Kyobo Ranks First in Capital Adequacy Ratio

Samsung's Internal Transactions Exceed 34 Trillion Won

[Asia Economy Reporter Oh Hyung-gil] Most financial groups with assets exceeding 5 trillion won have steadily increased their risk response capacity. On the other hand, Mirae Asset's capital adequacy ratio has decreased, indicating a need for capital management.

According to the financial sector on the 4th, six financial groups including Samsung (Samsung Life Insurance), Mirae Asset (Mirae Asset Daewoo), Hanwha (Hanwha Life Insurance), Hyundai Motor (Hyundai Capital), Kyobo (Kyobo Life Insurance), and DB (DB Insurance) disclosed their consolidated financial group reports as of the third quarter of 2020 through their representative companies on the 31st of last month. This is the second disclosure since the first one in September last year, covering 25 items such as ownership and governance structure, capital adequacy, and internal transactions.

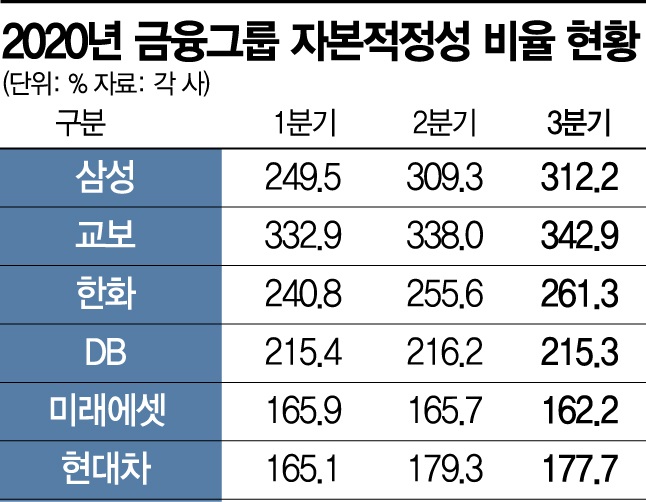

The capital adequacy ratio, which evaluates the loss absorption capacity at the financial group level, was led by Kyobo among the six financial groups. The capital adequacy ratio is calculated by dividing eligible capital (loss absorption capacity) by required capital (the sum of minimum required capital by business sector).

Kyobo's capital adequacy ratio steadily increased from 332.9% in Q1 to 338.0% in Q2, and 342.9% in Q3. Samsung also secured capital, raising its capital adequacy ratio by a remarkable 62.7 percentage points from Q1 to 312.2%. Hanwha, which had 240.8% in Q1, increased by 20.5 percentage points to 261.3% in Q3.

On the other hand, DB and Hyundai Motor's capital adequacy ratios slightly decreased to 215.3% and 177.7%, respectively, compared to the previous quarter. Especially, Mirae Asset has shown a downward trend in capital adequacy ratio since Q1, dropping from 165.9% in Q1 to 165.7% in Q2, and further to 162.2% in Q3.

The surplus capital, which is the difference between eligible capital and required capital, was highest for Samsung at 46.8903 trillion won. It was followed by Hanwha (10.884 trillion won), Kyobo (10.5534 trillion won), Hyundai Motor (7.2095 trillion won), DB (4.4844 trillion won), and Mirae Asset (4.1022 trillion won).

From the Second Half, Financial Authorities to Manage and Supervise Financial Groups

Although all financial groups exceeded the regulatory ratio of 100% set by financial authorities, they must pay closer attention to managing their capital adequacy ratios going forward.

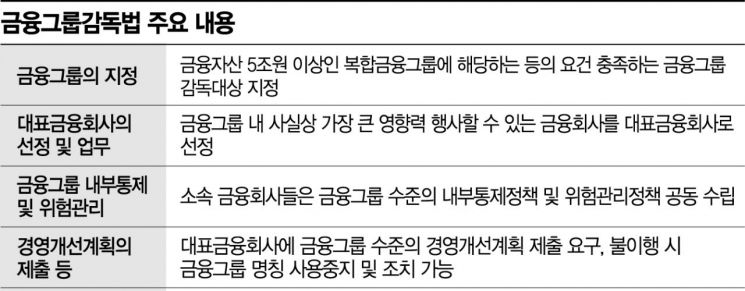

With the enactment of the "Act on the Supervision of Financial Conglomerates" at the end of last year, financial authorities will be able to manage and supervise financial groups starting from the second half of this year.

The Act on the Supervision of Financial Conglomerates designates groups as "financial conglomerates" if they operate two or more financial businesses among lending and deposit-taking, insurance, and financial investment, and if the total assets of affiliated financial companies exceed 5 trillion won, meeting criteria set by presidential decree.

Once designated as a financial conglomerate, the representative financial company must oversee and consolidate all tasks such as internal control, risk management, and soundness management, and submit reports to financial authorities.

Additionally, financial groups with capital adequacy ratios below 100% or poor risk management must submit management improvement plans to financial authorities, including capital expansion or disposal of risky assets. If these plans are not implemented, financial authorities may order prohibition of name usage or take measures under relevant financial laws.

Meanwhile, Samsung's internal transactions among affiliates exceeded last year's scale.

As of Q3, Samsung's internal transaction volume was 34.2351 trillion won, the highest among the six financial groups, surpassing the 33.2525 trillion won recorded in 2019.

Mirae Asset followed with internal transactions of 12.716 trillion won, then Kyobo with 10.6588 trillion won, Hanwha with 7.7143 trillion won, DB with 3.8655 trillion won, and Hyundai Motor with 6.014 trillion won.

The six financial groups must disclose quarterly reports within three months from the end of each quarter and annual reports within five months and 15 days.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)