Bank of Korea, Financial Stability Report for the Second Half of the Year

Household Debt at 1,682 Trillion Won by End of Q3

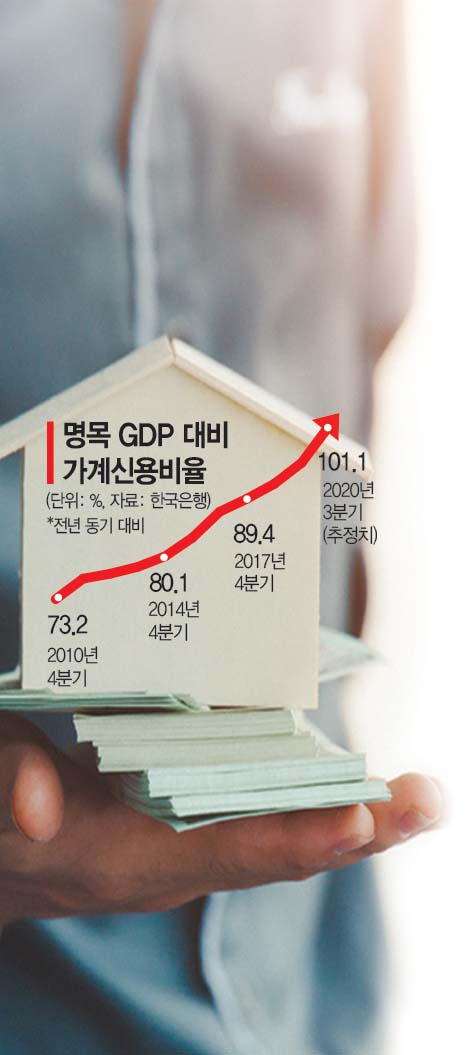

Nominal GDP Surpasses Debt for the First Time

Loans for 20s-30s Surge 8.5%

Impact of Support for Self-Employed and Corporate Loans

[Asia Economy Reporter Eunbyeol Kim] Since the outbreak of the novel coronavirus disease (COVID-19), household debt has rapidly increased, surpassing the Gross Domestic Product (GDP, approximately 1,664 trillion won) for the first time. This is a result of debt growing faster than economic growth. The biggest reasons for the increase in debt are the real estate and stock investment craze centered on people in their 20s and 30s, as well as the reduced interest burden due to the low interest rate environment. Loans to businesses and self-employed individuals, supported by government policies after the COVID-19 outbreak, have also surged. Additionally, as of the end of the third quarter, private sector credit (household and corporate debt) reached 211.2% of nominal GDP, marking the highest level since related statistics began in 1975.

According to the "2020 Second Half Financial Stability Report" submitted by the Bank of Korea to the National Assembly on the 24th, the ratio of household loans to nominal GDP (annual estimate) as of the end of the third quarter was 101.1%, up 7.4 percentage points from the same period last year. This is the first time the ratio of household loans to nominal GDP has exceeded 100%.

As of the end of the third quarter, household debt stood at 1,682.1 trillion won, a 7.0% increase compared to the same period last year. The growth rate of household loans has gradually increased since the end of last year, when it was 4.1%.

The burden of debt has also increased. The disposable income growth rate has slowed due to the COVID-19 crisis, increasing the debt repayment burden. The ratio of household debt to disposable income at the end of the third quarter was 171.3%, up 10.7 percentage points from the same period last year. In particular, the household loan growth rate among young people in their 20s and 30s reached 8.5%, indicating the need for adjustment in pace. Min Jwahong, Director of the Financial Stability Bureau at the Bank of Korea, stated, "As the economic downturn continues and incomes decrease, and factors that reduced debt burdens such as interest rate cuts do not persist, household debt burdens may rapidly increase. We need to manage household debt risks in preparation for the future."

During the COVID-19 response, the ratio of corporate loans to nominal GDP also rose to 110.1%, up 9.2 percentage points from the same period last year. Corporate loans (as of the end of the third quarter, 1,332 trillion won) surged 15.5% compared to the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)