Real Estate 114 "Current Sentiment Expected to Continue Until Smooth Supply is Secured"

[Asia Economy Reporter Yuri Kim] Seoul apartment sale prices have increased their rate of growth for the second consecutive week. As in the previous week, areas with a concentration of mid-to-low priced apartments such as Dobong, Gangbuk, and Guro led the rise in Seoul housing prices. Among the 25 districts in Seoul, 16 districts saw an expanded rate of increase compared to the previous week. The actual demand segment, unable to endure the immediate rental insecurity, is switching to buying.

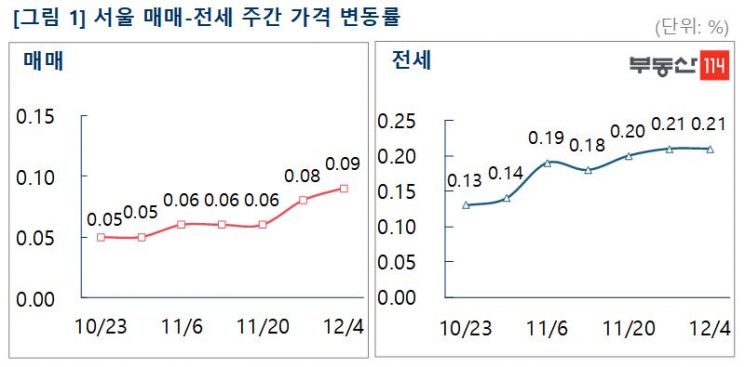

According to Real Estate 114 on the 4th, the rate of change in Seoul apartment sale prices recorded an expanded increase of 0.09% compared to the previous week. Reconstruction and general apartments rose by 0.08% and 0.10%, respectively. Additionally, Gyeonggi and Incheon rose by 0.09%, and new towns increased by 0.13%.

In Seoul, while the rapid rise in Nowon slowed from 0.12% to 0.07%, the rate of increase expanded in Dobong, Gangbuk, and Guro. As price burdens grow, buyers are looking for relatively less expensive areas and apartments even within places densely populated with mid-to-low priced apartments. The increases were in the order of Dobong (0.19%), Gangbuk (0.16%), Guro (0.14%), Songpa (0.14%), Gangdong (0.12%), Seongbuk (0.12%), Yeongdeungpo (0.12%), and Jung-gu (0.12%). In Dobong, Changdong Bukhansan I-Park, Samsung, and Ssangyong rose by 10 to 20 million KRW. In Gangbuk, Mia-dong SK Bukhansan City, Singu, and Suyu-dong Suyu Raemian increased by 2.5 to 15 million KRW. In Guro, Oryu-dong Oryu-dong Prugio and Cheonwang-dong Cheonwang I-Pen House 2nd complex rose by 10 to 15 million KRW.

In new towns, the rise in Ilsan, which had been relatively less, was prominent, while the upward trend in Gimpo Hangang, which is designated as a regulated area, was still maintained. By region, the increases were Ilsan (0.22%), Gimpo Hangang (0.17%), Pyeongchon (0.16%), Wirye (0.14%), Bundang (0.12%), and Dongtan (0.11%). In Ilsan, demand inflow was smooth, with Ilsan-dong Hugok 9th complex LG, Lotte, Madu-dong Gangchon 7th complex Seonkyung Kolon, and Janghang-dong Hosu 4th complex LG, Lotte rising by 5 to 10 million KRW. In Gimpo Hangang, Gurae-dong Gimpo Hangang I-Park and Janggi-dong Chodang Village Unam Firstville rose by 5 to 10 million KRW.

In Gyeonggi and Incheon, the increases were in the order of Gimpo (0.22%), Seongnam (0.16%), Suwon (0.15%), Yongin (0.14%), Goyang (0.13%), Uiwang (0.12%), Uijeongbu (0.12%), and Paju (0.11%). In Gimpo, Gamjeong-dong Pureun Village Sinan Silk Valley and Bukbyeon-dong Daerim rose by 5 to 10 million KRW. In Seongnam, Eunhaeng-dong Doosan We've and Hadaewon-dong Seongnam Jaiga rose by 5 to 7.5 million KRW. In Suwon, the upward trend has continued for more than nine months even after being designated as a regulated area in February. Jeongja-dong Suwon SK Skyview, Jowon-dong Suwon Hanil Town, Sindong Raemian Yeongtong Mark One 2nd complex, and Gokbanjeong-dong Hyundai I-Park rose by 5 to 10 million KRW.

The metropolitan area rental market saw a shortage of listings continuing into December, with Seoul rising by 0.21%. Gyeonggi, Incheon, and new towns rose by 0.10% and 0.15%, respectively. In Seoul, rental prices increased their rate of rise in the Gangnam area including Songpa, Gangnam, and Gangdong, with the shortage of listings persisting. The increases were in the order of Songpa (0.35%), Gangnam (0.33%), Gwangjin (0.27%), Gangdong (0.24%), Yangcheon (0.24%), Guro (0.23%), and Nowon (0.23%). In Songpa, Garak-dong Helio City, Jamsil-dong Jamsil Els, and Geoyeo-dong Ssangyong Sweet Dot Home Geoyeo Station 1st complex rose by 10 to 25 million KRW. In Gangnam, Yeoksam-dong Gaenari Prugio, Daechi-dong Samsung Raemian, and Dogok-dong Tower Palace 3rd complex rose by 10 to 50 million KRW. In Gwangjin, Jayang-dong The Sharp Star City and Gwangjang-dong Hyundai 10th complex rose by 10 to 25 million KRW.

In new towns, the increases were Sanbon (0.28%), Dongtan (0.26%), Gwanggyo (0.21%), Wirye (0.17%), Paju Unjeong (0.15%), Pyeongchon (0.14%), and Bundang (0.12%). In Gyeonggi and Incheon, the increases were Seongnam (0.28%), Yongin (0.18%), Paju (0.18%), Gimpo (0.15%), Uiwang (0.15%), and Suwon (0.13%).

Although entering the full winter season, the upward trend in rental prices remains solid. The government announced plans in December to recruit tenants for 39,000 vacant public rental units (16,000 in the metropolitan area, 5,000 in Seoul), and recently unveiled a public rental model (sample) suitable for families of 3 to 4 members, actively striving to stabilize the rental market. Considering the current rental shortage, competition for public rental units is expected to be intense, likely leading to early closure. As the burden of rent and deposit grows, some rental demand is continuing to convert into purchase demand. Yoon Ji-hae, senior researcher at Real Estate 114, said, "While the rise in rental prices has somewhat slowed, sale prices have increased their growth rate for two consecutive weeks," adding, "Until a smooth supply of rental and lease units is achieved, the current trend is expected to continue for a considerable period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)