On the 7th, the Shale Gas theme rose 3.12% compared to the previous day, showing strength, while SK Gas, which is attracting attention as a related stock, surged 9.95% compared to the previous day. SK Gas is known as a liquefied petroleum gas (LPG) company affiliated with the SK Group.

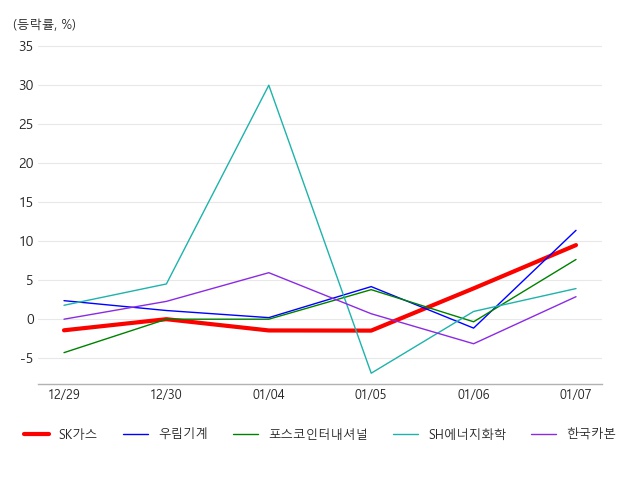

[Graph] Major stock price changes in the Shale Gas theme

According to provisional data compiled at 10:51, institutional investors are net buying 0.10 million shares of SK Gas.

[Table] Net trading volume of foreigners and institutions (unit: 10,000 shares)

According to the analysis by Thinkpool Robo Algorithm RASSI, SK Gas’s quant financial score is 48.58 points, ranking 6th within the Shale Gas theme, with higher stability and profitability scores than the average of other related stocks. This indicates that SK Gas’s ability to respond to internal and external economic environment changes and its efficient profit-generating capacity are better compared to other stocks in the theme from a financial perspective.

[Table] Top stocks by financial score within the theme

※ The quant financial score is the result of the Robo Algorithm’s analysis based on each company’s sales growth rate, equity growth rate, debt ratio, current ratio, ROA, ROE, and other factors.

※ This article was generated in real-time by an automatic article generation algorithm jointly developed by Asia Economy and the financial AI specialist company Thinkpool.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.