Junggyeonryeon Announces Results of '2021 Q1 Mid-sized Companies Economic Outlook Survey'

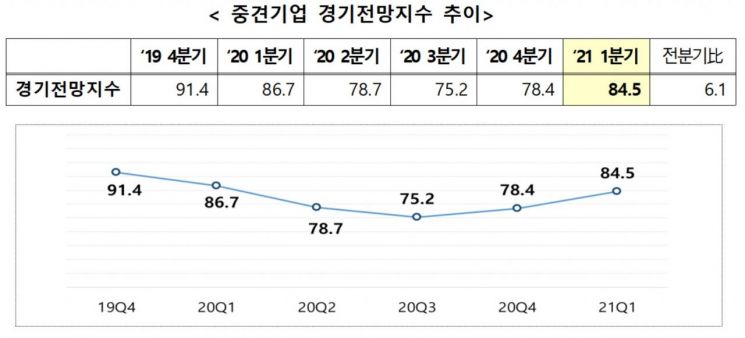

[Asia Economy Reporter Kim Cheol-hyun] The business outlook for mid-sized companies in the first quarter of 2021 recorded an upward trend for the second consecutive quarter following the previous fourth quarter. The Korea Federation of Mid-sized Enterprises announced the results of the '2021 1st Quarter Mid-sized Enterprise Business Outlook Survey,' conducted from November 11 to 25 with 500 mid-sized companies, revealing this trend.

The survey results showed that the business outlook index for the first quarter of 2021 rose by 6.1 points from the previous quarter to 84.5. This figure is close to the level of the first quarter of this year (86.7), before the spread of the novel coronavirus infection (COVID-19). The manufacturing sector recorded a slight increase of 1.7 points from the previous quarter to 81.8, whereas the non-manufacturing sector led the overall index increase with a significant rise of 9.0 points to 86.2.

Sales outlooks showed a continuous upward trend for two consecutive quarters, with domestic sales at 86.3, up 7.3 points from the previous quarter, and exports at 82.8, up 5.8 points. The operating profit outlook index increased by 5.4 points from the previous quarter to 83.9, supported by significant rises in industries such as transportation (90.7, up 18.6 points), food and beverages (85.0, up 18.3 points), publishing, communication, and information services (83.9, up 10.5 points), and electronic components (106.8, up 9.0 points).

The financial condition outlook index rose by 5.0 points from the previous quarter to 88.6, with notable increases in sectors such as food and beverages (92.5, up 21.1 points), electronic components (111.4, up 20.1 points), and real estate and leasing (92.9, up 10.0 points). The manufacturing production outlook index increased by 4.1 points from the previous quarter to 85.7. It was confirmed that all sectors except the automobile industry (88.1, down 10.0 points) showed an increase.

The management difficulties faced by mid-sized companies were surveyed in the order of sluggish domestic demand (58.4%), rising labor costs (34.8%), excessive competition among companies (34.6%), and sluggish exports (23.2%). Notably, in the automobile sector, which experienced the largest decline in the business outlook index compared to the previous quarter, sluggish exports (76.2%) were identified as the biggest obstacle.

Ban Won-ik, Executive Vice Chairman of the Korea Federation of Mid-sized Enterprises, stated, "Although the business outlook index for mid-sized companies has risen in the first quarter of next year following the fourth quarter of this year, it is important to clearly recognize the reality that the mid-sized enterprise sector still holds a negative perception when 100 is the baseline, and to be cautious of excessive optimism." He added, "We must prepare a turning point for the Korean economy's leap forward in the post-COVID-19 era through the implementation of effective policies that closely reflect the status and difficulties of each industry, including measures to resolve uncertainties in the automobile sector, where the business outlook index has sharply declined."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.