Zigbang Announces Summary of Real Estate System Changes in 2021

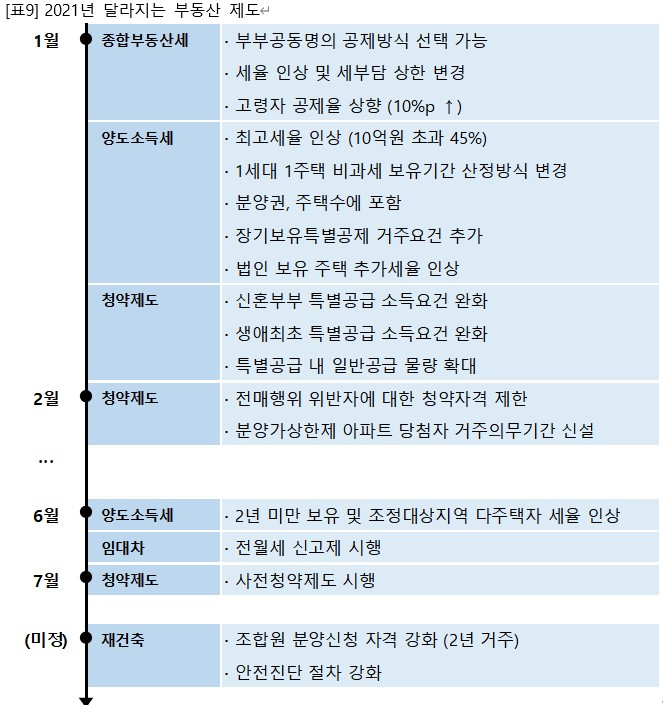

[Asia Economy Reporter Lim On-yu] This year, despite the spread of the novel coronavirus infection (COVID-19), the real estate market saw an increase in transaction volume and price rises due to abundant liquidity and inflows of funds driven by low interest rates. Accordingly, numerous measures were announced to stabilize the market and curb investment demand, including strengthening capital gains tax (CGT) and comprehensive real estate holding tax (CREHT), with many systems scheduled to be implemented next year. Additionally, changes are expected in various areas, such as the relaxation of special supply subscription qualifications and the implementation of a pre-subscription system. Zigbang summarized the new or changed real estate systems to be implemented next year on the 21st.

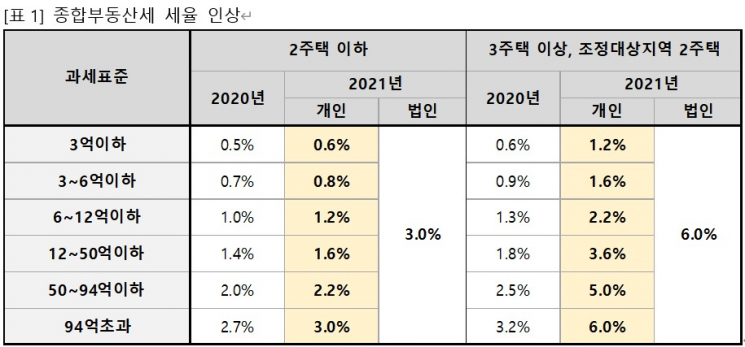

◆ Comprehensive Real Estate Holding Tax (CREHT)

▲ Increase in tax rates and changes to tax burden caps (January)

For owners of two or fewer houses, the tax rate will increase by 0.1 to 0.3 percentage points depending on the taxable standard bracket, while for owners of three or more houses and owners of two houses in regulated areas, the increase will be 0.6 to 2.8 percentage points by taxable standard bracket. For corporate-owned houses excluding dormitories, the highest individual tax rate will be uniformly applied: 3% for two or fewer houses and 6% for three or more houses. The fair market value application ratio used to determine the taxable standard based on the official house price will also increase from 90% this year to 95% next year. The tax burden cap for owners of two houses in regulated areas will be raised to 300% (previously 200%), and the tax burden cap for corporate-owned houses will be abolished. The basic deduction of 600 million KRW for corporate-owned houses will also be eliminated.

▲ Increase in elderly deduction rates (January)

The tax credit rate for elderly real demand single-house owners will be increased by 10 percentage points by bracket. The combined deduction limit, including long-term holding deductions, will also be raised by 10 percentage points (from 70% to 80%), reducing the CREHT burden for elderly owners.

