"Not Surprising If It Hits $35,000 Within the Next 3 to 6 Months"

[Asia Economy Reporter Jeong Hyunjin] Bitcoin, a representative virtual currency, surpassed the $20,000 (approximately 21.82 million KRW) mark for the first time in its 12-year history on the 16th (local time). As central banks and governments around the world, including the U.S. Federal Reserve (Fed), supply massive liquidity, institutional investors are increasing demand for Bitcoin, leading the price surge on the front lines. There are also forecasts that the price could rise to the $30,000 level.

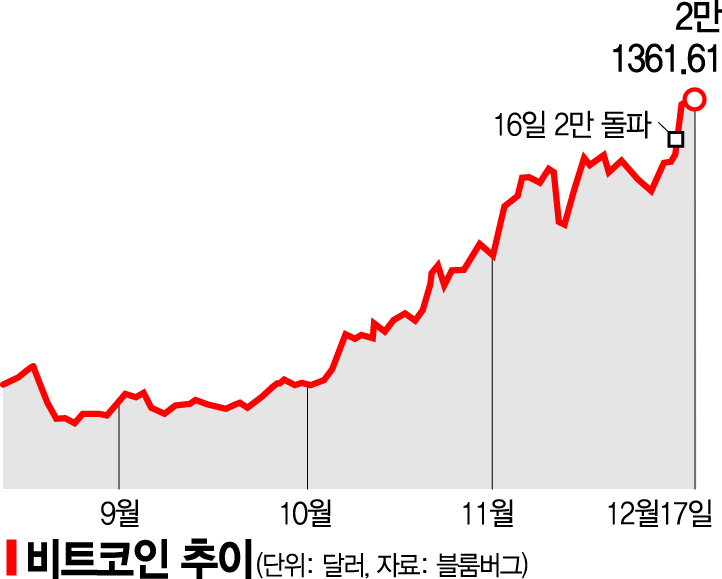

According to Bloomberg News, Bitcoin recorded $20,893 during intraday trading on that day, up 7.6% from the previous day. It continued to show a steady upward trend, reaching $21,339.0 as of 9:17 AM Korean time on the 17th, maintaining its high-altitude rally. This is the first time Bitcoin's price has exceeded $20,000. Compared to the beginning of the year, it has risen more than 195%, and it has increased by about 110% compared to September, just three months ago. Michael Sonnenshein, Managing Director of Grayscale Investments, a virtual currency investment fund, described the breakthrough of $20,000 as "a very symbolic point recorded as a historic year for Bitcoin comes to an end."

The recent rise in Bitcoin seems to be influenced by liquidity released into the market as a response to the COVID-19 pandemic flowing into risk assets. In particular, foreign media are paying attention to the fact that, unlike in the past, institutional investors rather than individuals are expanding their investments in Bitcoin. Hedge fund managers Paul Tudor Jones, Stanley Druckenmiller, and U.S. insurance company MassMutual have publicly disclosed holding Bitcoin this year. On the same day, UK asset management firm Ruffer also announced that it holds about $744 million worth of Bitcoin.

With yields on U.S. Treasury bonds and others falling sharply due to the COVID-19 crisis, institutional investors are increasing the proportion of Bitcoin in their portfolios aiming for profitability. On the day the Fed announced it would maintain bond purchases until economic recovery, the yield on the representative safe asset, the U.S. 10-year Treasury bond, closed at 0.923%, up 0.73%. Another safe asset, gold, traded at $1,867.40, up 0.45%, showing little movement amid conflicting issues of optimism about vaccines and concerns over the spread of COVID-19.

Bitcoin's price rise is expected to continue for the time being. The ultra-low interest rate environment is expected to persist for a long time, showing no signs of reduced demand, and interest in virtual currencies is increasing, as financial information service provider S&P Dow Jones Indices announced plans to launch a virtual currency index next year. Meltem Demirors, Chief Strategy Officer at virtual currency asset management firm CoinShares, said, "Macroeconomic conditions are the biggest factor (in price determination), and the situation is perfect for Bitcoin," adding, "Everything is moving quickly, and I would not be surprised if it hits the $35,000 level within the next 3 to 6 months."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.