As Spending on COVID-19 Response Increases, Tax Hikes Likely to Be Discussed More Realistically

South Korea's VAT at 10%, Half of OECD Average 19.3%

Political Burden Makes Next Year's Discussion Difficult

[Asia Economy Reporter Jang Sehee] To keep up with the significantly increased expenditures, the government needs to increase its revenue. Currently, the stance is to try to plug as much leakage as possible through spending cuts, but as the scale of expenditures grows, the method of raising more taxes is expected to be discussed more realistically.

Experts are cautiously bringing up specific tax increase measures. Along with the principle of broadening the tax base rather than implementing 'wealth tax increases' such as raising the comprehensive real estate holding tax or income tax rates, they also suggest measures to adjust the rates of some tax items to more realistic levels. Kim Yuchan, President of the Korea Institute of Public Finance, said, "It is better to secure tax revenue from various fields rather than raising the rates of specific tax items," adding, "Tax revenue from assets should also be expanded compared to the current level."

◆ Italy and UK VAT rates higher than Korea's = If tax increases are to be made, the priority tax item is value-added tax (VAT). VAT, along with income tax and corporate tax, is one of the three main sources of government revenue. As of 2018, income tax revenue was 84.5 trillion won, corporate tax was 70 trillion won, and VAT revenue alone was 70.9 trillion won.

Kim Woochul, Professor of Taxation at the University of Seoul, pointed out, "If taxes increase for certain groups, the actual revenue effect such as redistribution is very small beyond psychological comfort and political effects." He stated, "Leading tax increases should occur in VAT and personal income tax, which have significant redistributive effects."

