Bank of Korea Housing Price Outlook CSI Hits Another Record High

KB Real Estate Report... "Prices Will Rise Again Next Year"

Emphasizes Need to Expand Supply Volume

[Asia Economy Reporters Eunbyeol Kim, Onyu Lim] In the real estate market, the expectation that housing prices will rise next year has become a foregone conclusion. Regardless of the general public, experts, gender, age, or region, most agree that "housing prices inevitably will rise further." The issue lies in the extent of the increase, with experts predicting that nationwide housing sale prices will rise by 1-3%, and the metropolitan area by more than 5%. Although there are opinions from the public sector and academia that housing prices will be controlled due to the government's strong loan regulations and tax increases, the downward pressure is expected to be limited.

According to the Consumer Sentiment Survey results released by the Bank of Korea on the 29th, the housing price outlook Consumer Sentiment Index (CSI) for respondents under 40 this month was 137, the highest among all age groups. The housing price outlook CSI for those under 40 is 5 points higher than the overall average of 132. This reflects the sentiment of young people who purchase homes through "Yeongkkeul" (loans gathered to the bone). The housing price expectations of those aged 50-60 (127→130) and 60-70 (126→132), which were relatively low until last month, have also increased. The six major metropolitan cities (137) showed higher expectations than Seoul (128), confirming a balloon effect caused by government regulations. The housing price outlook CSI was 132 for men and 134 for women, showing high expectations regardless of gender. Hwang Hee-jin, head of the Bank of Korea's statistics survey team, stated, "This appears to be influenced by the nationwide rise in housing and rental prices." The proportion of responses regarding major items expected to affect consumer price inflation over the next year was overwhelmingly high for rent (58.0%).

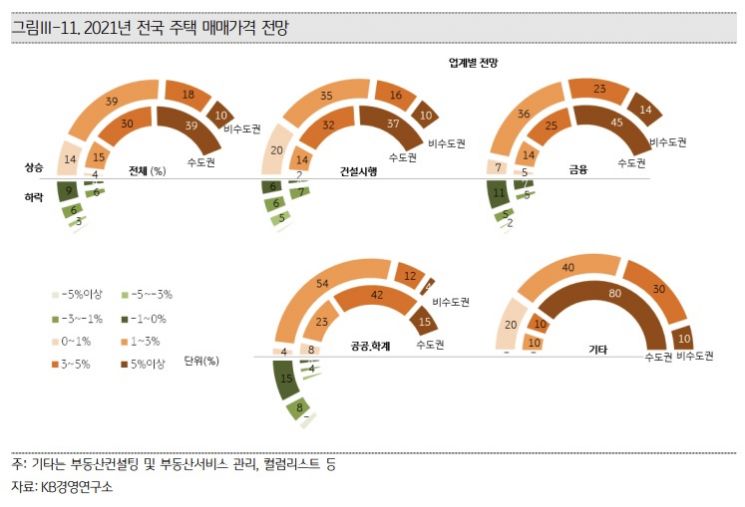

Real estate experts also forecast housing price increases next year. According to the KB Real Estate Report, 39% of real estate experts responded that housing sale prices in the metropolitan area will rise by more than 5% next year. For non-metropolitan areas, the highest response rate (39%) expected an increase of about 1-3%. Asset management professionals (PBs) also expected nationwide housing sale prices to rise by 1-3% (29%). Additionally, 24% of PBs anticipated an increase of about 3-5%.

Experts unanimously agree that housing prices cannot be controlled unless the supply shortage is resolved. Professor Kwon Dae-jung of Myongji University’s Department of Real Estate stated, "It is clear that housing prices will rise next year, and the variable is the extent of the increase. The record-high growth rate this year was due to a shortage of supply, and since the supply shortage continues due to government regulations, the upward trend in housing prices will continue until 2022." He added, "The government is implementing various regulations to stabilize housing prices, but there is no solution against the supply shortage. If the law of supply and demand is not followed, the real estate market will inevitably be distorted."

He also cited abundant liquidity due to the low-interest-rate environment as a factor driving housing price increases. The KB Real Estate Report pointed to increased demand for purchase conversions due to instability in the Jeonse (long-term lease) market (23%), supply shortages (22%), and decreased listings due to strengthened government regulations (19%) as the main causes of housing price increases caused by supply shortages relative to demand.

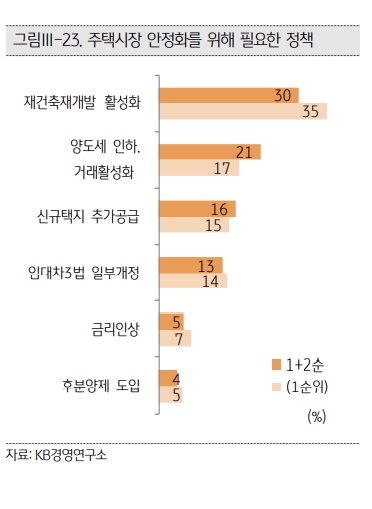

However, Professor Kwon added, "The upward trend may slow down in the second half of the year when the increased capital gains tax rates on multiple homeowners and property tax hikes become a reality, and when new government measures are likely to be introduced." PBs ranked capital gains tax reductions (25%) as the top policy for stabilizing the housing market. This suggests that providing exit strategies for multiple homeowners to increase market listings is necessary. Real estate experts identified revitalizing reconstruction and redevelopment within urban areas (30%) as a necessary policy for housing market stabilization. They also emphasized the need to secure supply volumes insufficient relative to demand, such as through transaction activation via capital gains tax reductions (21%) and additional new land supply (16%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.