Ahead of the Second Half of Next Year’s Maximum Interest Rate Reduction

Financial Authorities Seek Cooperation from the Industry

Card Companies Say "Indirect Pressure"

Profitability Deterioration Inevitable if Retroactive

[Asia Economy Reporter Ki Ha-young] As the statutory maximum interest rate is set to be lowered in the second half of next year, the issue of whether this will be applied retroactively to credit card companies is emerging as a hot topic. Financial authorities maintain that there will be no retroactive application following the interest rate reduction, but the market believes that they have already begun indirect pressure by emphasizing 'cooperation' in meetings with card companies. If retroactive application occurs, card companies with a high proportion of members subject to high interest rates will inevitably face profitability deterioration, causing them to be on high alert.

According to the financial sector on the 14th, financial authorities recently held meetings with the credit finance industry and savings banks to discuss responses to the maximum interest rate reduction. During the meetings, the purpose of lowering the maximum interest rate was explained, and industry cooperation was requested.

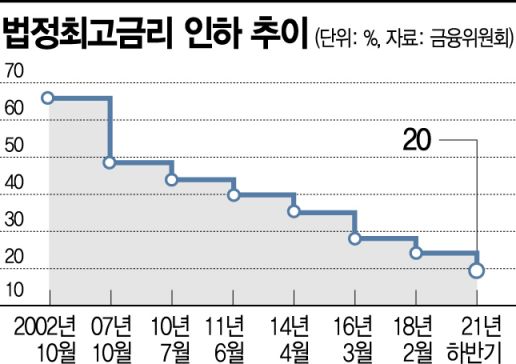

Last month, the Democratic Party of Korea and the government decided through party-government consultations to lower the statutory maximum interest rate from the existing 24% to 20%. The implementation is scheduled for the second half of next year, but it is expected that the timeline could be moved forward depending on the government's preparation status.

Financial authorities officially stated that there will be no retroactive application. However, the card industry views the authorities' request for cooperation as indirect pressure aimed at retroactive application. In fact, when the maximum interest rate was lowered from 27.9% to 24% in 2018, savings banks and credit finance companies applied the interest rate reduction retroactively to existing loans. Savings banks, following the revision of the Financial Supervisory Service's credit transaction standard terms and conditions in November of the same year, are required to retroactively lower the interest rates on existing loans whenever the maximum interest rate is reduced in the future. Although card companies do not have such retroactive application clauses and thus no obligation to apply the rate cut retroactively to existing loans, they voluntarily lowered the interest rates on existing loans to below 24%.

Card companies are anxiously concerned about facing a similar situation this time. Although there is no contractual basis requiring retroactive reduction of existing loan interest rates, if financial authorities demand it, they will have no choice but to apply it retroactively again. In this case, combined with the discussions on recalculating credit card fee rates expected to begin next year, it is anticipated to have a significant negative impact on profitability.

According to the Credit Finance Association, as of the end of October, Samsung Card had the highest proportion of card loans with interest rates above 20% at 23.95% among the seven major full-service card companies. Hyundai Card also had a relatively high level at 17.49%. If the statutory maximum interest rate is lowered, these companies will not be able to sell loan products to these customers, resulting in a hit to their earnings. Not only card loans but also cash advances, which are short-term card loans, have nearly 50% of their volume subject to interest rates above 20%.

An industry official said, "In 2018, although card companies were not obligated to apply the rate cut retroactively, they lowered the interest rates on existing loans exceeding the maximum rate under pressure from financial authorities," adding, "If retroactive application becomes a reality this time as well, combined with the recalculation of merchant fees, a decrease in interest income for card companies will be inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.