As social distancing and remote work measures have been strengthened due to the novel coronavirus infection (COVID-19), people have been spending more time at home. Meals and shopping that were previously done outside are now being handled through the internet or smartphone applications. According to Statistics Korea, the online shopping transaction amount reached 14.2445 trillion KRW in October last year, a 20.0% increase compared to the same period the previous year. Since August last year, the online shopping transaction amount has consistently stayed above 14 trillion KRW each month. Consequently, there is growing confidence in the forecast that this year's online shopping transaction amount will surpass 160 trillion KRW. Along with the increase in online shopping transactions, parcel delivery volumes have also been continuously rising. According to data received by Kang Jun-hyun, a member of the National Assembly Land, Infrastructure and Transport Committee from the Ministry of Land, Infrastructure and Transport, the parcel delivery volume from the beginning of last year until August reached approximately 2.16034 billion parcels, a 20.0% increase compared to the same period the previous year. Demand for corrugated cardboard used in food delivery trays and parcel boxes has also increased. Asia Economy examines the performance and financial status of paper manufacturers Seha and Taerim Packaging, which are growing alongside the expansion of the untact (contactless) consumption culture, and assesses their future growth potential.

[Asia Economy Reporter Yoo Hyun-seok] Seha is benefiting from the spread of COVID-19. As food delivery through delivery services has increased instead of dining out, the use of white cardboard has significantly increased. Additionally, the cost of raw materials has decreased, greatly improving operating profit.

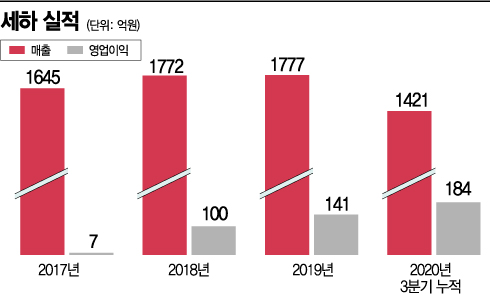

◆ Cumulative Operating Profit Up 92% in Q3 Last Year = Seha engages in the manufacturing of industrial white cardboard and box cardboard and was established in 1984. White cardboard is mainly used as packaging material for confectionery, cosmetics, and home meal replacements (HMR). Major clients include Lotte Confectionery, Dongseo Food, Ottogi, and Mediheal. The company was listed on the KOSPI market in 1996.

In the third quarter of last year, sales and operating profit were 142.1 billion KRW and 18.4 billion KRW, respectively. Sales increased by 8.8% and operating profit by 92.14% compared to the same period the previous year. By product, sales of white cardboard rose from 117.2 billion KRW to 123.1 billion KRW based on cumulative Q3 2019 figures, and sales of food carrier boards increased from 10.2 billion KRW to 15.9 billion KRW, showing improvement in most product performances.

The most notable aspect is the improvement in operating profit. China’s ban on the import of solid waste has led to a downward stabilization in the recycled paper market, which is the raw material for white cardboard. Recycled paper accounts for 40-50% of the raw materials in white cardboard manufacturing. The reduced raw material cost burden has translated into improved operating profit. As of Q3, the price of one of the raw materials, Bleached Hardwood Kraft Pulp (LBKP), was 591 KRW per kilogram, down 33.60% from 890 KRW in 2018. During the same period, the price of another raw material, Northern Bleached Kraft Pulp (NBKP), also decreased from 1,021 KRW to 597 KRW per kilogram.

A company official stated, "Internally, there has been an increase in domestic sales proportion and sales of high value-added products, a restructuring of the export market portfolio, and cost reductions through synergy with Korea Paper. Externally, demand has increased due to reduced competition following the suspension of Shinpoong Paper’s operations and the growth in parcel delivery volumes driven by increased online shopping amid COVID-19, leading to improved performance."

The outlook for Q4 performance is also positive, raising expectations for the full-year results. With the resurgence of COVID-19 and the re-strengthening of social distancing, sales of delivery food and HMR remain robust. According to FnGuide, securities firms forecast Seha’s sales and operating profit for last year at 197.9 billion KRW and 27.4 billion KRW, respectively, representing increases of 11.37% and 94.33% compared to the previous year.

The company official emphasized, "Recently, the price of recycled paper, especially premium recycled paper, has been slightly rising, and although export market profitability has somewhat declined due to the won’s appreciation and exchange rate drop compared to the first half of last year, domestic market demand remains steady." Seha expects performance improvements to continue even if COVID-19 ends this year. According to FnGuide, Seha’s sales and operating profit forecasts for 2021 are 214.9 billion KRW and 30.4 billion KRW, respectively, expected to increase by 8.59% and 10.95% compared to the previous year.

◆ Large-Scale Paid-in Capital Increase Lowers Debt Ratio to 100% Range = The financial structure has also greatly improved. Seha expanded its business into the energy sector through oil field development in Kazakhstan in 2005 but fell into a liquidity crisis and applied for workout at the end of 2013. It was later acquired by KAMCO (Korea Asset Management Corporation), but the financial structure was severely deteriorated at that time. The debt ratio, which was 821.1% in 2013, soared to 4,990.1% in 2015. Although the debt ratio had been decreasing since then, it still recorded a high level of 395.5% last year.

Last year, after being acquired by the Korea Paper-Haesung Industry consortium, Seha conducted a paid-in capital increase worth 35.7 billion KRW to repay borrowings. As a result, short-term borrowings decreased from 85.7 billion KRW in Q3 of the previous year to 51.7 billion KRW in Q3 last year. Consequently, the debt ratio improved. The debt ratio, which was 323.9% in the first half of last year, dropped to 124.5% in Q3.

A company official explained, "After being incorporated into the Haesung Group affiliates, we conducted a paid-in capital increase to repay 40 billion KRW in borrowings and improved interest rate conditions. In November last year, we repaid an additional 10 billion KRW in borrowings, significantly improving our financial structure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)