it can be reported to the 'Unretrieved Medical Expense Reporting Center.' The reporting center operates until the 17th.

In particular, the 2020 year-end tax settlement simplified service allows data viewing and dependent family data provision consent application/cancellation using private certificates (KakaoTalk, Payco, KB Kookmin Bank, telecom PASS from three companies, Samsung PASS).

However, private certificates can only be used on PC and not on the mobile Hometax application. Joint certificates (formerly public certificates/financial certificates), administrative electronic signatures (GPKI), and educational institution electronic signatures (EPKI) can be used on both PC and mobile services.

Dependent family simplified data can only be viewed by the employee after the dependent family member consents to provide the data. Data for minor children born after January 1, 2002, can be viewed by the employee themselves after applying for 'Minor Child Data Viewing.'

The 'Convenient Year-End Tax Settlement Service,' which allows employees to prepare deduction reports and companies to prepare and submit payment statements on Hometax rather than the company’s own system, will be operational from the 18th.

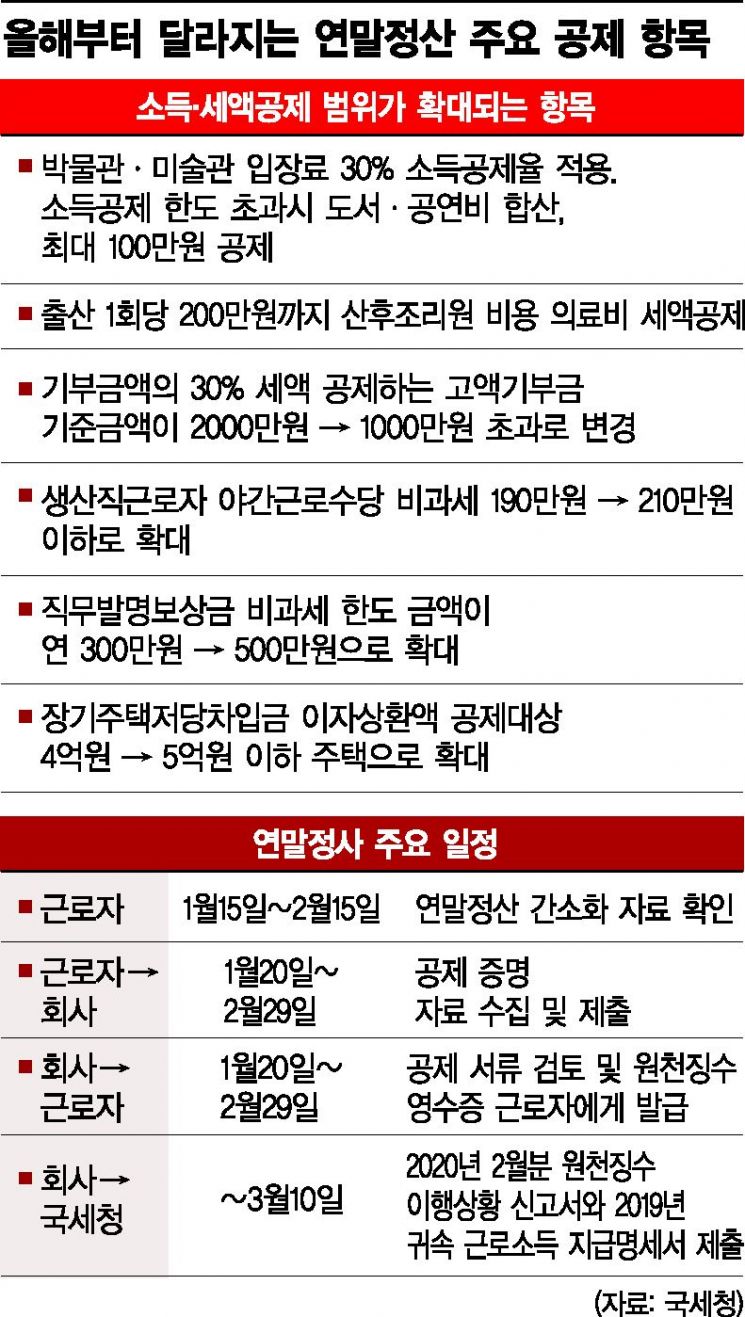

This year’s year-end tax settlement significantly expands card income deductions up to 80% depending on the consumption period. Even if the income deduction limit based on income is fully used, income deductions up to 1 million KRW each can be received for traditional markets, public transportation, and expenses for books, performances, museums, and art galleries. If the retrieved data differs from actual card usage, users can request a reissuance of the usage confirmation from the card company or separately submit proof of transactions to the company.

Additionally, from this year’s year-end tax settlement, tax-saving benefits can be utilized such as ▲new non-taxable spouse childbirth leave pay ▲income tax reduction for excellent personnel returning to Korea ▲expansion of the non-taxable limit for venture company stock option exercise gains to 30 million KRW.

Donations of emergency disaster relief funds are classified as statutory donations up to the amount received, and any amount donated beyond the received amount is classified as designated donations, both eligible for tax credits. If there are two or more wage earners in the household, one person among the head of household or household members can claim the full deduction.

Among medical expenses spent last year, indemnity insurance payments must be excluded from the medical expense tax credit application. If medical expense tax credits were claimed in the 2019 year-end tax settlement (January last year) and indemnity insurance payments were received last year, a revised tax return must be filed during the comprehensive income tax filing in May this year. Failure to file a revised return may result in unpaid taxes and penalties.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)