All Led by Individuals but Shift from Funds to Direct Investment

Debt Investment Scale Increases but Remains Stable Compared to Market Cap

"Trend of Rising Continues with Government Encouragement of Stock Investment"

[Asia Economy Reporter Minwoo Lee] Since the beginning of the new year, the KOSPI has shown a sharp upward trend, reaching the 3100 mark for the first time in history. Unlike 2005, when the index first surpassed the 1000 mark after about 15 years of a trading range, individual investors have led the market this time. Additionally, unlike the fund craze of the past, the market is growing centered on direct investment, and the liquidity risk among individuals is considered limited compared to before.

According to the Korea Exchange on the 10th, the KOSPI closed at 3,152.18 on the 8th, marking an all-time high closing price. After breaking through the 3000 mark intraday for the first time on the 6th, it surpassed the 3100 mark within two days. It broke through the 'trading range' that had rarely exceeded the mid-2000s since 2007 and moved into a new territory. There are claims that it is necessary to compare and analyze this with the period from 2004 to 2007, when the trading range that lasted about 15 years was broken and the index settled in the 2000s.

Direct Investment Instead of Funds... Individual Investors Lead the Breakout from the Trading Range

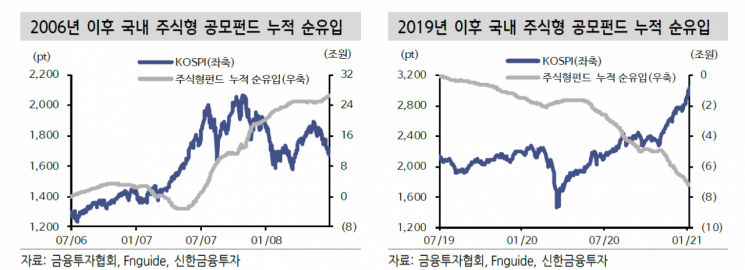

The main driving force behind breaking through the KOSPI 2000 and 3000 barriers was the power of individual investors. However, there is a difference between the current market and 2007. The current market is led by direct investments from individuals represented by the 'Donghak Ants' (Donghak Gaemi). During the 2004-2007 period, when the market was booming due to the China special, there was a strong fund craze. Dami Kim, a researcher at Shinhan Financial Investment, explained, "In the past, indirect investment methods investing in already composed portfolios were common. In contrast, recently, due to increased accessibility to information through online media such as YouTube, investors are redeeming equity funds and directly investing in individual stocks."

In fact, from 2004 until before the global financial crisis in 2008, installment savings-type funds, where a fixed amount was invested monthly, became wildly popular, leading to rapid growth in the equity mutual fund market. The net asset value (AUM) of domestic equity mutual funds, which was only about 6.7 trillion KRW at the beginning of 2004, surged to 64 trillion KRW by the end of 2007. This represents roughly a tenfold increase in four years.

The proportion of individual customers in the sales balance also reached 94.5% by the end of 2007. Among sales channels, banks accounted for 60-70%, far surpassing securities firms. Researcher Kim analyzed, "At that time, investors regarded funds as substitutes for bank savings products that earned returns by accumulating fixed amounts without special investment strategies. Compared to recent individual investors who aggressively select stocks and invest, they were somewhat passive."

Recently, a sharp shift toward direct investment has been detected. According to financial information provider FnGuide, the domestic equity fund assets under management stood at 38.8987 trillion KRW at the end of last year, having decreased by 17.44 trillion KRW during the year. On the other hand, individuals net purchased a total of 63.7 trillion KRW worth of stocks in the KOSPI market (47.4 trillion KRW) and KOSDAQ market (16.3 trillion KRW) last year. The most purchased stock was Samsung Electronics, with net purchases amounting to 9.5952 trillion KRW. Including Samsung Electronics preferred shares, the net purchase amount reached 15.7 trillion KRW.

