[Asia Economy Reporter Minji Lee] Entertainment companies are expected to record strong performance in the fourth quarter, driven by robust album and digital music sales. Among them, YG Entertainment is anticipated to grow more than 500% compared to last year, reflecting profit effects from online concerts.

According to financial information firm FnGuide on the 16th, the combined average operating profit forecasted by securities firms for the four major entertainment companies (YG Entertainment, Big Hit, JYP, SM) in the fourth quarter is 88.5 billion KRW. Assuming record-high performance, the total combined profit is estimated to exceed 100 billion KRW.

Among the four entertainment companies, YG Entertainment shows the most remarkable growth rate in fourth-quarter earnings. YG Entertainment is estimated to record an operating profit of 8.1 billion KRW, which is approximately a 523% increase compared to a year ago. In addition, Big Hit is expected to post profits of 59.1 billion KRW. JYP Entertainment and SM are projected to record 12.1 billion KRW and 9.2 billion KRW respectively, down 10% and 33% from last year.

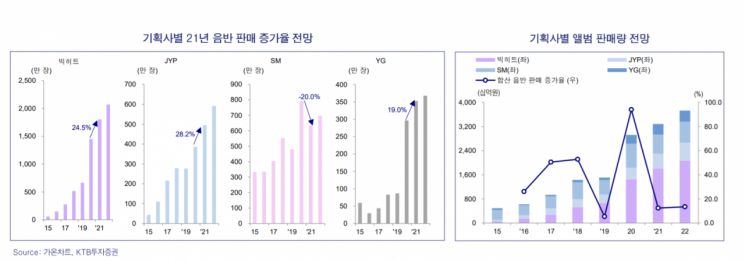

Despite the contraction of artists' activities due to the COVID-19 pandemic, album and digital music sales have supported the performance of entertainment companies. Fourth-quarter entertainment companies are expected to achieve record-high album sales. November's album sales grew 112% year-on-year to 5 million copies, and fourth-quarter sales are expected to surpass the previous highest quarterly sales of 9.75 million copies in the first quarter.

Hyunyong Kim, a researcher at Hyundai Motor Securities, said, "The expected album sales for the fourth quarter (October to December) are 14.84 million copies, representing a 115% growth compared to the same period last year," adding, "Big Hit and YG Entertainment, which account for 70% of operating profits in the entertainment industry and are expected to benefit from Blackpink's profit leverage, are our top preferred stocks." YG Entertainment and Big Hit are observed to have strong performance momentum due to Blackpink's and BTS's untact (non-face-to-face) concerts.

As entertainment companies have become stocks of interest for performance, foreigners and institutions are also buying shares. Among the top 10 net purchases by foreigners and institutions this month, JYP Entertainment (30 billion KRW) and YG Entertainment (22 billion KRW) were included. During the same period, institutions purchased 41.8 billion KRW worth of Big Hit shares. The stock price of YG Entertainment showed the largest increase, rising about 7% since the beginning of this month.

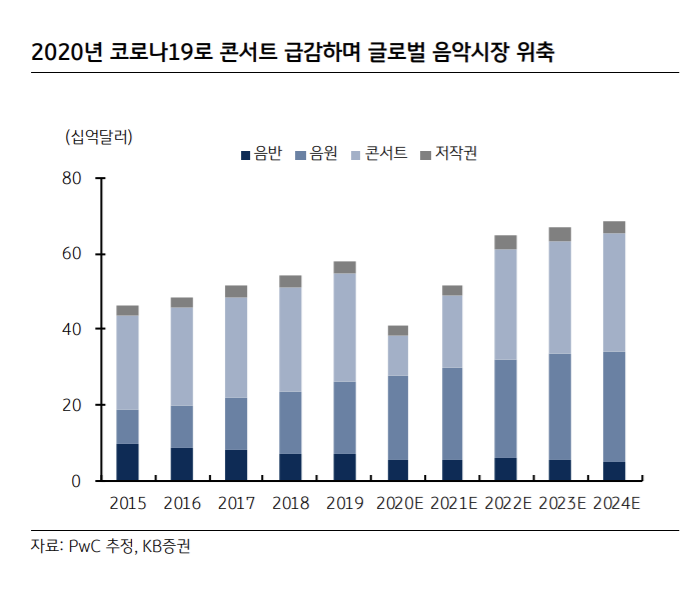

Entertainment companies are expected to continue their performance growth trend next year. According to estimates by KB Securities, the operating profits of the four major entertainment companies are expected to grow at an average annual rate of 32% through 2022. Concert-related revenues are expected to drive performance improvements next year. As global fandoms focus on K-pop and artists increase their activities, coupled with eased social distancing measures compared to this year, concert and other activities are expected to increase significantly.

The tightly scheduled comebacks and debuts of major artists and rookies also contribute to increased sales. If their performances are strong, album sales of the four entertainment companies next year are expected to grow about 10% compared to this year. SM has already debuted the rookie girl group aespa, and at the end of last month, Big Hit's boy group Enhypen debuted. JYP Entertainment's girl group NiziU and YG Entertainment's girl group Baby Monster (tentative name) are also expected to contribute to company performance. The comebacks of existing key artists such as NCT, BTS, Stray Kids, GOT7, and G-Dragon are also positive for performance.

The expansion of platform business and growth in overseas sales also raise expectations for performance. Hyoji Nam, a researcher at KTB Investment & Securities, said, "Entertainment companies have mostly relied on domestic sales, resulting in low profit resilience, but recently, 50% of sales come from overseas, and digital content distribution using their own platforms has become active, reducing performance volatility related to artist activities," adding, "If offline performances resume next year, the overseas sales ratio of the four agencies in the first half could rise to 60%."

He continued, "In the case of Big Hit, the Weverse platform business differentiates it from other agencies, which is positive as it can mitigate performance volatility for the agencies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)