▲ Option to choose joint spousal deduction method (January)

Couples who jointly own one house can choose the deduction method applied when calculating the comprehensive real estate holding tax. They can either receive a total deduction of 1.2 billion KRW (600 million KRW each) as currently or receive a 900 million KRW deduction as a single-household single-house owner and then apply elderly and long-term holding deductions, allowing them to select the more advantageous method.

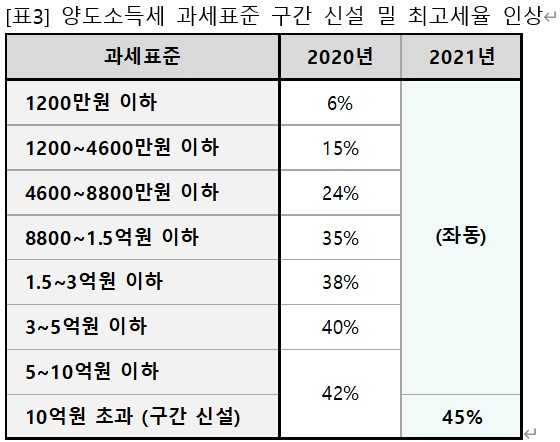

◆ Capital Gains Tax (CGT)

▲ Increase in highest tax rate (January)

The highest tax rate will rise from the current 42% to 45%. Currently, a 42% top rate applies to taxable standards exceeding 500 million KRW, but a new bracket exceeding 1 billion KRW will be introduced, raising the top rate to 45%.

▲ Change in calculation method for non-taxable holding period for single-household single-house owners (January)

The method of calculating the holding period for the non-taxable condition of owning one house for two years or more will change. For households that previously owned two or more houses and sold all except one to become single-house owners, the holding period for the non-taxable tax exemption on that house will be calculated from the date they became a single-house owner after selling the other houses, not from the acquisition date of the house. However, exceptions apply for houses qualifying for non-tax exemption due to unavoidable reasons such as temporary two-house ownership.

▲ Inclusion of pre-sale rights in house count (January)

Currently, pre-sale rights are not included in the house count when imposing capital gains tax, but when selling houses in regulated areas, pre-sale rights will be included in the house count and capital gains tax will be imposed. This applies only to pre-sale rights acquired after January 1 next year and does not apply to currently held pre-sale rights.

▲ Addition of residence requirement for long-term holding special deduction (January)

Until this year, the long-term holding special deduction for single-household single-house owners applied an 8% annual deduction per holding year for houses lived in for two years or more, with a maximum 80% deduction for 10 years or more. From next year, residence period will also be considered alongside holding period. The existing 8% annual deduction rate will be split into 4% for holding period and 4% for residence period. In other words, to receive the maximum 80% deduction, the house must be held and lived in for at least 10 years each, receiving 40% deduction for each.

▲ Increase in additional tax rate for corporate-owned houses (January)

The additional tax rate on gains from the sale of corporate-owned houses (excluding employee housing) will also increase. Currently, corporate housing capital gains are taxed at the basic corporate tax rate (10?25%) plus an additional 10%, but from next year, the additional rate will rise to 20%. The additional tax rate will also apply to occupancy rights and pre-sale rights.

▲ Increase in tax rates for ownership under two years and multi-house owners in regulated areas (June)

Currently, houses held for less than one year are taxed at 40%, and those held for less than two years are taxed at the basic rate. From June next year, the tax rate for houses held less than one year will increase by 30 percentage points to 70%. Houses held less than two years will be subject to a flat 60% rate. The capital gains tax rate on pre-sale rights currently applies a 50% rate regardless of holding period for those in regulated areas, but from June next year, a 70% rate will apply for holdings under one year regardless of region, and 60% otherwise. Additionally, the capital gains tax surcharges for multi-house owners selling houses in regulated areas will increase from 10% to 20% for two-house owners and from 20% to 30% for owners of three or more houses.

