Increased Interest in Secondary Battery, Chemical, and Steel Stocks

[Asia Economy Reporter Oh Ju-yeon] On the ex-dividend date of the 29th, foreign and institutional investors are selling stocks they had accumulated for dividends, while individual investors are buying stocks that have fallen due to dividend issues, defending against the stock price decline. The securities industry believes that since the year-end market has already priced in expectations for dividends and risen accordingly, stocks that have risen significantly recently are likely to fall on this day. However, investors' attention is expected to shift to the fourth-quarter earnings going forward, so interest in sectors and stocks with improved earnings is likely to increase after the dividend issue ends on this day.

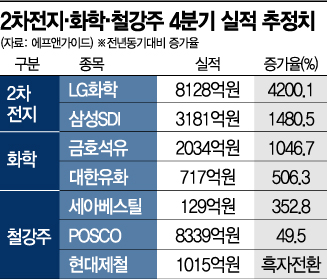

According to financial information provider FnGuide on this day, the sector expected to see the largest year-on-year increase in operating profit for the fourth quarter of this year, as estimated by three or more securities firms, is the secondary battery sector. The company with a dramatic increase in operating profit estimates is LG Chem. LG Chem's operating profit is projected to surge by 4200.1%, from 18.9 billion KRW in the fourth quarter of last year to 812.8 billion KRW this quarter. With accelerated battery technology innovation and growing expectations for the expansion of the electric vehicle market next year, the stock price has also risen significantly. The closing price on the 1st of last month was 623,000 KRW, and on the ex-dividend date, it traded at 811,000 KRW, down only 0.37% from the previous trading day, resulting in a return of 30.17% during this period.

Samsung SDI is also estimated to increase its operating profit for the fourth quarter to 318.1 billion KRW, up 1480.5% from 20.1 billion KRW in the same period last year. On this day, the stock price rose intraday to 603,000 KRW, hitting a 52-week high. Notably, these stocks have been the most purchased by foreigners this month. From the 1st to the 28th of this month, foreigners bought LG Chem and Samsung SDI stocks worth 330 billion KRW and 326 billion KRW respectively, ranking first and second in net purchases.

The securities industry is also raising target prices for these stocks. This month, Yuanta Securities, Hyundai Motor Securities, NH Investment & Securities, and Mirae Asset Daewoo have set LG Chem's target price above 1 million KRW, and Samsung SDI's target price has also been raised to 690,000 KRW. This implies a potential upside of up to 15% from the current stock price level.

Alongside this, the chemical and steel sectors are also showing notable earnings improvements. Kumho Petrochemical and Daehan Petrochemical are representative examples. Kumho Petrochemical's operating profit for the fourth quarter is expected to increase by 1046.7% year-on-year to 203.4 billion KRW, and Daehan Petrochemical's by 506.3% to 71.7 billion KRW. Recently, the stock prices of petrochemical sectors have underperformed the KOSPI's rise. Yoon Jae-sung, a researcher at Hana Financial Investment, analyzed, "This is due to overlapping effects of doubts about the sustainability of market conditions following the end of the year-end consumption season and profit-taking desires after short-term stock price increases." Yoon added, "However, the current tight supply-demand situation is expected to continue at least until the first half of 2021, and once the earnings season begins, a strong upward trend is anticipated."

Steel companies are also expected to see operating profit increases starting from the fourth quarter. Especially with steel price hikes scheduled for next year, profitability improvements through this are expected to become visible. Although stock prices have been somewhat sluggish recently due to profit-taking, the current point in time is considered one of the sectors to watch with an eye on next year's earnings market. POSCO's operating profit for the fourth quarter is expected to increase by 49.5% year-on-year to 833.9 billion KRW, and Hyundai Steel is expected to return to profitability. SeAH Besteel's operating profit is projected to rise by 352.8%, from 2.8 billion KRW in the fourth quarter last year to 12.9 billion KRW this quarter.

Lee Kyung-soo, a researcher at Hana Financial Investment, analyzed, "Fourth-quarter earnings have generally been revised upward, led especially by the refining, steel, home appliances, display, and utility sectors." He added, "The linkage between earnings and stock prices is gradually recovering, and on the ex-dividend date of the 29th, the start of a full-fledged individual stock market is expected to appear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.