'2020 Large Conglomerate Group Disclosure Compliance Inspection Results' Released

Fair Trade Commission: "Non-resolution and Non-disclosure Difficult to Consider as Mistakes"

[Asia Economy Reporter Moon Chaeseok]

#Yeji Industrial, affiliated with the corporate group E-Land, borrowed 970 million KRW from its affiliate E-Land Park on August 2 last year without board approval or disclosure.

#Jeil Feed, affiliated with the corporate group Harim, provided the Jeongan factory of its affiliate Harim Pet Food as collateral for the extension contract of 50 million USD and 20 billion KRW borrowed from KDB Industrial Bank on April 22 last year, but did not obtain board approval and only disclosed this fact on August 7 of the same year.

It was investigated that large-scale internal transaction disclosure violations such as affiliate fund borrowing and collateral provision are still occurring. Among companies receiving trademark (brand) fees as 'non-dividend income' from affiliates, the proportion of corporate groups with a controlling shareholder was higher than those without.

On the 27th, the Fair Trade Commission disclosed the '2020 Disclosure Target Corporate Groups (Large Corporate Groups) Disclosure Compliance Inspection Results and 2019 Trademark Usage Transaction Status' containing these details.

The results analyzed whether 2,284 affiliates of 64 large corporate groups with assets over 5 trillion KRW complied with three major disclosure obligations under the Fair Trade Act?internal transactions, corporate group status, and unlisted company disclosures?and the details of trademark usage fee transactions.

Disclosure Violations of Affiliate Fund and Asset Transactions Account for 59.6% of All Internal Transaction Disclosure Violations

The Fair Trade Commission imposed fines totaling 1.30986 billion KRW on 108 companies belonging to 37 corporate groups for 156 disclosure obligation violations. Although the number of violations decreased compared to last year (172 cases), the total fines (1.07596 billion KRW last year) increased.

The number of violations was highest in the order of Lotte (20 cases, 79 million KRW fine), Taeyoung (19 cases, 247 million KRW), E-Land (13 cases, 180 million KRW), and Harim (11 cases, 342 million KRW).

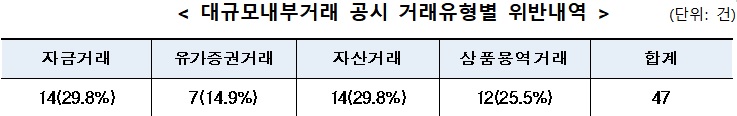

Fines for large-scale internal transaction disclosure violations (817.42 million KRW) accounted for 62.4% of the total. Among 47 internal transaction disclosure violations, fund transactions and asset transaction disclosure violations were the most frequent with 14 cases each (29.8%).

By type of act, 27 cases (57.4%) involved failure to obtain board approval or failure to disclose. This proportion increased by 17.8% compared to 39.6% last year (21 cases out of 53 internal transaction disclosure violations).

Large corporate groups must disclose transaction details through board approval if the transaction amount between affiliates is 5% or more of capital (total equity) or exceeds 5 billion KRW.

Violations of corporate group status disclosures accounted for 31 cases (39.7%) out of 78 total, mostly related to board operation and governance.

Many violation cases involved false, omitted, or delayed disclosures regarding committees within the board, board agenda items, or the number of outside directors attending. The most violations were by Lotte (19 cases, 73.29 million KRW fine), Taeyoung (9 cases, 153.95 million KRW), and NongHyup (6 cases, 17.8 million KRW).

Min Hyeyoung, head of the Fair Trade Commission’s Disclosure Inspection Division, said, "It is difficult to regard the numerous cases of non-approval, non-disclosure, and long-term delayed disclosure as simple mistakes. Since similar disclosure violations frequently recur within the same corporate groups, each corporate group must make greater efforts to comply with disclosure obligations."

Among 36 corporate groups violating disclosure obligations this year (excluding newly included Janggeum Shipping), 66.7% (24 groups) also violated last year.

The Proportion of Paid Trademark Usage in Corporate Groups with Controlling Shareholders is More Than Twice That of Groups without

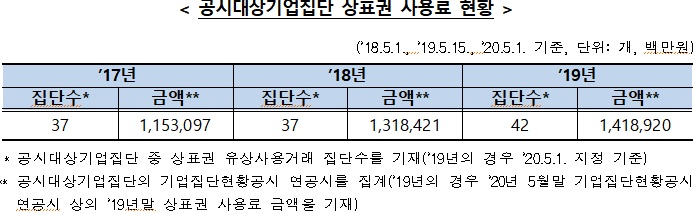

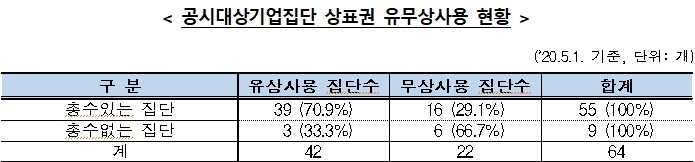

As of last year, 42 out of 64 large corporate groups (65.6%) engaged in paid trademark usage transactions with affiliates, up 2.9 percentage points from 62.7% in 2018 (37 out of 59 groups).

