Foreign Exchange Authorities' Repeated Verbal Interventions Fail to Halt Won Strengthening

Authorities and Exporters Monitor Tensions

"Won Strengthening Expected to Continue Until First Half of Next Year" Forecast

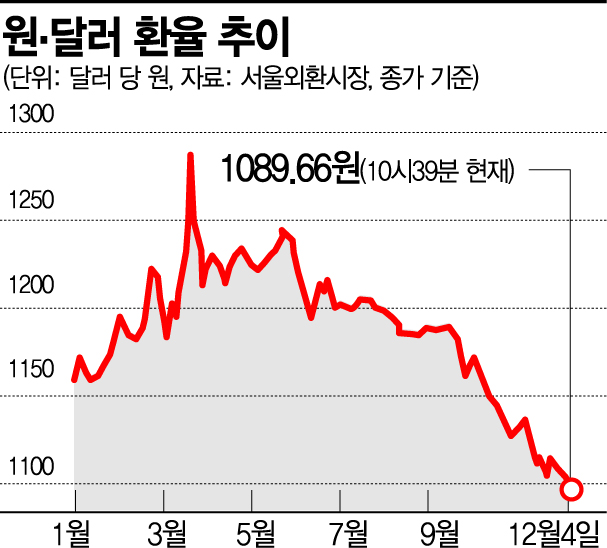

[Asia Economy Reporters Eunbyeol Kim and Giho Sung] Export companies and foreign exchange authorities are on high alert as the won-dollar exchange rate is falling more steeply than expected. The won-dollar exchange rate, which broke below the 1,100 won level the previous day, also fell below 1,090 won during trading, continuing its relentless decline. The foreign exchange authorities are also facing a dilemma. Considering the weak dollar, preference for risk assets, and South Korea's favorable economic indicators, won appreciation is an unavoidable factor, but they cannot simply stand by and watch the sharp decline in the exchange rate.

On the 4th, as the won-dollar exchange rate fell below 1,090 won during trading, the Bank of Korea and the Ministry of Economy and Finance are closely monitoring the exchange rate with heightened vigilance. As of 10:39 a.m. that day, the won-dollar exchange rate was trading at 1,089.66 won.

Recently, the foreign exchange authorities have repeatedly emphasized market stability. Since mid-last month, the heads of the authorities have consecutively engaged in "verbal interventions." On the 19th of last month, Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki stated, "Excessive exchange rate fluctuations are never desirable," and added, "We will actively respond at any time to stabilize the market." On the 26th of last month, Bank of Korea Governor Lee Ju-yeol announced that he is closely watching the recent trend of exchange rate decline. Although verbal interventions temporarily defended against the short-term exchange rate drop, the rate soon fell again.

Export companies are on edge as the exchange rate has reached levels they consider their bottom line. According to the Korea International Trade Association, small and medium-sized enterprises consider a won-dollar exchange rate of 1,100 won, and large corporations consider 1,000 won as the threshold for tolerable exchange losses.

The automotive industry is expected to suffer the greatest impact. According to the Korea Automobile Manufacturers Association, a 10 won drop in the exchange rate is expected to reduce sales by approximately 400 billion won for the five major automakers. In particular, Hyundai and Kia Motors have a high proportion of overseas sales and are constantly exposed to exchange rate fluctuation risks in various currencies. A Hyundai-Kia Motors official said, "We can withstand short-term exchange rate declines to some extent," but added, "However, as an export company whose sales and operating profits are directly affected by the exchange rate, prolonged won appreciation will inevitably cause damage."

The semiconductor industry, which accounts for 95% of exports, is also not free from exchange rate effects. However, since raw materials and equipment are purchased in dollars, the exchange rate decline is not expected to be a major negative factor. The steel and petroleum industries are also concerned about adverse effects on sales due to the exchange rate decline. There is also concern that won-denominated sales and operating profits may decrease in year-end financial results.

In the market, there are expectations that foreign exchange authorities will increase the level of verbal interventions and strengthen 'smoothing operation' measures to slow down the exchange rate decline. However, due to concerns about being designated as a currency manipulator by the United States, the authorities find it difficult to intervene indiscriminately in the foreign exchange market. Currently, South Korea is designated as a monitoring country, one step before currency manipulation, by the U.S. Treasury Department, and if designated as a currency manipulator, it could face sanctions from the U.S.

It is uncertain whether foreign exchange intervention can prevent won appreciation. The U.S. has been pumping money in response to the COVID-19 pandemic, which inevitably leads to a weak dollar trend, and South Korea's relatively strong economic growth makes it difficult to avoid won appreciation. Dongjin Rak, a researcher at Daishin Securities, said, "The fact that South Korean exports turned positive in November, raising expectations for trade normalization, and the anticipation of economic normalization due to COVID-19 vaccine development have expanded risk asset preference," adding, "The Chinese government's promotion of yuan internationalization and the resulting yuan value revaluation also support won appreciation." He said, "this trend is expected to continue until the first half of next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.