Emphasis on Economic Recovery Support... Direction Indicated Ahead of This Month's FOMC Meeting

Beige Book: One-Third of U.S. Regions at Zero Growth

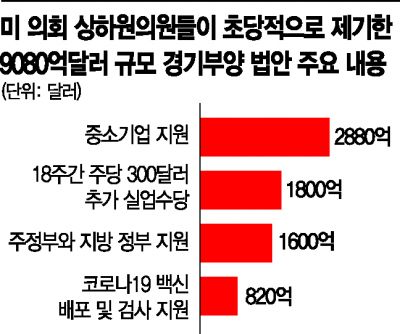

U.S. Congress Pushes $908 Billion Economic Stimulus Bill

[Asia Economy New York=Correspondent Baek Jong-min] Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), indicated that he has no intention of pursuing a tightening monetary policy. Earlier, the Fed discussed the possibility of changing asset purchases, but signaled that it will not reduce money supply for the time being. This appears to take into account the fact that the novel coronavirus infection (COVID-19) is still raging and adversely affecting the U.S. economic recovery.

According to Bloomberg News on the 2nd (local time), Chairman Powell appeared before the U.S. House Financial Services Committee and said, "There are no plans to hastily reduce the asset purchase program." He added, "We will focus on supporting the economy until the current crisis is overcome," and explained, "We will keep the benchmark interest rate at a low level and use all available tools until we are confident that the economic risks have clearly passed."

Powell's remarks on this day drew attention as they came ahead of the Federal Open Market Committee (FOMC) meeting scheduled for the 15th-16th. The Fed had previously disclosed through the FOMC minutes last month that members discussed changes to the asset purchase program or providing guidelines.

Since June, the Fed has been supplying liquidity to the market by purchasing $80 billion in U.S. Treasury securities and $40 billion in mortgage-backed securities monthly, totaling $120 billion.

Bloomberg News evaluated Powell's remarks as "no signal to ease money supply," interpreting that there will be no change at least in the purchase level. It added, citing market experts, that as the COVID-19 situation worsens, the Fed is expected to support the economic recovery indirectly at this month's FOMC by expanding the asset purchase program or including long-term bonds.

This stance of the Fed was also confirmed in the Beige Book, a report on economic conditions released on the same day. The Fed stated in the Beige Book that among the 12 Federal Reserve Banks, four "witnessed little or no economic growth." This report will be used as basic material for this month's FOMC meeting.

John Williams, President of the New York Federal Reserve Bank, reinforced Powell's view by mentioning the recent worsening of the COVID-19 situation. He expressed concern that "economic recovery will slow down over the next few months" due to the high uncertainty caused by the spread of COVID-19.

Kim Sung-taek, Senior Fellow at the International Finance Center, predicted, "Since monetary policy must support fiscal policy for economic stimulus in the U.S., it will be difficult to reduce Treasury purchases at least until next year." He also forecasted, "South Korea will also continue accommodative policies for the time being, but the effectiveness of the COVID-19 vaccine could be a variable."

The U.S. Congress has also strongly pressured for the passage of a stimulus package to support the economy. Nancy Pelosi, Speaker of the House, and Chuck Schumer, Senate Majority Leader, both Democrats, issued a statement supporting the $908 billion bipartisan economic stimulus bill proposed by members of both houses of Congress the day before.

President-elect Joe Biden also urged the passage of the stimulus bill before his inauguration on the same day.

However, Senate Republican Leader Mitch McConnell maintained his position to pass a $500 billion stimulus bill, leaving the final agreement still uncertain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)