Soaring House Prices... Hong Nam-ki "Regrettable and Apologetic"

However, Positive Evaluation of Regulations like the Lease Protection Act

Byun Chang-heum Likely to Continue Previous Government Policy Direction

[Asia Economy reporters Moon Jiwon and Lee Chunhee] "It seems they are trapped in a self-assurance that they are absolutely right. There is no sign of admitting failure anywhere."

This is the evaluation from experts who observed the results of the real estate market inspection meeting held on the 22nd at the Government Seoul Office, chaired by Deputy Prime Minister and Minister of Economy and Finance Hong Namgi. On that day, Minister Hong bowed his head, expressing "regret" over the rapidly rising market prices for sales and jeonse (long-term lease). However, he repeated the existing positive and optimistic assessments regarding the necessity and effectiveness of the measures, stating that the market would regain stability once the announced housing supply is delivered. In the market, considering the government's perception and recent remarks by nominee for Minister of Land, Infrastructure and Transport Byun Changheum, concerns are emerging that even stronger, regulation-focused measures may be unleashed in the future.

Is it really stable after prices have risen so much?

At the meeting, Minister Hong said, "Under a firm policy stance this year, the government has actively pursued supply-demand measures and residential stability measures," adding, "However, it is regrettable and I feel sorry that market stability has not yet been established as new systems are settling in."

Nonetheless, he evaluated that overall, the market is finding stability, similar to previous real estate market inspection meetings. Regarding the jeonse and monthly rent cap system and the right to request contract renewal, which have been blamed as the main causes of the nationwide jeonse shortage since their implementation at the end of July, he explained that the proportion of tenant households renewing contracts has increased compared to last year. He emphasized, "In the jeonse market, the rate of increase has somewhat narrowed since December due to eased moving demand, and there are signs of accumulating jeonse listings."

The market points out that the government is ignoring the overall market atmosphere and is fixated only on some statistics. December is typically an off-season when jeonse prices tend to pause, so it is inappropriate for the government to cite this as an effect of policy. According to statistics from the Korea Real Estate Board, the Seoul apartment jeonse price increase rate last month was 0.53%, significantly higher than 0.27% in the same month last year and 0.00% in 2018.

The view of apartments in the Gangnam area from Maebongsan Mountain in Seoul. (Photo by Yonhap News)

The view of apartments in the Gangnam area from Maebongsan Mountain in Seoul. (Photo by Yonhap News)

Optimistic supply outlook despite piling up regulations

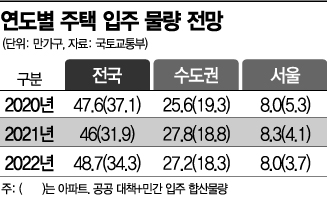

There are criticisms that the government's judgment on housing supply and demand is too complacent. The government judged that the market could become unstable as next year's apartment move-in volume is expected to decrease compared to previous years, and announced the November 19 supply measures last month. The government expects that including this supply volume, a total of 460,000 houses nationwide (278,000 in the metropolitan area, 83,000 in Seoul) will be supplied next year.

However, the market explains that measures to partially ease regulations such as reconstruction maintenance projects and price ceiling systems are also necessary to increase both public and private housing simultaneously. There are concerns that the housing market will not easily stabilize by only improving the quantity or quality of public rental housing through government budget input while continuously strengthening regulations. In particular, many point out that most of the recently announced supply volume by the government consists of villa-type housing rather than apartments, making it difficult to attract demand from the middle class.

Minister of Land, Infrastructure and Transport nominee Byeon Chang-heum is arriving at the hearing preparation office set up at the Seoul Regional Land Management Office in the Government Complex Gwacheon, Gyeonggi Province on the 21st. / Gwacheon - Photo by Kim Hyun-min kimhyun81@

Minister of Land, Infrastructure and Transport nominee Byeon Chang-heum is arriving at the hearing preparation office set up at the Seoul Regional Land Management Office in the Government Complex Gwacheon, Gyeonggi Province on the 21st. / Gwacheon - Photo by Kim Hyun-min kimhyun81@

Stronger regulations predicted despite 24 failures

Byun Changheum, the nominee who will take over the key to real estate policy, also expressed his intention to maintain the government's 24 failed real estate policy stances during his confirmation hearing response the day before. Byun especially showed a stance to further strengthen various regulations, including increasing tax burdens on multi-homeowners and owners of high-priced homes.

He said, "According to the principle of fair taxation, the more houses one owns and the higher the price of the houses, the greater the tax burden should be," showing a negative stance toward the term 'tax bomb.' He also responded positively to the three lease laws. Byun defended, "After the three lease laws, both jeonse supply and demand have decreased, making it difficult for new tenants to find listings, and there are conflicts and frictions related to leases due to changes in transaction practices. However, since the law's implementation, the contract renewal rate of existing tenants has increased, showing positive effects."

Rather, Byun predicted even stronger regulations regarding private reconstruction and property tax. He stated, "Huge capital gains and unearned income have occurred, leading speculative demand to flow into the housing market and widening asset gaps between classes." Lee Eunhyung, senior researcher at the Korea Construction Policy Institute, said, "Although the rationale for strengthening property tax is to recover unearned income, there are many unrealistic aspects of the policy, such as not considering the increased tax burden on single-homeowners. For the 'good policy intentions' Byun talks about, it is necessary to consider the effectiveness of the policy more carefully."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)