Proposed Amendment Raises Penalties

Up to 3 Administrative Actions Leading to License Revocation

Financial Services Act Enforcement Adds to Challenges

[Asia Economy Reporter Jo Gang-wook] A bill has been proposed that allows for the complete suspension of business operations or even the cancellation of approval if administrative actions are taken three times within a year across the entire financial sector, including banks, securities, insurance, and credit card companies. This is the so-called 'Financial Sector Three-Strikes-Out System.' Within the financial sector, complaints are pouring in that despite concerns about soundness amid the prolonged COVID-19 pandemic, the political sphere is focusing solely on populist bills that tighten regulations on financial companies under the pretext of protecting financial consumers.

Bill Proposed to Raise Penalties with 'Three-Strikes-Out System' in Finance: Approval Cancellation After 3 Administrative Actions

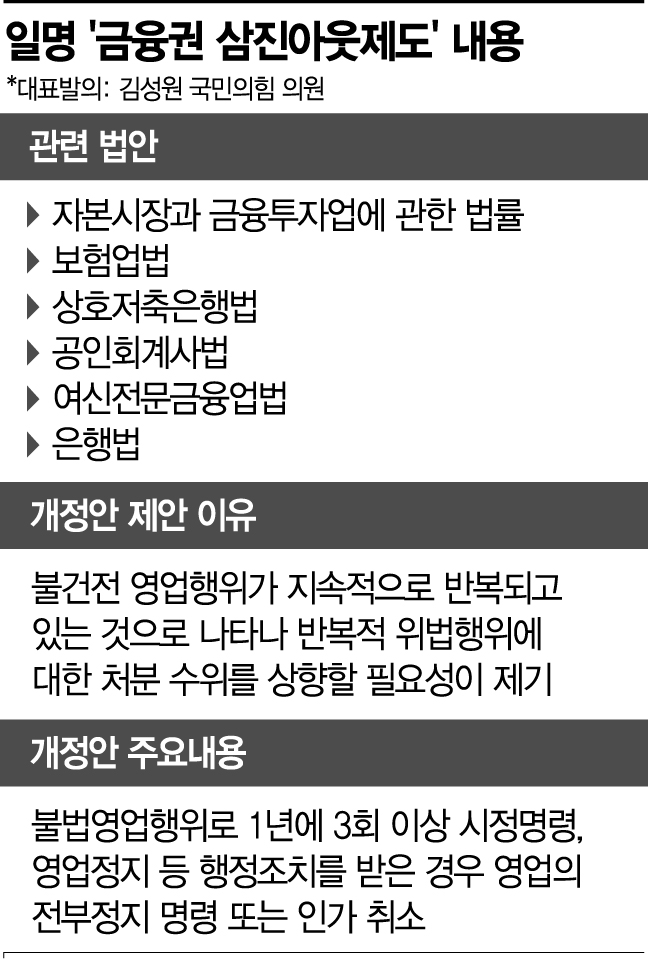

According to financial and political sources on the 4th, Kim Seong-won, a member of the National Assembly’s Environment and Labor Committee from the People Power Party, officially proposed a bill on the 1st that significantly raises penalties across financial-related laws such as the Banking Act, Insurance Business Act, and Specialized Credit Finance Business Act. The main point of the amendment is that if a financial company receives administrative sanctions such as corrective orders or business suspensions three or more times within a year due to unsound business practices, it will be subject to a complete suspension of business operations or cancellation of approval. The laws applying the financial sector three-strikes-out system include the Capital Markets Act, Insurance Business Act, Mutual Savings Bank Act, Certified Public Accountant Act, Specialized Credit Finance Business Act, and Banking Act.

In the case of the Certified Public Accountant Act, the amendment stipulates that a certified public accountant who repeatedly conducts poor audits two or more times will face suspension of duties for up to two years, and if three or more times, their registration will be canceled. Additionally, accounting firms that repeatedly commit illegal acts three or more times will have their registration canceled, strengthening sanctions.

This is not the first time Rep. Kim has proposed such a bill. Two years ago, in the 20th National Assembly, when he was a member of the Liberty Korea Party and served on the Political Affairs Committee, he introduced an amendment with the same content. Rep. Kim pointed out, "Improvement is urgently needed regarding the light punishments by financial authorities."

Financial Services Commission Abolished It in 2015... 'Three-Strikes-Out System' to Revive After 5 Years if Amendment Passes

The financial sector three-strikes-out system was initially introduced in 2010. Employees of financial companies who caused consumer disputes three or more times due to incomplete sales of financial products such as insurance or funds were expelled, and financial companies receiving three institutional warnings faced restrictions on overseas expansion or new business ventures. However, in 2015, then Financial Services Commission Chairman Lim Jong-ryong abolished it, stating, "As financial companies increase overseas expansion and cross-business activities become active, such regulations have a self-defeating aspect that hinders the development of our financial companies."

If this amendment passes, the financial sector three-strikes-out system will be revived after about five years. It will cover the entire financial sector with even stronger penalties. The financial sector is opposing this as a regulation that goes against the times amid already difficult circumstances due to COVID-19. Especially, with the enhanced Financial Consumer Protection Act set to take effect in March next year, this is seen as adding insult to injury.

The Financial Consumer Protection Act centers on a 'punitive surcharge' system that imposes fines of up to 50% of the revenue from related products if financial companies violate obligations such as explanation duties, prohibition of unfair solicitation, and false or exaggerated advertising. It also includes a 'right of withdrawal' system allowing consumers to cancel subscriptions without any reason within a certain period for bank loans, insurance products, funds, and more. Under the subordinate regulations of the Financial Consumer Protection Act, responsibility can also be imposed on executives such as CEOs, making financial company CEOs directly accountable for consumer protection.

Financial Consumer Protection Act to Take Effect in March Next Year... Industry Opposes Excessive Financial Company Regulation

A financial company official said, "Ahead of the Financial Consumer Protection Act taking effect in March next year, we are sharing joint response measures and focusing on eliminating elements of incomplete sales internally," adding, "There are already related regulations, so I do not think strengthening penalties through another bill will improve effectiveness."

Another financial company official also pointed out, "Recently, the political sphere has even shown movements to interfere with the tenure and personnel of financial company executives," and warned, "With concerns about a 'bad debt tsunami' caused by COVID-19 next year, the enforcement of the Financial Consumer Protection Act, and the lowering of the maximum interest rate, the management environment is tough, and excessive regulations disconnected from reality could shake the entire Korean financial sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.