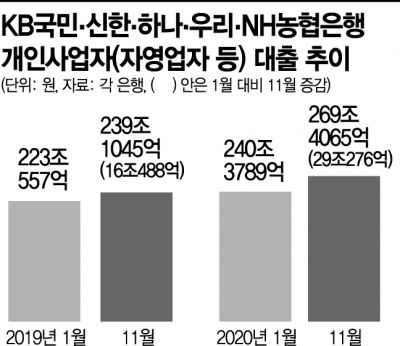

29.03 Trillion Increase from January to November This Year

80% Growth in Increase Compared to Previous Year

[Asia Economy Reporter Kim Hyo-jin] From January to November this year, the increase in loans to individual business owners (self-employed) by major commercial banks nearly doubled compared to the same period last year. This is interpreted as a result of a significant rise in self-employed individuals surviving on debt due to the compounded impact of the structural recession, excessive competition within commercial districts, and the shock of the novel coronavirus infection (COVID-19), which have already worsened conditions.

With the strengthening of social distancing measures due to the third wave of COVID-19 and the accompanying business restrictions, it is expected that the reliance of self-employed individuals on loans will continue to rise for the time being.

According to the banking sector on the 4th, the outstanding loans to individual business owners at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?amounted to 269.4065 trillion won at the end of last month. This is an increase of 29.0276 trillion won compared to the end of January (240.3789 trillion won). During the same period last year, loans to individual business owners at the five banks increased by 16.0488 trillion won. This means that this year's increase is 80.9% (12.9788 trillion won) larger than last year's.

The outstanding balance at the end of last month rose by 2.6877 trillion won compared to the previous month (266.7188 trillion won). Although the growth rate temporarily slowed down earlier, the overall sharp increase has continued throughout this year.

The loan trend is similar across all deposit banks. According to the 'Loans by Industry of Deposit-taking Institutions' data released by the Bank of Korea on the 2nd, the outstanding loans to non-corporate enterprises (self-employed) at deposit banks reached 387.9 trillion won at the end of September, marking the highest level since related statistics began in the fourth quarter of 2018. This is a sharp increase of 9.1 trillion won compared to the end of the second quarter.

Loan Dependence Likely to Increase Further Due to Third Wave of COVID-19

A representative from a commercial bank said, "With the third wave of COVID-19 causing the real economy to freeze rapidly, the number of self-employed individuals seeking bank loans to maintain their businesses will continue to rise," adding, "It seems difficult to predict the timing, whether it will be 'until the first quarter of next year' or 'until the first half of next year.'

The number of self-employed individuals who cannot even endure with debt and end up closing their businesses is also increasing significantly. According to the Ministry of Employment and Labor and others, 4,277 people who closed their self-employed businesses and received employment insurance from January to July this year exceeded the total of 3,404 people over the three years from 2017 to last year. According to the Small Enterprise and Market Service's 'Recent Four Years of Closure Support Fund Status,' 4,526 people applied for closure support funds in the first half of this year, exceeding 70% of last year's total applicants (6,503 people).

Given these circumstances, there are also expectations within and outside the financial sector and financial authorities that the COVID-19 damage loan and interest repayment deferral measures for small business owners, initially extended from September to March next year, may be extended again.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)