'Management Performance and Risk Factors of Life Insurance Companies' Report

Need to Secure Capital Capacity Including Reduction of Shareholder Dividends

[Asia Economy Reporter Park Sun-mi] It has been pointed out that the spread of the COVID-19 virus exacerbates management risks as it leads to deterioration in profitability caused by the contraction of face-to-face sales in life insurance companies, increased loss ratios, and structural secondary adverse selection margins.

According to the Deposit Insurance Corporation on the 13th, Kim Min-hyuk, Deputy Director of the Deposit Insurance Research Center, recently pointed out this in a report titled "Management Performance and Risk Factors of Life Insurance Companies," stating, "The decline in interest rates and stock prices, the sharp rise in exchange rates, and the resulting decrease in the value of held assets, along with increased credit and market risks due to expanded financial market volatility, lead to additional reserves for guarantees (liabilities) and increased required capital commensurate with risks, causing a decline in the financial soundness of life insurers, such as their solvency ratios,

which means that management risks are likely to increase further."

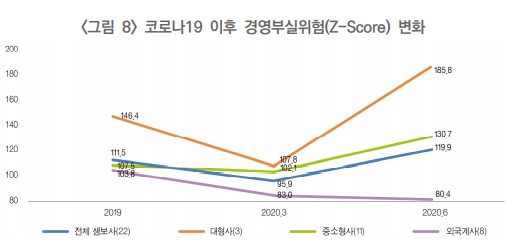

He noted that immediately after the outbreak of COVID-19 in the first quarter of 2020, the risk of management failure (Z-Score) sharply declined across large, medium, small, and foreign life insurance companies, confirming a significant deterioration in management stability.

Although in the second quarter, due to national infectious disease responses and the implementation of financial stability policies, financial market volatility decreased, resulting in an overall increase in life insurers' Z-Score values and a reduction in management risks, he cautioned that this should not be interpreted as a result of resolving the structural factors negatively affecting life insurance management, so careful interpretation of the results is necessary.

Deputy Director Kim analyzed, "Even before the COVID-19 outbreak, life insurers, characterized by interest rate-sensitive assets and liability structures, faced negative impacts on management under low interest rate environments, but after the outbreak, under an ultra-low interest rate environment, secondary adverse selection margins expanded, loss ratios increased, and profitability deteriorated."

Additionally, the increase in guarantee reserves and other liability-type reserves due to expanded market volatility, along with increased required capital, has doubled the burden of capital expansion. If the International Financial Reporting Standards 17 (IFRS17) and the new solvency regime (K-ICS) are introduced as scheduled in 2023, implementing new financial soundness supervisory systems based on fair value evaluations, concerns about management failure risks may further increase," he expressed.

In the COVID-19 Era, the Life Insurance Industry Needs to Restrict Capital Outflows and Secure Capital Capacity

Accordingly, Deputy Director Kim advised that life insurers need to secure capital capacity in the short term by restricting excessive shareholder dividends and other capital outflows and actively retaining earnings. It is important to double loss absorption capacity through direct capital expansion such as rights offerings. Furthermore, in the long term, by newly establishing policy support such as buy-back and contract transfer systems, life insurers should restructure liabilities focused on high-interest insurance products to enhance financial soundness through increased contract value and reduced required capital.

He explained, "The deepening of secondary adverse selection margins due to the high proportion of high-interest insurance products sold in the past has led to continuous profitability deterioration for Korean life insurers. The experience of the Japanese insurance industry, which faced a similar situation in the late 1990s, can serve as a good reference. After competition for external expansion in the 1980s, Japanese insurers faced burdens from secondary adverse selection margins due to low interest rates, resulting in the bankruptcy of seven life insurers and one non-life insurer between 1997 and 2001. However, they responded to low interest rates through product restructuring, asset portfolio improvement, and maximizing non-interest income," he explained.

Finally, Deputy Director Kim advised, "It is essential for financial companies to have appropriate risk management systems in place independently. Financial supervisory authorities should continuously monitor and improve risk assessment models to detect and respond early to risk factors, ensuring that the stability of the financial system is not compromised due to the deterioration of financial companies' soundness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)