[Asia Economy Reporter Eunmo Koo] As clothing consumption recovers mainly in the United States, the stock prices of domestic clothing Original Equipment Manufacturer (OEM) companies are beginning to stretch out.

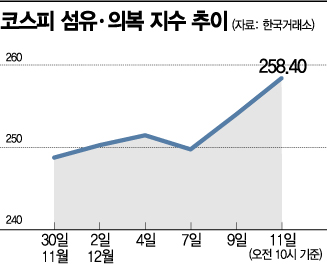

According to the Korea Exchange on the 11th, the stock price of Youngone Corporation closed at 31,300 KRW, up 0.32% (100 KRW) from the previous trading day. Youngone's stock price, which had risen for three consecutive trading days until the previous day, showed a recovery trend by rising more than 10% since last month. As of 10 a.m. on the day, it continued its upward trend, rising more than 6% compared to the previous day. Hanse Industrial, another leading clothing OEM company, also showed a recovery trend by rising for three consecutive trading days recently.

The recent rise in stock prices of clothing OEM companies is interpreted as an effect of expanded expectations for business condition improvements. Due to the unprecedented pandemic, global consumption temporarily froze this year, and clothing and footwear companies as well as OEM manufacturers could not avoid a significant decrease in profits in the second and third quarters. However, global consumption is recently recovering rapidly, centered on the United States. According to recently released U.S. retail data, U.S. consumption has recovered to the level at the beginning of the year, and clothing and footwear consumption increased by 5.6% and 2.2% respectively in September and October compared to the same period last year.

Along with the improvement in business conditions, the decline in market share of Chinese products and the disruption of existing supply chains are also factors raising expectations for domestic companies. First, the market share of Chinese products in U.S. imported clothing and footwear items is rapidly falling. According to the Korea International Trade Association, from January to September this year, U.S. imports of clothing and footwear decreased by 28% and 26% respectively, while Chinese products decreased by 32% and 38%. Researcher Junghyun Yoo of Daishin Securities said, "During last year's intensified U.S.-China trade dispute, the market share sharply declined, and the competitiveness weakened once more due to the COVID-19 pandemic," adding, "Even if the market recovers next year, Chinese products will not be able to regain their previous level of market share."

The disruption of existing supply chains caused by the external shock of COVID-19 is also becoming an opportunity for domestic OEM companies to expand their market share. As customers' bankruptcies continue, small manufacturers are going bankrupt, and the clothing OEM market is being reorganized around large companies in Korea and Taiwan. Researcher Yoo explained, "The most important issue manufacturing faced during the pandemic was not the immediate sales decline but the collapse of the value chain and the significant drop in companies' competitiveness during that process," adding, "However, large Korean companies are expanding their competitiveness through restructuring of small businesses, so-called manufacturer integration effects."

According to financial information provider FnGuide, Hanse Industrial is estimated to turn a profit in operating income in the fourth quarter of this year with 13.3 billion KRW, compared to the same period last year. Next year, operating income is expected to increase by 32.3% to 88.6 billion KRW compared to this year. Youngone Corporation is also forecasted to grow operating income by 29.0% year-on-year to 44.8 billion KRW in the fourth quarter.

Recently, interest in eco-friendly and ethical production in the fashion industry has increased due to the COVID-19 situation, which is also seen as an opportunity. Researcher Jiyoung Lee of NH Investment & Securities said, "Large companies such as Hanse Industrial and Youngone Corporation are proactively responding by developing eco-friendly fabrics, constructing eco-friendly factories, engaging in fair trade, and strictly complying with labor compliance, leading to a significant increase in related orders," adding, "This is a favorable change for large businesses, and the restructuring of businesses will accelerate further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.