Smarter Individual Investors... Faster Market Response

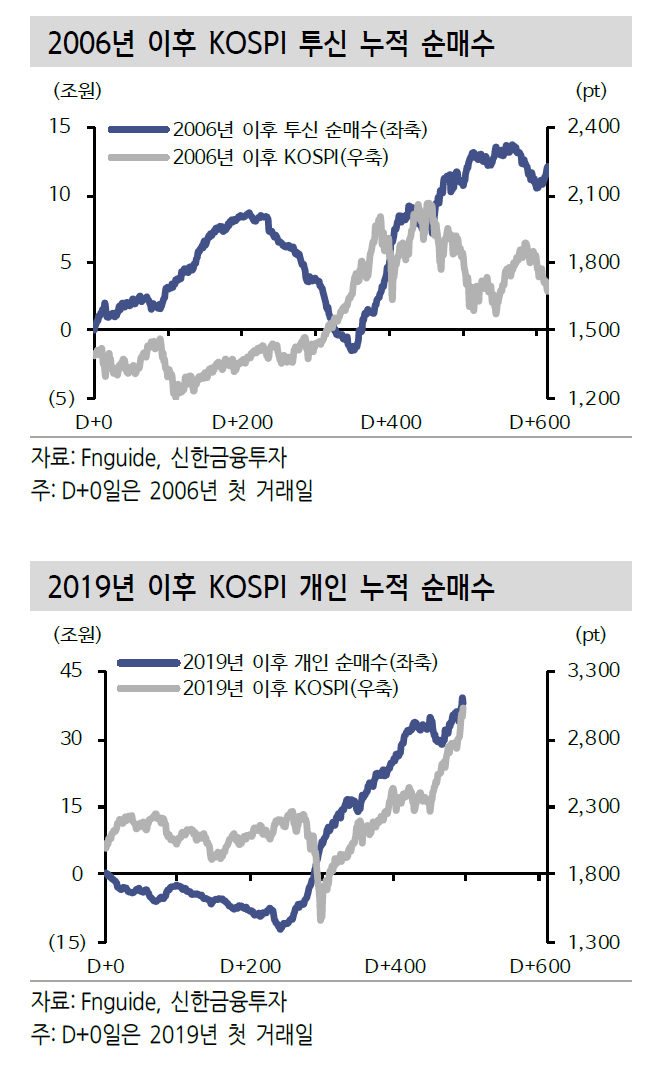

As direct investment increases, evaluations suggest that individual investors' speed in responding to market changes has noticeably accelerated compared to the past. Researcher Kim said, "While the KOSPI trust fund inflows, representing indirect investment, slightly lagged the index during the 2006-2007 rise, the KOSPI individual inflows, indicating direct investment, moved ahead of the index since March last year, acting swiftly. Since the spread of COVID-19, individual participation in the stock market has increased, and more investors have become agile in responding to market changes."

The inflows of leading stocks contributing to the market rise showed similar movements. Trust fund inflows into cyclical stocks such as chemicals and steel, which were classified as beneficiaries of China's growth from 2004 to 2007, began in earnest after the KOSPI broke through 2000. In contrast, the scale of individual direct investment in sectors identified as growth stocks after COVID-19, such as IT and healthcare, has steadily increased since early last year.

Researcher Kim diagnosed, "Installment fund investments popular until 2007 could achieve high returns with little effort during upward trends but were vulnerable during crises like the 2008 subprime mortgage crisis. After the COVID-19 shock, individual investors are actively responding to crises by utilizing diverse information, building on lessons learned from the financial crisis."

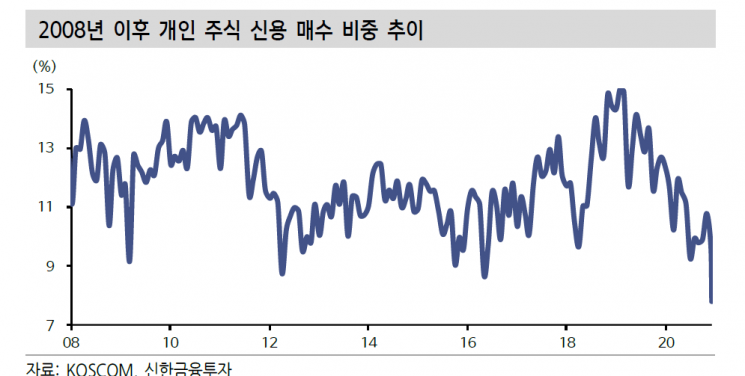

Individual Liquidity Risk Also Limited Compared to the Past

Analyses show no particular risk signs compared to 2007 in terms of customer deposits, which are funds waiting to be invested by individuals, and credit loan balances. Researcher Kim explained, "After the KOSPI broke through 2000 in July 2007, customer deposits as a proportion of total market capitalization recorded 1.6% and then sharply declined. In contrast, the current customer deposit ratio has remained around 3% even after the KOSPI hit new highs in the fourth quarter of last year."

Concerns about a surge in 'debt investing'?buying stocks on margin?are also limited compared to the past. In July 2007, the credit loan balance surged 14 times within five months following the introduction of a credit trading activation system in February of that year, increasing the risk of forced liquidation due to sharp price fluctuations. In contrast, according to the Korea Financial Investment Association, as of the 7th, the credit loan balance stood at 20.1223 trillion KRW (10.1319 trillion KRW in KOSPI, 9.9903 trillion KRW in KOSDAQ). Although this is the highest level since records began in 1998, it is considered stable relative to market capitalization. Researcher Kim explained, "The proportion of individual stock credit purchases also remains below the average level of 11% since the financial crisis due to strict risk management by securities firms."

Since government policies also encourage individual stock investment, the individual-led market trend is expected to continue. Although concerns about overheating in asset markets disconnected from the real economy have been raised, the real estate market is more likely to be targeted first than the stock market. Researcher Kim predicted, "The ruling party and government regard the KOSPI breaking through 3000 as a major achievement and have hinted at long-term investment tax benefits and further extensions of the short-selling ban since the end of last year. Despite concerns about short-term speed adjustments, the individual-led stock market trend will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)