Operating Profit Expected to Reach 920 Billion KRW This Year

Target Stock Price Set Up to 48,000 KRW

[Asia Economy Reporter Minji Lee] GS Engineering & Construction is expected to see improved performance due to a favorable housing market. In the securities industry, GS Engineering & Construction is presented as the top pick among construction stocks, with target prices being raised.

According to financial information provider FnGuide on the 9th, GS Engineering & Construction's estimated sales for the fourth quarter of last year are 2.7135 trillion KRW, which is expected to decrease by about 3% compared to the same period last year. Operating profit is expected to grow by about 11.86% to 203.6 billion KRW.

Sales are projected to decline due to decreased revenue in the plant and civil engineering sectors despite growth in the housing sector. However, similar to the third quarter, a favorable profit margin is expected to continue, showing a double-digit increase in operating profit. Net profit is likely to have decreased due to foreign exchange valuation losses caused by a decline in exchange rates.

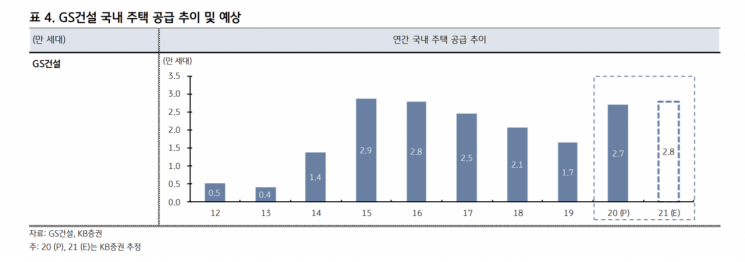

This year, profit improvement is expected based on increased housing supply. Last year's housing supply was 26,909 units, significantly up from 16,616 units the previous year. Due to the spread of COVID-19, the Songdo delayed project (1,500 units) and a total of 3,000 units' supply were postponed to early this year. Considering this, housing supply is expected to exceed 30,000 units this year.

Song Yurim, a researcher at Hanwha Investment & Securities, said, "There is growth in construction orders centered on housing, an increase in apartment supply nationwide, and an expansion of market share by large construction companies. Based on strong apartment brands, it is necessary to pay attention not only to housing-centered performance improvement but also to whether orders or supply exceed expectations."

Sales from the Vietnam Nabe project and new businesses are also anticipated. Sales from the Vietnam Nabe project are expected to be recognized in the second half of this year or early next year based on delivery. Sung Jeonghwan, a researcher at Hyundai Motor Securities, explained, "Concerns about overseas sites have significantly decreased compared to the past, and sales from new businesses such as Vietnam are expected. Due to increased new business performance, annual operating profit next year is expected to exceed 1 trillion KRW, showing a significant increase."

The securities industry estimates operating profit this year to be around 920 billion KRW. Sales are estimated to reach about 11 trillion KRW. Last year, GS Engineering & Construction is expected to have recorded sales of 10 trillion KRW and operating profit of 750 billion KRW.

Target prices have also been revised upward. The securities industry has suggested target prices ranging from 42,000 KRW to 48,000 KRW, with Hana Financial Investment offering the highest target price. Yoon Seunghyun, a researcher at Hana Financial Investment, said, "The valuation of the construction sector, which had been excessively low, is in the process of normalization. The overseas business structure improvement through the expansion of GS Inima, which operates water treatment concession business, and Danwood, which operates detached housing business, is also positive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)