0.40%↓ Since First Trading Day of Year

KOSDAQ January Effect Disappears

Impact of Large-Cap Concentration Including Samsung Electronics

Individuals Spent 10 Trillion Won in Both Markets, Investing 8 Trillion Only in 10 Net Purchase Stocks

[Asia Economy Reporter Oh Ju-yeon] This year, as large-cap stocks have shown remarkable strength in the domestic stock market, the KOSDAQ market, which had been expected to benefit from the 'January effect,' is experiencing a decline in upward momentum. Although individual investors' participation in the stock market has become active, most of their investment funds have been concentrated in large-cap stocks, causing small- and mid-cap stocks to be relatively neglected during the January rally.

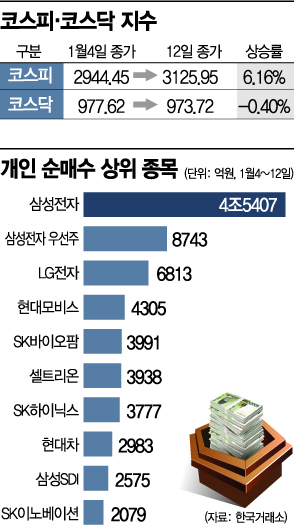

According to the Korea Exchange on the 13th, the KOSDAQ index closed at 977.62 on the first trading day of the new year, January 4, raising expectations for the era of 'KOSPI 3000 and KOSDAQ 1000.' However, by the close on the 12th, it fell to 973.72, unable to advance further, marking a 0.40% decline. In contrast, during the same period, the KOSPI rose 6.16%, from 2944.45 to 3125.95.

Statistics showing that the KOSDAQ index's January gains surpass those of the KOSPI have not yet applied through the first week of this year. Even when extending the period back to November last year, when foreign inflows surged and the domestic stock market soared, the KOSDAQ's gains still lag behind the KOSPI's. From November 2 to January 11, the KOSPI rose 36.88%, while the KOSDAQ index increased by only 21.63%.

Typically, the KOSDAQ has outperformed the KOSPI in January. This is because investors repurchase stocks in January that they had reduced in December to avoid year-end major shareholder capital gains tax requirements, and because early in the year, operating profit estimates tend to be evaluated optimistically. This characteristic is especially pronounced in the KOSDAQ market, which has a high proportion of individual investors, making the 'January effect' generally stronger in the KOSDAQ market.

According to a calculation by Daishin Securities of the average monthly excess returns of the KOSDAQ over the KOSPI from 2001 to 2020, the KOSDAQ's returns in January outperformed the KOSPI by 4.2 percentage points, the highest among all 12 months. In terms of winning rate, out of 240 months from 2001 to 2020, the KOSDAQ recorded higher returns than the KOSPI in only 105 months (43.8%), but in January, it did so in 13 out of 20 months, showing a winning rate of 65.0%.

It is also interesting that when stock prices rise in January, the annual returns tend to be positive. From 1981 to 2020, when the KOSDAQ index rose in January, the stock price increased during the year 46.7% of the time, which is less than the KOSPI's 80%, but when the KOSDAQ index rose in January and ended the year with gains, the average annual return was 64.6%, higher than the KOSPI's 33.9%. Conversely, when prices fell in January, even if annual returns rose, the increase was limited to 14.6%.

SK Securities also analyzed that the January effect has historically appeared mainly in the KOSDAQ. Since 2010, over 11 years, the KOSPI has risen an average of 0.7% in January, while the KOSDAQ rose 2.6%. The probability of gains was 54.5% for the KOSPI and 72.7% for the KOSDAQ.

However, this year's weaker January gains in the KOSDAQ compared to the KOSPI are due to individual investors concentrating their purchases on large-cap stocks such as Samsung Electronics, LG Electronics, and Hyundai Motor. Since the beginning of the year, the stock most purchased by individuals across both the KOSPI and KOSDAQ markets was Samsung Electronics. From January 4 to 12, individuals bought Samsung Electronics shares worth 4.5407 trillion won, ranking first in net purchases. The second was Samsung Electronics preferred shares, with net purchases of 874.3 billion won.

The total net purchases by individuals in the stock market this year amount to over 10.644 trillion won, with 8.55 trillion won in the KOSPI market and 2.0941 trillion won in the KOSDAQ market. More than half of this amount (5.415 trillion won) was poured into Samsung Electronics and its preferred shares alone, accounting for 50.87% of the total.

Excluding exchange-traded funds (ETFs), the top 10 net purchased stocks were all KOSPI-listed companies: LG Electronics (681.3 billion won), Hyundai Mobis (430.5 billion won), SK Biopharm (399.1 billion won), Celltrion (393.8 billion won), SK Hynix (377.7 billion won), Hyundai Motor (298.3 billion won), Samsung SDI (257.5 billion won), and SK Innovation (207.9 billion won). Individuals spent a total of 8.4611 trillion won on these 10 stocks alone, concentrating 80% of their funds on them.

Lee Kyung-min, a researcher at Daishin Securities, said, "Unlike in the past, individual net purchases are mostly concentrated in large-cap stocks," adding, "The January small-cap rally usually occurs as a rebound in the following month for stocks that fell significantly the previous month. However, since small-cap stocks in both the KOSPI and KOSDAQ recorded positive returns in December last year, the probability of a small-cap rally this year may be somewhat lower."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)