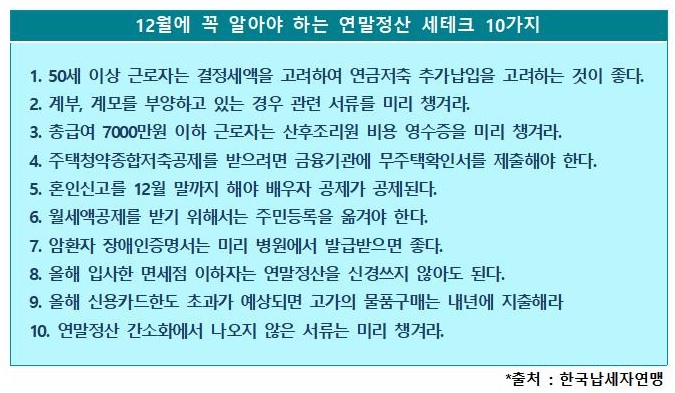

[Asia Economy Reporter Kwangho Lee] For workers aged 50 or older this year, it is advisable to consider additional contributions to pension savings accounts, taking into account the final tax amount. Starting from this year’s year-end tax settlement, the deduction limit for pension savings accounts for those aged 50 and above has been increased by 2 million KRW, allowing for maximized deductions during the year-end tax settlement. However, it is necessary to first check whether there is a final tax amount after subtracting the tax credit amount from the calculated tax amount.

Also, from this year’s year-end tax settlement, if remarried parents have passed away, stepfathers or stepmothers who are actually supporting the taxpayer can be eligible for dependent family deductions. Since it may be difficult to issue a family relationship certificate when remarried parents have died, it is recommended to secure a removal from family register certificate (jejeokdeungbon) in advance before the year-end tax settlement.

The Korea Taxpayers Federation announced on the 9th, ahead of the full-scale 2020 year-end tax settlement season, the "10 Year-End Tax Saving Tips You Must Know in December" containing these details.

According to the Taxpayers Federation, postpartum care center expenses may not be confirmed through the simplified service, so to apply for medical expense deductions, it is helpful to obtain a receipt in advance from the payment institution.

Also, since the final judgment of a severely ill patient requiring constant treatment as a disabled person under tax law is made by a doctor, especially if the hospital is located in a provincial area, obtaining a disability certificate in December in advance can help avoid the busy period in January and reduce the burden.

If a worker without a home has subscribed to the Housing Subscription Savings, they must submit a certificate of non-homeownership to the financial institution by December to be confirmed through the National Tax Service’s simplified service and receive deductions during the year-end tax settlement.

For workers who joined mid-year, if the final tax amount becomes "0 KRW" with only basic income deductions such as earned income deduction or personal exemption, they can receive a full refund of the withholding tax already paid, so they do not need to worry about the year-end tax settlement.

Furthermore, if there are plans for high-value expenditures on credit cards in December, and if exceeding the credit card income deduction limit is expected at this point, it is advantageous to make such expenditures after January 1 of next year.

Especially this year, from March to July, the deduction rate was temporarily increased, so it is expected that many cases will exceed the deduction limit. Therefore, it is recommended to check in advance whether the credit card usage amount exceeds the limit through the "Year-End Tax Settlement Preview" section provided by the National Tax Service’s Hometax.

In addition, to receive monthly rent deductions, it is convenient to move the resident registration by the end of December and, if the mobile phone number has changed, to update it in advance in the Hometax cash receipt section. Also, it is helpful to prepare receipts for hearing aids, glasses, school uniforms, etc., which are not searchable in the year-end tax settlement simplified service.

Kim Seontak, chairman of the Taxpayers Federation, advised, "Checking your final tax amount through the year-end tax settlement calculator provided by the Taxpayers Federation helps in planning your year-end tax settlement. If submitting documents to the company is burdensome, it is also possible to get assistance for additional deduction applications through the Federation after the year-end tax settlement is completed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)