Among five newly added groups, three (Hyundai Heavy Industries, Korea Investment & Finance, Celltrion) were designated as 'continuously designated groups' by signing new contracts last year, and two groups (IMM Investment, Samyang) were newly designated as large corporate groups.

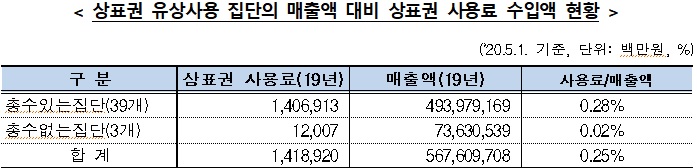

Income from trademark usage fees by large corporate groups reached 1.4189 trillion KRW, a 7.6% (100.5 billion KRW) increase from 1.3184 trillion KRW last year. This has steadily increased since 865.4 billion KRW in 2014.

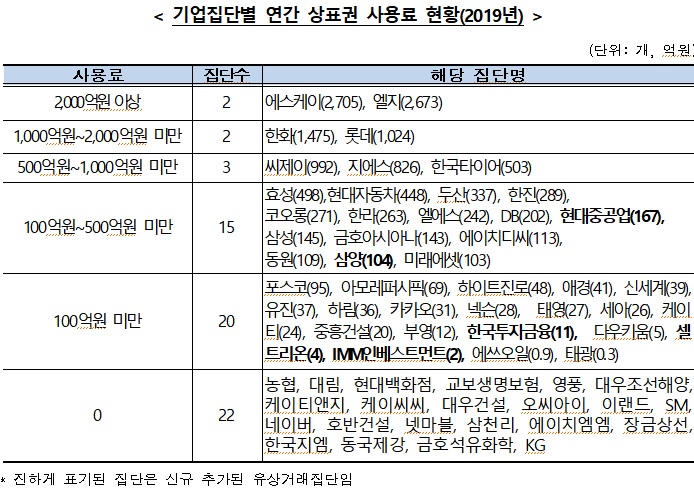

Companies with high trademark usage fee transaction amounts last year included SK (270.5 billion KRW), LG (267.3 billion KRW), Hanwha (147.5 billion KRW), and Lotte (102.4 billion KRW).

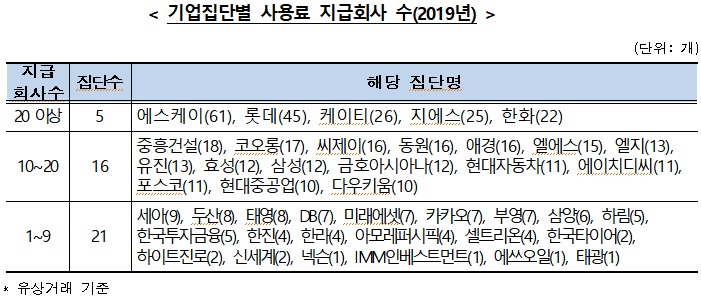

Five corporate groups paid trademark usage fees to 20 or more affiliates: SK (61 affiliates), Lotte (45), KT (26), GS (25), and Hanwha (22).

Notably, the proportion of paid trademark usage and the ratio of trademark usage fee income to sales in corporate groups with controlling shareholders were significantly higher than those without.

Trademark usage fees are recorded as non-dividend income along with management consulting fees and real estate rents. Non-dividend income has been a concern as a means for controlling family-owned companies to receive unfair support from affiliates, and disclosure obligations are expanding accordingly. Therefore, competition authorities pay close attention to the proportion of trademark transactions in corporate groups with high controlling family shareholdings.

The proportion of paid trademark usage in corporate groups with controlling shareholders (70.9%) was more than twice that of groups without controlling shareholders (33.3%). The ratio of trademark usage fee income to sales of recipient companies in groups with controlling shareholders (average 0.28%) was 14 times higher than that of groups without (average 0.02%).

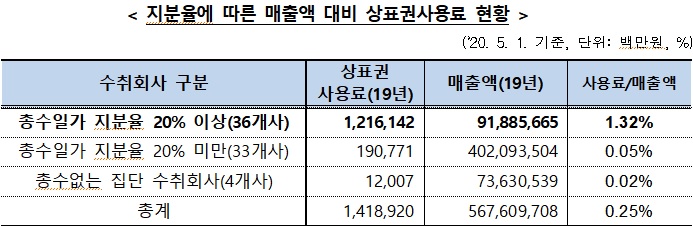

The average controlling family shareholding in 69 recipient companies of trademark usage fees was 25.79%, with 36 companies (52%) having controlling family shareholdings of 20% or more.

The ratio of trademark usage fee income to sales in recipient companies with controlling family shareholdings of 20% or more (1.32%) was 26 times higher than that of recipient companies with less than 20% controlling family shareholdings (average 0.05%).

Min said, "The analysis shows that recipient companies with controlling family shareholdings of 20% or more have a significantly higher proportion of trademark usage fee income relative to sales compared to those with less than 20% shareholdings."

She added, "With the recent amendment to the Fair Trade Act, companies with controlling family shareholdings of 20% or more will be subject to private benefit appropriation regulations regardless of listing status, which will enhance the effect of preventing unfair internal trademark transactions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.