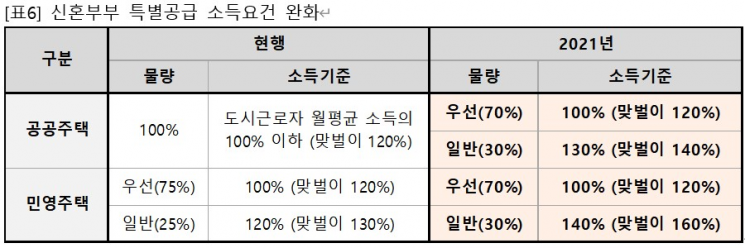

◆ Subscription System

▲ Relaxation of income requirements for newlywed special supply (January)

Currently, the income criteria for newlywed special supply in private housing are 120% of the average monthly urban worker income for single earners and 130% for dual earners. From next year, these will be relaxed to 140% for single earners and 160% for dual earners. For public housing, the current criteria of 100% for single earners and 120% for dual earners will be raised to 130% and 140%, respectively.

▲ Relaxation of income requirements for first-time special supply (January)

The income criteria for first-time special supply will also be relaxed. Currently, the public housing first-time special supply income limit is 100% of the average monthly urban worker income, and for private housing, it is 130%. From next year, the limits will be raised to 130% for public housing and 160% for private housing.

▲ Expansion of general supply quota within special supply (January)

Currently, 75% of the newlywed special supply quota is preferentially allocated to those with income below 100% (120% for dual earners) of the income standard, but next year this ratio will decrease to 70%, with the general supply quota for higher income groups increasing from 25% to 30%. The first-time special supply will also be allocated as 70% preferential supply and 30% general supply. The general supply will be conducted by lottery.

▲ Restriction on subscription qualifications for violators of resale restrictions (February 19)

Until now, only those who disturbed the supply order by means such as false residence registration or fake pregnancy certificates were banned from subscription. However, from February 19 next year, those who violate or broker resale restrictions on pre-sale rights will also be restricted from subscription for 10 years from the date the violation is detected, the same as other supply order violators.

▲ Introduction of residence obligation for winners of apartments under private land price ceiling system (February 19, 2021)

The residence obligation period for apartments subject to the price ceiling system will be set at 2 to 3 years even in private land areas. Currently, only public land public sale housing has a residence obligation period of 3 to 5 years, but this will be extended to private land and public land private sale housing. The residence obligation will apply to complexes that apply for resident recruitment approval after February 19 next year.

▲ Implementation of pre-subscription system (July?December)

From July to December next year, pre-subscription will begin for 60,000 public sale apartments in 3rd generation new towns such as Hanam Gyosan and Namyangju Wangsuk, as well as major metropolitan area sites. Pre-subscription is a system that selects winners for some units 1 to 2 years before the main subscription, aiming to stabilize the housing market by early supply. Winners must maintain non-homeowner status until the main subscription to retain eligibility.

◆ Lease System

▲ Implementation of rental reporting system (June)

From June next year, when signing a housing lease or monthly rent contract, both parties must jointly report the contract details to the city, county, or district office within 30 days. A confirmed date will be assigned upon reporting. Additionally, if the deposit, rent, or other prices change or the lease contract is terminated after reporting, the changes or termination must also be jointly reported within 30 days from the date of confirmation. The areas and rent ranges subject to the rental reporting system will be determined by presidential decree. Failure to report or false reporting will result in a fine of up to 1 million KRW. Non-residential properties such as officetels and goshiwon are not subject to reporting.

◆ Reconstruction

▲ Strengthening of qualification for union member subscription application (Undecided)

In reconstruction projects within speculative overheated districts in the metropolitan area, union members must have resided for at least two years before applying for subscription. The residence period does not need to be continuous but must total two years or more. Union members who do not meet the residence requirement will be cashed out at the appraised or market price and must leave. This will apply from the first union establishment approval application after the revision of the Urban and Residential Environment Maintenance Act.

▲ Strengthening of safety inspection procedures (Undecided)

Currently, the first safety inspection agency is selected by the city, county, or district, but in the future, the selection and management authority will shift to the city or province. The second safety inspection request will also be handled by the city or province. Previously, falsifying safety inspection reports was punishable by up to two years imprisonment, but under the revision, submitting substandard reports will incur a fine of 20 million KRW, and if falsification or substandard reporting is detected, bidding for safety inspections will be restricted for one year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)