Goddess Finance Research Institute

'The Rise of Subscription Economy Trends and Future Growth Directions for Domestic Capital Companies'

[Asia Economy Reporter Ki Ha-young] Domestic capital companies have been advised to incorporate subscription economy models to discover future growth engines.

According to the 'Rise of Subscription Economy Trends and Future Growth Directions for Domestic Capital Companies' recently published by the Credit Finance Research Institute on the 27th, as of the second quarter, the total assets of domestic capital companies amounted to 155.9 trillion KRW, showing a 12.5% increase compared to the previous year. Over the past five years, the asset size of domestic capital companies has shown a steady growth rate of around 10%.

However, the report diagnosed that despite steady asset expansion, the domestic capital industry needs to discover new growth engines. This is due to the deteriorating potential business environment caused by the impact of COVID-19, economic slowdown, strengthened household loan regulations, and intensified competition in the automobile finance market. In particular, as the global industrial environment is shifting consumption paradigms from ownership to usage with the spread of subscription economy trends, domestic capital companies should also launch services utilizing the subscription economy to establish new growth engines and improve profitability.

The subscription economy refers to economic activities where consumers pay a fixed amount regularly to use products or services. Recently, consumer preference for the subscription economy, which allows differentiated consumption experiences through small subscription fees, has been increasing. The business models of the subscription economy are classified into three types: unlimited, regular delivery, and rental.

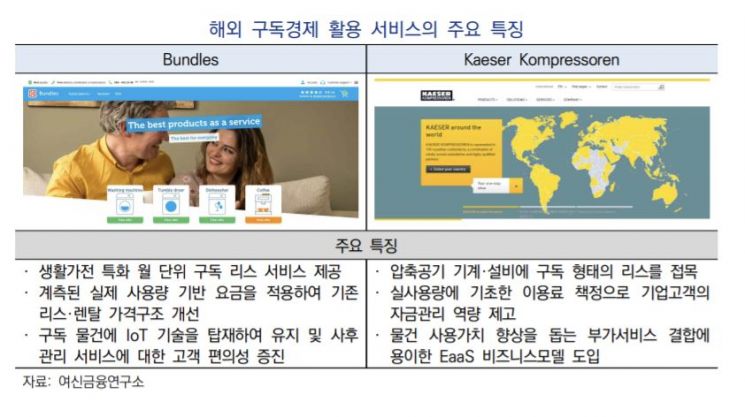

The report focused on the cases of the Netherlands' Bundles and Germany's Kaeser Kompressoren, which have successfully launched services utilizing the subscription economy. These two companies use the latest technologies such as the Internet of Things (IoT) to introduce subscription fees based on measured actual usage and implement business models that convert subscription items into service forms, distinguishing them from traditional leasing and rental models.

The report forecasted that domestic capital companies could consider adopting new types of lease finance and rental business models by integrating subscription economy features that show differentiation in overseas cases. For example, it explained that a subscription economy-based business model specialized in machinery and equipment could be promoted by applying a usage-based pricing structure to increase service flexibility. At this time, the unique lease finance capabilities accumulated by capital companies through existing leasing and rental operations can play an important role. It also anticipated that by building digital platforms as core sales channels for new business models, companies could simultaneously diversify their business portfolios and digitalize capital companies.

Choi Min-ji, a senior researcher at the Credit Finance Research Institute, advised, "Along with capital companies' own efforts to discover new items suitable for digital channels, institutional support is needed to expand the range of items that can be handled in subscription economy-based business models in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.