Despite Overvaluation Concerns, Soaring Prices Supported by Foreign Demand

Foreigners Betting on Economic Normalization Driven by COVID-19 Vaccines

Vaccine Tailwinds Remain, Additional Gains Possible

Prices May Stall After Vaccination... Vaccine Side Effects Also Pose Risks

On the afternoon of the 4th, KOSPI surpassed the 2700 mark for the first time in history, and an employee is smiling brightly in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. [Image source=Yonhap News]

On the afternoon of the 4th, KOSPI surpassed the 2700 mark for the first time in history, and an employee is smiling brightly in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] An analysis has emerged that the soaring KOSPI is driven not by economic fundamentals but by supply and demand factors. This is because the stock price has consistently remained at a high level compared to fundamentals. Despite concerns about overvaluation, with the positive news of the COVID-19 vaccine still present, foreign buying is expected to continue, leading to further increases driven by supply and demand.

KOSPI Surpasses GDP and Export Amounts... The Reason is 'Supply and Demand'

On the 5th, IBK Investment & Securities analyzed that the current rise in KOSPI is due to supply and demand. The previous day, KOSPI surpassed 2700 for the first time ever, closing at 2731.45. This is considered significantly high compared to fundamentals. From the third quarter of last year to the second quarter of this year, the ratio of KOSPI market capitalization to nominal Gross Domestic Product (GDP) over the recent four quarters exceeded 0.9%, surpassing +2 standard deviations of the long-term trend extracted through the Hodrick-Prescott (HP) filter. The last times KOSPI exceeded this range were during the 2000 IT bubble and just before the 2008 global financial crisis.

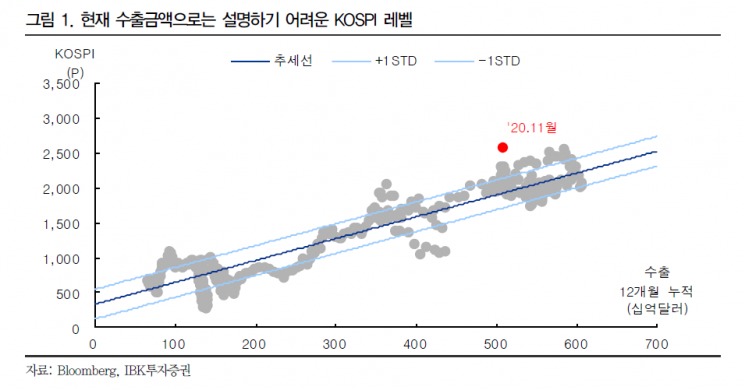

The same applies when measured against export amounts. Looking at the long-term correlation between export amounts and KOSPI since the 1990s, the current stock price level is somewhat high compared to the export amount over the past 12 months. Soeun Ahn, a researcher at IBK Investment & Securities, pointed out, "To explain the current KOSPI index exceeding 2700 inversely, an annual export amount of $750 billion must be assumed. This is 48% higher than the export amount over the recent 12 months and is a figure difficult to find even in the consensus forecast for next year's export growth rate, considering the base effect."

Therefore, the basis for the stock price rise is seen as supply and demand. In particular, foreign investors' supply and demand played a crucial role. The overall index and sectoral stock prices were influenced by the strength of foreign net buying. Researcher Ahn explained, "About a quarter of the foreign funds that exited during the eight months after the COVID-19 outbreak returned within a month. Although there were one-off issues such as the index composition rebalancing due to the Morgan Stanley Capital International (MSCI) regular changes, the trend of foreign capital inflow has appeared strong."

Foreigners Returning to Korean Stock Market Because of Vaccine

The key variable that changed foreigners' perspective on the Korean stock market nine months after the COVID-19 outbreak was identified as the vaccine. While the won-dollar exchange rate strength is also important, it is explained that this too is based on optimistic economic assessments and risk asset preferences due to the development of the COVID-19 vaccine.

