Closing Price Surpasses 3,000 for the First Time Ever

13 Years and 5 Months After Breaking 2,000

[Asia Economy Reporter Song Hwajeong] The KOSPI crossed the 3000-point mark for the first time ever based on the closing price on the 7th, ushering in the 'KOSPI 3000 era.' It showed a steep upward trend recently, recording the highest growth rate among the Group of Twenty (G20) countries.

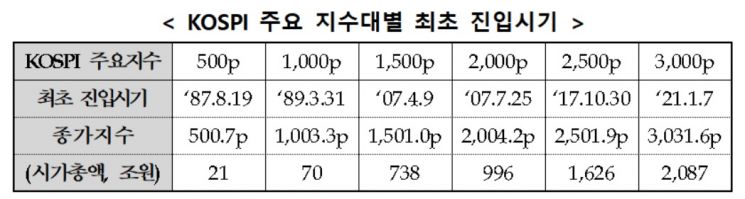

According to the Korea Exchange on the 7th, the KOSPI closed at 3,031.68 points, surpassing the 3000-point mark for the first time in history based on the closing price.

This is the first time the KOSPI has entered the 3000-point range since the current KOSPI index was announced, and it is the first time in 13 years and 5 months since it first crossed 2000 points on July 25, 2007. The KOSPI market capitalization also exceeded 2,000 trillion won for the first time ever, achieving 2,000 trillion won after 10 years and 4 months since it first reached 1,000 trillion won.

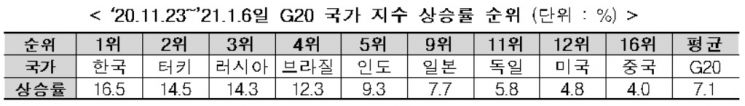

The KOSPI showed relative strength compared to global stock markets. After hitting its lowest point in March last year due to the spread of the novel coronavirus disease (COVID-19), the KOSPI showed the fastest recovery among the G20 countries and recorded the highest stock market growth rate last year. In particular, since breaking its all-time high on November 23 last year after 2 years and 6 months, the growth rate reached 16.5% as of this day, the highest among G20 countries, significantly surpassing the G20 average of 7.1%.

Compared to 2007, when the KOSPI first entered the 2000-point range, traditional manufacturing sectors such as shipbuilding, shipping, steel, and chemicals recorded high stock price growth rates, whereas this year IT, electric vehicles, batteries, and bio sectors led the market.

The proportion of individual trading increased from 52.6% in 2007 to 69%. In 2007, individuals participated in the stock market through indirect investment via equity funds, while last year and this year, they participated through direct investment. As of early this year, customer deposits amounted to 69.4 trillion won, and the number of active stock trading accounts reached 35.63 million, marking an all-time high.

Valuation levels were similar to those in 2007. The KOSPI price-to-earnings ratio (PER) slightly increased from 13.9 times in 2007 to 14.7 times recently. The capitalization rate, which represents the market capitalization relative to gross domestic product (GDP), expanded from 106% to 128%. The price-to-book ratio (PBR) decreased from 1.73 times in 2007 to 1.19 times.

An official from the Korea Exchange explained, "Despite recent controversies over stock market overheating, the fact that the KOSPI surpassed the 3000-point mark for the first time ever reflects a positive evaluation of our stock market fundamentals, including export growth based on global economic recovery and improved corporate earnings. However, risks include the possibility of a correction due to the historically high valuation levels of global stock markets overall and concerns about inflation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)