Bank of Korea 'Second Half System Risk Survey'

[Asia Economy Reporter Kim Eunbyeol] Domestic and international economic and financial experts identified the prolonged possibility of the novel coronavirus infection (COVID-19) as the most threatening 'financial system risk' factor. As the COVID-19 situation continues, the most critical points to watch are poor corporate performance and increased credit risk. The weakening of financial institutions' soundness and the shift to a non-face-to-face business environment were seen as difficulties faced by financial institutions.

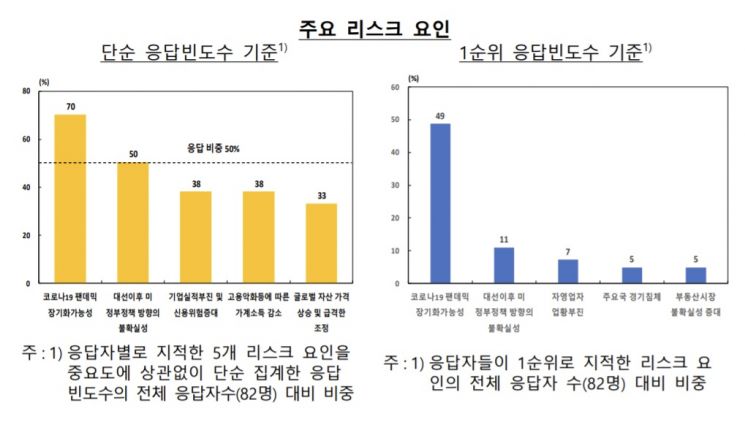

According to the results of the 'System Risk Survey' announced by the Bank of Korea on the 14th, 70% of respondents cited the 'possibility of prolonged COVID-19' as the main risk factor for South Korea's financial system. This is a simple tally of the top five risk factors selected by 82 respondents. The Bank of Korea surveyed a total of 82 people from the 10th to the 25th of last month, including employees of domestic financial institutions, staff from financial industry associations and financial and economic research institutes, and Korean investment officers at overseas financial institutions.

Next, uncertainty about the U.S. government's policy direction after the U.S. presidential election accounted for a high response rate of 50%, followed by poor corporate performance and increased credit risk (38%), and decreased household income due to worsening employment (38%). Other high-ranking factors included global asset price increases and sharp adjustments (33%) and poor business conditions for self-employed individuals (32%).

Based on the frequency of first-choice responses, the possibility of a prolonged COVID-19 pandemic (49%) accounted for the highest proportion, followed by uncertainty about the U.S. government's policy direction after the presidential election (11%) and poor business conditions for self-employed individuals (7%).

Among the major risk factors, respondents generally expected the prolonged COVID-19 pandemic, uncertainty about U.S. government policies after the presidential election, and poor corporate performance to appear in the short term (within one year). Decreased household income due to worsening employment and global asset price increases and sharp adjustments were identified as risk factors likely to materialize in the medium term (1 to 3 years).

Compared to the survey conducted in June, uncertainty after the U.S. presidential election, decreased household income due to worsening employment, and global asset price increases and sharp adjustments emerged as new risk factors. Economic recessions in major countries and domestic economic recessions were excluded from the top five risk factors.

However, the likelihood of shocks that could cause a crisis in the financial system in the short term (within one year) was found to have decreased compared to the June survey. The proportion of respondents answering 'high' dropped from 38% to 20%, while those answering 'low' rose from 29% to 45%. Trust in the stability of South Korea's financial system over the next three years also increased, with the proportion answering 'high' rising from 48% to 59%.

Meanwhile, regarding the 'possibility of prolonged COVID-19,' which respondents identified as a major risk factor, the Bank of Korea's detailed questions revealed that 52% of respondents mentioned poor corporate performance and credit risk as risks in the mid-to-long term. Other frequently mentioned factors included deterioration of financial institutions' soundness (35%), worsening fiscal soundness (24%), and economic recession (22%).

When asked about the biggest difficulties faced by financial institutions in the changed environment due to the prolonged COVID-19, respondents mainly mentioned the deterioration of financial institutions' soundness and the shift to a non-face-to-face business environment. In a survey of the three industries expected to be severely impacted by the COVID-19 pandemic, travel agencies and other travel support services, air passenger transportation, and restaurant and accommodation operations ranked high.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)