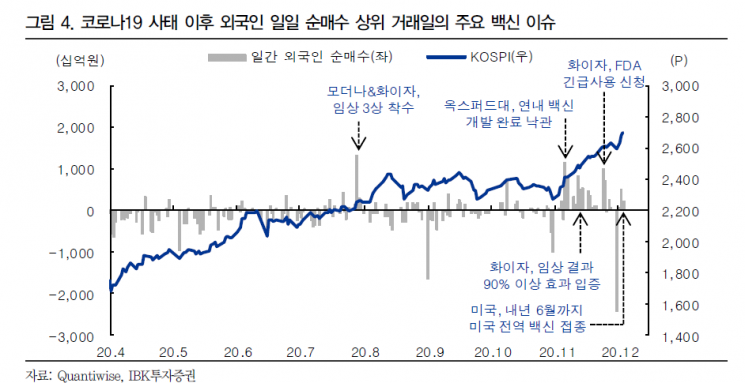

The importance of the 'vaccine' was confirmed in the flow of foreign buying in the domestic stock market this year. The main positive factor on trading days when foreign net buying was large after the COVID-19 outbreak was the vaccine. On July 28, when foreign net buying in the KOSPI market reached its highest level (13.06 trillion won) this year, US pharmaceutical companies Moderna and Pfizer announced the entry into phase 3 trials of their COVID-19 vaccines. Although foreign buying slowed as expectations weakened afterward, large-scale net buying resumed after Pfizer's optimistic phase 3 results announcement in early last month.

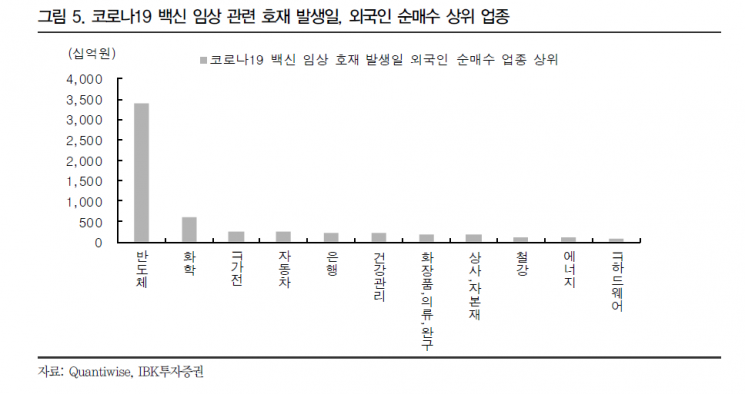

The reason foreigners are sensitive to the vaccine is that, regardless of actual efficacy, it is currently the only factor enabling economic normalization. Although some advanced countries such as the UK and the US will start vaccinations first, expectations are reflected that Korea's exports can also improve through the normalization of external demand and trade. Researcher Ahn interpreted, "Even during periods when foreigners bought large amounts, the top sectors for buying were concentrated in large-cap related sectors such as semiconductors/IT, chemicals, and automobiles. This is not simply a sector issue related to the vaccine but reflects 'Buy Korea' type funds that anticipate recovery and growth in the Korean market."

Remaining Vaccine Positives Are Driving Further KOSPI Gains

As positive news related to vaccines remains until the end of the year, there is a forecast that further index gains driven by foreign supply and demand are possible. The last positive factor related to vaccines expected to be reflected in the market is 'vaccination.' The UK, which first officially approved the Pfizer vaccine, will begin vaccinations next week. The US Food and Drug Administration (FDA) is scheduled to decide on emergency use authorization for the Pfizer and Moderna vaccines on the 10th and 17th, respectively. The European Union (EU) Commission has also mentioned aiming to start vaccinations within this month. This is why it is expected that positive news regarding COVID-19 vaccinations in major advanced countries will appear until the end of the year.

However, after the approval and start of vaccination in major regions, the stock market's upward momentum driven by vaccine-related factors may weaken. Researcher Ahn said, "Due to the nature of the stock market, much of the positive news has already been priced in, and the economic normalization expected by the market is unlikely to become visible immediately after vaccination. Rather, negative factors such as unexpected side effects, setbacks in herd immunity due to vaccination refusal, and a resurgence of COVID-19 in winter due to overconfidence in the vaccine may be highlighted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.