Closed Overnight... Drying Self-Employment, Bleeding Alleyway Owners

Industries with Inevitable Contact Close Faster... Popular Startup Sectors Also Kneel to COVID-19

KB Financial Research Institute's 'COVID-19 and the Dual Faces of Self-Employment' Report

Untact and Contact Industries Show Starkly Divergent Fortunes

Closure Speed Expected to Accelerate Further in Second Half

Rapid Increase in Closures Inevitable Considering 2nd and 3rd Waves

On the 3rd, as the third wave of the novel coronavirus infection spreads, quarantine measures in the metropolitan area are being strengthened to curb the spread, and stores on Myeongdong Street in Jung-gu, Seoul are closing down. Photo by Jinhyung Kang aymsdream@

On the 3rd, as the third wave of the novel coronavirus infection spreads, quarantine measures in the metropolitan area are being strengthened to curb the spread, and stores on Myeongdong Street in Jung-gu, Seoul are closing down. Photo by Jinhyung Kang aymsdream@

[Asia Economy Reporter Park Sun-mi] "We assist with the closure and demolition of indoor golf practice ranges." "We will help expedite various paperwork and approvals so that small business owners can receive 2 million KRW in demolition support funds for closed stores." "We also provide one-stop solutions for used product and waste disposal." These are online advertisements from demolition specialists experiencing an unexpected boom amid a surge in self-employed business closures due to the third wave of the novel coronavirus infection (COVID-19). The ads specifically target indoor golf practice ranges, which are seeing a wave of closures. This highlights the stark contrast in fortunes among industries divided by the COVID-19 outbreak.

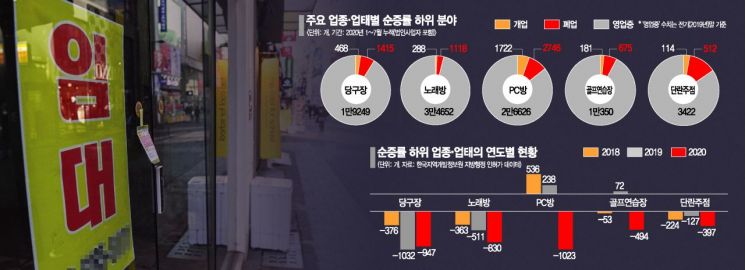

Due to the spread of COVID-19, closures are rapidly increasing in general consumer and leisure sectors where contact with customers is unavoidable. In particular, billiard halls, karaoke rooms, and PC bangs have seen over 5,000 closures from the start of this year through July. These figures were compiled before the second (August) and third (December) waves of COVID-19, and considering the strengthened social distancing measures, the pace of closures in the second half of the year is expected to have accelerated further.

On the other hand, hygiene and health-related industries and consumer sectors utilizing non-face-to-face methods have greatly benefited from COVID-19. Experts predict that as more industries are unable to operate until the end of the year due to the 2.5-level social distancing measures in the Seoul metropolitan area, the gap in fortunes between industries and business types will widen even more.

PC Bang Closure Rate Exceeds 10%

Billiard Halls, Golf Practice Ranges, Karaoke Rooms Also See Closures 3-4 Times Higher Than Openings

◆Decline in Self-Employment... "Greater Impact Expected During 2nd and 3rd Waves"=According to the KB Financial Group Management Research Institute’s report "COVID-19 and the Pros and Cons of Self-Employment" on the 9th, from January to July this year, industries and business types where closures exceeded openings due to COVID-19 include PC bangs, billiard halls, golf practice ranges, karaoke rooms, barbershops, bathhouses, and entertainment bars. Notably, PC bangs had a closure rate exceeding 10%, and billiard halls, golf practice ranges, and karaoke rooms recorded closures 3 to 4 times higher than openings, classifying them as industries severely impacted by COVID-19.

During this period, PC bangs reported 1,722 new openings but 2,746 closures. Billiard halls closed 1,415 locations, three times the 468 openings, karaoke rooms closed 1,118 locations, about four times the 288 openings, and entertainment bars recorded 512 closures, nearly five times the 114 openings.

Golf practice ranges, once considered a rising startup sector due to the growing young golf population, also felt the impact of COVID-19. Over the past seven months, 675 locations closed, more than three times the 181 openings. Industries such as door-to-door sales, general game rooms, and domestic and international travel, which had seen growth in entrepreneurs until last year, faced similar situations.

The issue is that these statistics reflect data before the second and third waves of COVID-19. This raises concerns that closures in the second half of the year may surge compared to the first half. Kim Dong-woo, a research fellow at KB Financial Group Management Research Institute, predicted, "With the third wave of COVID-19 emerging after November, the number of closures in industries already hit by COVID-19 is expected to increase further," adding, "The gap in fortunes between industries will become even more pronounced."

Beneficiary Industries Also Emerge

Disinfection Industry Sees 1,711 Openings from January to July... Ten Times More Than Closures

Telecommunication Sales Also Benefit from Non-Face-to-Face Consumption Growth

◆COVID-19 Boom... Disinfection and Health Supplement Sales Thrive=Despite the decline in self-employment, some industries are experiencing a boom. Telecommunication sales, medical device sales, leasing, waste disposal, disinfection, and health functional food sales are representative beneficiary industries of COVID-19.

In particular, disinfection and health functional food sales had either stagnated or declined in the number of business operators until last year but saw a significant increase in openings after the COVID-19 outbreak. The disinfection industry recorded 1,711 openings from January to July this year, which is ten times the 169 closures. This means that over the past seven months, more than a quarter of the total 6,752 active business operators opened new businesses.

Additionally, telecommunication sales saw 107,823 openings during the same period, far exceeding the 5,965 closures, and with growing public interest in health, health functional food sales opened nearly 15,000 new stores.

Research fellow Kim explained, "Even within similar industries, the impact of COVID-19 varies significantly depending on whether the business operates face-to-face or not," adding, "For example, within the restaurant sector, the number of operators in delivery-focused businesses like chicken and pubs has greatly increased, whereas those operating physical locations such as Japanese cuisine, butcher shops, and raw fish restaurants have seen a significant decrease in operators, which clearly illustrates this difference."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)