High-Amount and Habitual Tax Delinquents Increase by 127 from Last Year... Delinquent Amount Decreases by 587 Billion Won

79 Non-Compliant Donation Organizations... Religious Groups Account for 84%

35 Tax Evaders... Decrease of 18 from One Year Ago

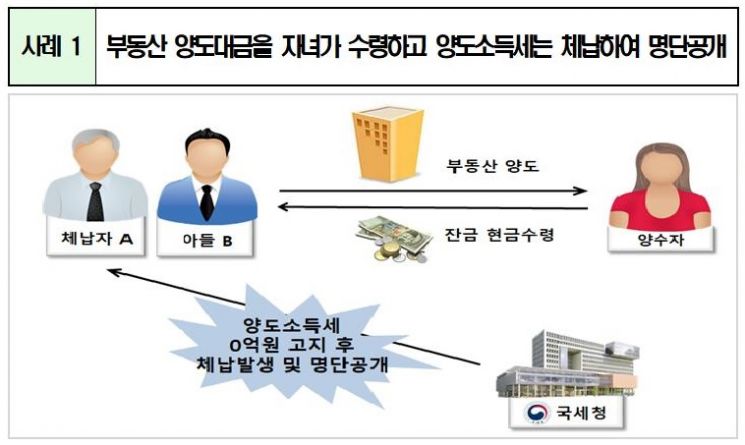

[Asia Economy Reporter Kwangho Lee]#Case 1= Elderly A transferred land located in ○○ City, Gyeonggi Province, but did not report capital gains tax. Later, A was notified of capital gains tax amounting to 0 billion KRW, and due to non-payment, a tax delinquency of 0 billion KRW occurred. During the National Tax Service's follow-up investigation, including verification of the use of the transfer proceeds, it was confirmed that A's son B received 0 billion KRW in cash and checks and subsequently acquired new real estate, indicating that A concealed the transfer proceeds through his son B. Through a two-year follow-up investigation, including filing a lawsuit to cancel fraudulent conveyance against son B, 0 billion KRW was recovered. Nevertheless, there remains unpaid delinquent national tax exceeding 2 billion KRW, meeting the disclosure criteria, and A was publicly listed this year as a high-amount habitual tax delinquent.

#Case 2= ○○○ is a donation organization without regular donating members. When someone seeking to claim a donation deduction for year-end tax adjustment requested a donation receipt, the organization issued high-value donation receipts for a certain fee and did not prepare or keep ledgers managing the issuance of donation receipts. The National Tax Service confirmed false donation receipt issuance amounting to 0000 million KRW and failure to prepare and keep donation receipt issuance details amounting to 0000 million KRW. The donation organization was fined 000 million KRW as a penalty for issuing false donation receipts, and recipients of false donation receipts were denied the improperly claimed donation tax credit, resulting in an additional income tax of 0000 million KRW.

#Case 3= ○○○ is a doctor operating a plastic surgery clinic mainly targeting Chinese clients. ○○○ recruited Chinese patients through Chinese brokers, had the plastic surgery fees paid locally in China by credit card or other means, and received the funds through so-called 'hwan-chigi' (informal money transfer). To conceal surgery details, the electronic medical charts were manipulated, related ledgers such as daily settlement sheets for payment receipts were destroyed, and income tax was evaded by underreporting income to the local tax office.

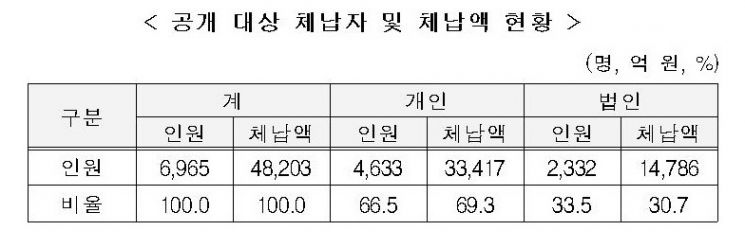

On the 6th, the National Tax Service disclosed the list of 6,965 high-amount habitual tax delinquents this year (4,633 individuals and 2,332 corporations) on the National Tax Service website and tax office bulletin boards.

The disclosure targets are those with national tax delinquency of 2 billion KRW or more, one year after the occurrence of the delinquency. The disclosed information includes the delinquent taxpayer's name or business name (corporate name), age, occupation, address, tax item of the delinquency, payment deadline, and summary of the delinquency.

This year, the number of disclosed individuals increased by 127 compared to last year. However, the total delinquent amount decreased by 587 billion KRW to 4.8203 trillion KRW compared to one year ago, influenced by a decrease in the number of delinquents owing 10 billion KRW or more. The highest individual delinquency amount was 117.6 billion KRW, and the highest corporate delinquency amount was 26 billion KRW.

The disclosed list includes former Shindonga Group Chairman Choi Sun-young (107.3 billion KRW), former Hansol Group Vice Chairman Cho Dong-man (71.4 billion KRW), former JU Development CEO Joo Soo-do (57 billion KRW), who engaged in illegal multi-level marketing fraud, Kwon Hyuk, chairman of Sido Shipping, known as Korea's ship king (2.2 billion KRW), and former Kia Tigers baseball player Lim Chang-yong (300 million KRW). The individual with the highest delinquency is Hong Young-chul, operator of an online gambling site, with 163.3 billion KRW.

The main age group and residential areas of individual disclosure targets are 40s to 50s, residing in the Seoul metropolitan area including Gyeonggi, Seoul, and Incheon. The delinquency amount range of 200 million to 500 million KRW accounted for 4,732 people, representing 67.9% of the total. The delinquency amount in this range was 1.6114 trillion KRW, accounting for 32.5% of the total.

This year, there are 79 non-compliant donation organizations: 60 that issued false donation receipts five times or more or exceeding 50 million KRW, 4 that did not prepare or keep donation receipt issuance details, and 15 that were fined 10 million KRW or more for failing to comply with obligations under the Inheritance and Gift Tax Act.

By type, 66 (84%) are religious organizations, 8 medical corporations, 3 educational organizations, 1 social welfare organization, and 1 academic/scholarship organization.

This year’s tax evaders are 35 individuals who were convicted with final judgments between July 1 and December 31 of last year, meeting the threshold amount by period. This is 18 fewer than one year ago.

The decrease in disclosure targets is due to the first-time implementation of a prior notification system this year, which grants an opportunity to explain to those scheduled for disclosure, and temporarily adjusted the disclosure period from one year to six months.

The average evaded tax amount among the 35 disclosed individuals is about 2 billion KRW. As a result of criminal trials, 34 were sentenced to imprisonment (25 suspended sentences, 9 actual imprisonment), and one received a fine.

The National Tax Service stated, "We will continue to strictly respond to high-amount habitual tax delinquents, non-compliant donation organizations, tax evaders, and those violating overseas financial account reporting obligations to encourage compliance with tax laws and foster a culture of sincere tax payment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.