CM Channel Premium Income Surge

Kyobo Life and Carrot Quick Steps

"Must Differentiate from Existing Insurers"

[Asia Economy Reporter Oh Hyung-gil] Since the outbreak of the novel coronavirus disease (COVID-19), non-face-to-face interactions have become a key topic in the insurance industry. With the introduction of various non-face-to-face services, cyber marketing (CM) channel premium income has also surged. However, digital-only insurance companies are evaluated to have fallen short of expectations due to their failure to differentiate themselves from traditional insurers.

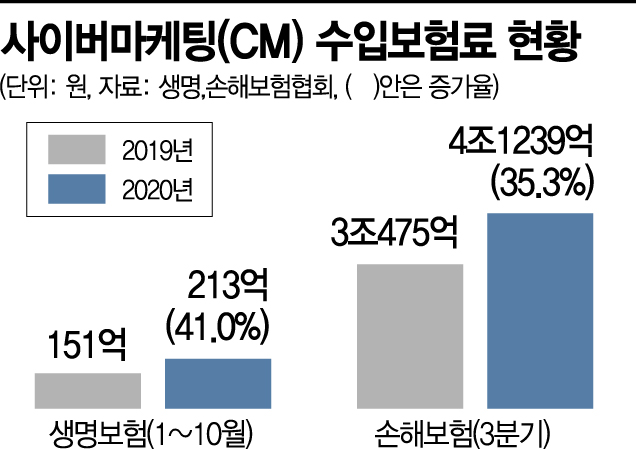

According to the Life and Non-life Insurance Associations on the 12th, out of the total premium income of 69.9205 trillion KRW collected from customers by non-life insurers up to the third quarter of last year, CM channel premiums accounted for 4.1239 trillion KRW. This represents a 35.3% increase compared to 3.0475 trillion KRW in CM premiums during the same period the previous year.

The proportion of CM channels within the total premiums also grew by 1.1 percentage points, from 4.7% in 2019 to 5.8% last year.

In life insurance, the first-time premiums paid through CM channels from January to October last year reached 21.3 billion KRW, a sharp increase of 41.0% compared to 15.1 billion KRW in the same period the previous year. This is a notable growth trend in the life insurance market, where CM insurance sales have been relatively less active compared to non-life insurers selling automobile insurance.

As face-to-face sales slowed due to COVID-19, insurance companies expanded their focus on online and direct channels. Samsung Fire & Marine Insurance recorded premium income of 1.9908 trillion KRW through CM channels, a 21.5% increase from 1.6382 trillion KRW in the same period last year.

The share of CM channels in Samsung Fire & Marine Insurance’s total premium income of 16.5456 trillion KRW reached 12.0%. DB Insurance and Hyundai Marine & Fire Insurance each achieved CM channel premiums of 552.1 billion KRW and 548.7 billion KRW, marking over 50% growth compared to the previous year.

Samsung Life Insurance posted CM premium income of 3.3 billion KRW last year, up 22.2% from 2.7 billion KRW in the same period the previous year. Notably, KB Life Insurance revised its pension insurance products into mobile bancassurance-exclusive products, resulting in CM channel premiums soaring from 3.1 billion KRW to 9.0 billion KRW during the same period.

The growth factors are analyzed to be the insurance companies’ introduction of products utilizing online or direct channels in response to consumers’ changing preferences, who felt burdened purchasing insurance products through face-to-face channels with agents.

On the other hand, the performance of digital-only insurance companies was modest.

Kyobo Lifeplanet, which relies 100% on the CM channel without agents, recorded first-time CM premiums of 480 million KRW, a 12.7% decrease compared to 550 million KRW in the same period last year.

Carrot General Insurance, a digital non-life insurer, also showed a gap compared to major companies with CM premiums totaling 11.7 billion KRW accumulated through the third quarter in its first year of operation last year.

Competition among digital-based insurers is expected to intensify further this year. Kakao Pay is planning to establish a digital insurance company in the second half of the year, signaling changes in the CM market.

An industry insider said, "Digital-only insurers still face limitations in organization and scale to directly compete with existing insurers," but added, "Since the digital insurance sector can expand mainly among the 20s and 30s age group, a long-term strategic approach is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.