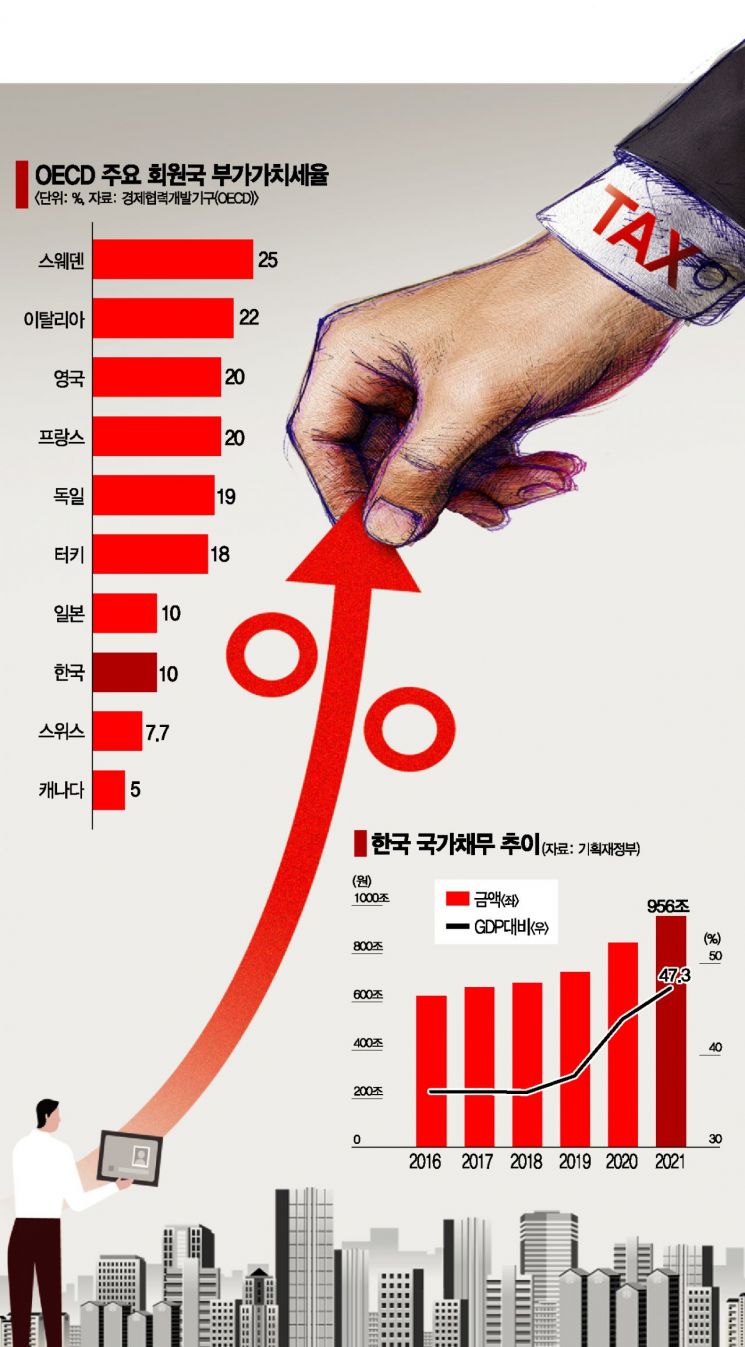

Another factor for raising VAT is that Korea's VAT rate is lower than other countries. According to the OECD's recently published "Consumption Tax Trends 2020," Korea's VAT rate is 10%, ranking third lowest among 36 member countries excluding the United States, following Canada (5%) and Switzerland (7.7%). The OECD average is 19.3%. Since introducing VAT in 1977, Korea has never raised the rate. Even Japan, facing low growth and a super-aged society, raised its VAT rate from 5% to 8% in 2015 and again to 10% this year for universal tax increases. Italy (22%), the UK (20%), and Germany (19%) also have higher rates than Korea.

The National Assembly Legislative Research Office previously stated in an analysis of National Assembly audit issues that Korea could consider raising the VAT rate as a means to recover from the COVID-19 shock and prepare for long-term low growth and a super-aged society.

The necessity of raising VAT is also related to population aging. According to a recent report by Kim Haksoo, Research Fellow at the Korea Development Institute (KDI), if the current VAT system is maintained, VAT revenue, which was 50.4 trillion won in 2017, is expected to decrease by about 10 trillion won due to population decline and aging. This means that VAT revenue could be directly impacted at a time when increased spending such as raising basic pensions is inevitable due to rapid aging.

According to the Ministry of Economy and Finance's "2020-2024 National Fiscal Management Plan" submitted to the National Assembly, mandatory welfare expenditures will increase at an average annual rate of 7.6%, from 119.7 trillion won this year to 131.5 trillion won next year, 139.9 trillion won in 2022, 148.8 trillion won in 2023, and 160.6 trillion won in 2024.

However, as an indirect tax, VAT is likely to face widespread criticism from the public. While universality is maintained because everyone pays the same tax when buying the same goods regardless of wealth, it inevitably disadvantages low-income groups.

A government official said, "Income tax applies progressive taxation to high-income earners, but indirect taxes like VAT are difficult to impose higher rates on the wealthy or provide consideration for low-income groups, making it difficult to raise," adding, "This is why national consensus on the big discourse of 'moderate burden and moderate welfare' is necessary."

.

Experts also advise that reducing existing VAT exemptions could be an option. Hong Woohyeong, Professor of Economics at Hansung University, said, "Reducing the scope of exemptions such as VAT exemptions and simplified taxation is also a method." Instead of the burden of collecting more taxes, narrowing the exemption scope can secure more tax revenue.

◆ Realistically difficult tax increase discussions = However, most responses indicate that discussions on tax increases are realistically unlikely to arise immediately from next year. With the presidential election next year, it will be difficult for both the government and political circles to gain momentum. The Ministry of Economy and Finance's "2020-2024 National Fiscal Management Plan" makes no mention of tax increases. The ministry's stance is to secure tax revenue through reforming tax exemptions and deductions and strengthening efforts to uncover hidden income.

In the National Assembly, although the 21st National Assembly boldly called for tax increases until June when it was inaugurated, such talk has quieted down as the year-end approaches. For example, Lee Wonwook of the Democratic Party said in June, when Kim Jongin of the People Power Party officially announced basic income, "Basic income without tax increases is impossible," and Lee Yongho said just before the National Assembly opened, "It is time to seriously discuss tax increases to prepare for the post-COVID-19 era," but now it is quiet.

A government official said, "It is practically difficult to expect changes at the end of an administration," emphasizing that the possibility of tax increase discussions surfacing is low.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)