Kiwoom Securities Report

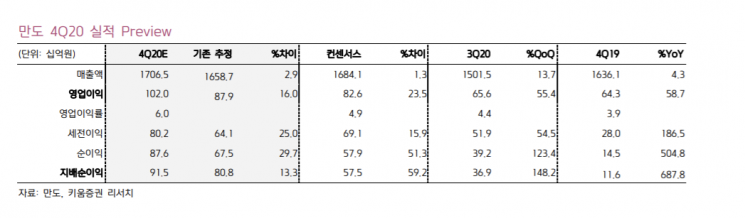

[Asia Economy Reporter Minji Lee] Mando is expected to surpass 100 billion KRW in operating profit in the fourth quarter, driven by increased operating rates centered on domestic, China, and India markets.

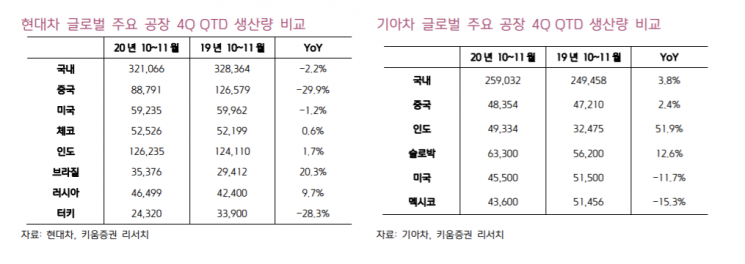

According to Kiwoom Securities on the 5th, Mando is expected to record an operating profit of 102 billion KRW in the fourth quarter. This is estimated to reflect the rise in operating rates mainly in domestic, China, and India markets. Minseon Kim, a researcher at Kiwoom Securities, noted that Hyundai and Kia's production volumes in October and November showed regional variations compared to the same period last year?domestic (Hyundai, Kia -2.2%, 3.8%), India (Hyundai, Kia 1.7%, 51.9%)?but production levels in key regions appear to have recovered to last year's levels.

The continued strong demand in the Chinese automotive industry, local response to North American electric vehicle manufacturers' Chinese factory volumes, increased operating rates of US GM and Ford, and the normalization of factory operating rates in emerging countries (Brazil, Russia, Mexico) are also estimated to be positive factors.

Looking at operating profit margins, they were 4.3% domestically, 7% in China, 8.5% in India, 4.2% in North America, and 4% in other regions. Researcher Minseon Kim projected, “The third quarter operating profit margins by region were estimated at 3.7% domestic, 4.7% China, 5.7% India, 4% North America, and 6% Mexico, but the fourth quarter is expected to be higher than these figures.”

As the securities industry's expectations for Mando rise, the current point appears to be the beginning of performance improvement. This is because sales growth driven by increasing demand for Advanced Driver Assistance Systems (ADAS) and volume increases based on customer diversification are expected to continue beyond next year.

The increase in volumes for North American electric vehicle manufacturers and the rapid growth in EV supply to major OEMs and EV startup companies based on supply performance are also positive signs. Contribution margins vary by region but are estimated to be around 18?22%. This means that when sales increase by 100 billion KRW, operating profit could increase by approximately 18 to 22 billion KRW.

The structural growth in sales toward eco-friendly vehicles is also an anticipated factor. Related sales accounted for 12% in the third quarter (North American electric vehicles 6%, Hyundai·Kia 5%, others 1%), and among the order backlog of 39.6 trillion KRW at the end of the third quarter, the eco-friendly vehicle proportion is about 18%, significantly exceeding the market average penetration rate.

Operating profit for next year is forecasted to reach 382.4 billion KRW, a 1.9% increase from previous estimates. Researcher Minseon Kim stated, “We maintain a buy rating on Mando and raise the target price by 32% from the previous level to 66,000 KRW.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.