Steep Growth Driven by AI and 5G Demand

Market Size Expected to Reach $73.8 Billion Next Year

[Asia Economy Reporter Dongwoo Lee] The global semiconductor foundry market is showing rapid growth, coinciding with the entry into a semiconductor supercycle, and is emerging as Samsung Electronics' next major growth engine.

With the expected increase in demand for artificial intelligence (AI) and 5G next year, there is a forecast that global fabless orders seeking 5nm and below processes from companies such as Qualcomm and AMD will surge explosively. Excluding China's foundry company SMIC, which is subject to U.S. government export restrictions, the fact that only Taiwan's TSMC and Samsung Electronics possess ultra-fine process technology of 7nm and below is a positive factor.

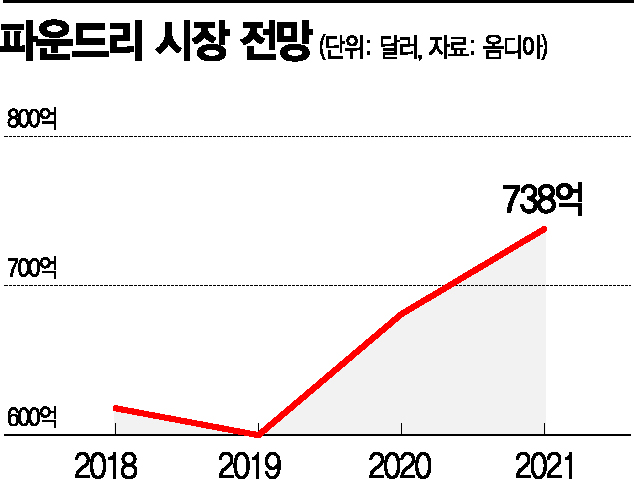

According to market research firm Omdia on the 21st, the global foundry market size is expected to grow to $73.8 billion (approximately 81.3 trillion KRW) next year. The global foundry market shrank from $61.8 billion in 2018 to $60 billion last year but re-entered a growth phase this year with $68.1 billion. The market is dominated by the duopoly of TSMC and Samsung Electronics. TrendForce predicted that in the fourth quarter of this year, TSMC will hold a 55.6% share of the global foundry market, while Samsung Electronics will have 16.4%. The gap in market share between the two companies had narrowed to 32.7 percentage points in the second quarter.

The industry expects next year to be the year Samsung Electronics will officially begin chasing TSMC. Through this year's regular personnel reshuffle, Samsung Electronics newly appointed key personnel such as the head of the foundry division, the head of strategic marketing, and the head of the manufacturing technology center. Recently, it was reported that Samsung purchased more than 258 acres (1,044,088 square meters) of land near its Austin plant in the U.S. and requested development approval from the Austin City Council. Although specific utilization plans have not been disclosed, the industry is placing weight on the possibility of foundry expansion. It is anticipated that Samsung Electronics will actively expand its foundry production lines to secure local customers in the U.S.

Samsung Electronics is also focusing on securing extreme ultraviolet (EUV) lithography equipment, which is essential for ultra-fine semiconductor processes. As of the end of this year, TSMC and Samsung Electronics are estimated to possess 40 and 18 EUV machines respectively. The issue is that ASML, which holds the core technology for lithography equipment, effectively monopolizes supply, and despite the price exceeding 150 billion KRW per unit, the annual quantity available is limited. After Vice Chairman Lee Jae-yong personally visited ASML in the Netherlands last October to secure equipment, there is a forecast that Samsung Electronics will be able to acquire about 10 additional units next year.

The financial investment sector estimates that Samsung Electronics' system semiconductor sales, which are around 17 trillion KRW this year, will surpass 20 trillion KRW for the first time next year due to foundry business growth. An industry insider said, "Samsung Electronics plans to invest 133 trillion KRW by 2030 aiming to become number one in system semiconductors," adding, "To achieve this, the foundry business is envisioned to lead the growth portfolio at the forefront."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.