Central Bank Reaffirms Commitment to Curb Inflation

Base Interest Rate Expected to Rise Up to 20% This Year

Fundamental Improvement in Political Actions Needed

[Asia Economy Reporter Minji Lee] Although the market environment is improving due to the Turkish Central Bank (TCBM)'s base interest rate hike, opinions have emerged that fundamentally, President Erdogan's political actions need to improve.

According to NH Investment & Securities on the 1st, Turkey's base interest rate is expected to be raised 2 to 3 times this year, reaching 19-20%. Since it was confirmed at last month's monetary policy meeting that TCBM's policy independence has been strengthened, the base interest rate hike trend is expected to continue until price stability is achieved.

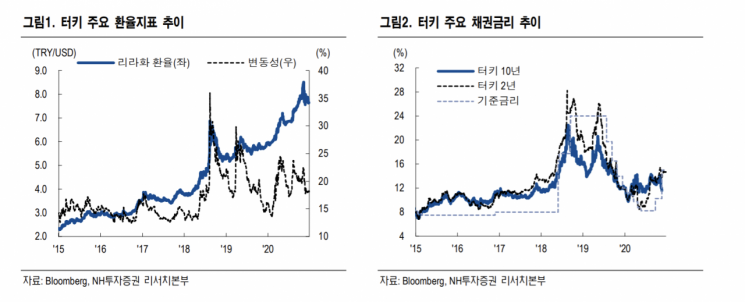

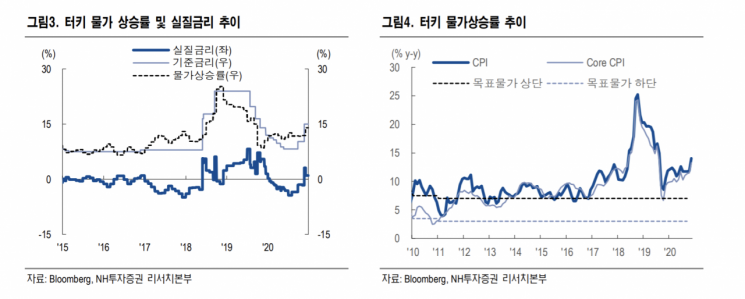

On the 24th of last month (local time), TCBM decided to raise the base interest rate by 200 basis points to 17%. After sharply raising the previous month's base interest rate from 10.25% to 15%, TCBM further increased the base interest rate to curb inflation and defend the exchange rate of the lira. Raising the base interest rate reduces the amount of money circulating in the market, thereby lowering the inflation rate.

Accordingly, the market responded positively to the monetary policy results, and the exchange rate fell from 7.65 lira to 7.54 lira. Compared to last October when the Turkish lira was trading around 8.5 dollars, this is a significant improvement. The two-year government bond yield fell by 5 basis points to 14.84%, and the base interest rate hike acted as a factor to resolve policy uncertainty.

Seongsu Kim, a researcher at NH Investment & Securities, analyzed, “This monetary meeting showed a generally similar stance to the previous one, indicating the continuation of the base interest rate hike trend by prioritizing the suppression of inflation despite economic uncertainties. The wording expressing concerns about the side effects of previous policies relying on leverage appeared stronger than before.”

This meeting also showed an improvement in TCBM's policy independence. This is because wording was added that contradicts President Erdogan's economic philosophy that low base interest rates induce low inflation and thereby enable economic growth. Researcher Kim said, “It states that the base interest rate is raised to achieve low inflation and that economic growth can be pursued after price stability. Considering that the lost independence of monetary policy was a factor that hindered Turkey's investment environment, this is a positive signal.”

Currently, Turkey has shown a sharp strengthening since declaring policy normalization at the end of last October. The market reacted as the severely damaged policy credibility was restored. For the investment environment in Turkey to change further, political actions are expected to improve.

Researcher Kim said, “President Erdogan is trying to foster internal unity by creating political and diplomatic noise when his approval rating falls, but how he will bring about a rebound in the recently stagnant approval rating is important. Since political actions are likely to determine the future investment environment, it will not be too late to consider investment after confirming the political stance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.