Interbank Loan Rates Surge... 'Daesuman-gwan' Reappears at People's Bank

People's Bank Governor: "Fiscal Deficit Should Not Be Burdened"

Deutsche Bank: "Two Rate Hikes Possible Next Year"

US Congressional Advisory Panel: "Focus Likely on Ensuring China's Financial Stability"

[Asia Economy Reporter Lee Hyun-woo] While countries around the world are focused on economic stimulus measures due to the aftermath of the novel coronavirus disease (COVID-19) crisis, China has alone shifted to a tightening stance. Unlike other countries where the COVID-19 situation remains severe, China declared an early end to the pandemic and has shown a clear economic recovery. Analysts suggest this move is also intended to preemptively block potential crises in the financial system amid diplomatic and economic frictions with the United States.

The tightening stance can be confirmed through indicators within China. On the 3rd, Hong Kong's South China Morning Post (SCMP) reported, citing China Index Academy (CIA), a private real estate research firm, that the growth rate of new home prices in 100 major Chinese cities slowed to 0.32% month-on-month last month. CIA explained that this was due to reduced demand as funds flowing into real estate decreased amid the Chinese government's tightening policy.

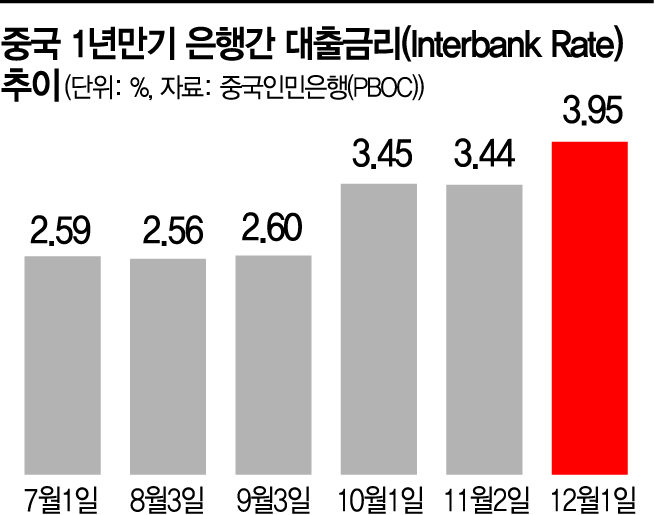

Interbank borrowing in China is also becoming more difficult. The one-year interbank lending rate announced by the People's Bank of China (PBOC) at the beginning of this month rose sharply by 66% to 3.95%, compared to 2.59% in early July. Some smaller banks that cannot directly transact funds with the PBOC are reportedly facing difficulties in securing liquidity. Earlier, despite announcements of defaults by state-owned enterprises such as Huachuan Group, Tsinghua Unigroup, and Yongcheng Coal Power, the Chinese government did not announce any separate support measures and instead declared it would impose strong penalties for violations.

The PBOC has also been sending signals of tightening since the end of last month. In the Q3 Monetary Policy Implementation Report released on the 26th of last month, the PBOC included the phrase "will definitely not 'pour water in large quantities'." The phrase means not to supply excessive liquidity to the market. PBOC Governor Yi Gang recently emphasized in a media article that "the fiscal deficit should not be borne by purchasing government bonds."

Unlike the United States and Europe, China's shift to a tightening stance is interpreted as confidence in the economic recovery. China's Manufacturing Purchasing Managers' Index (PMI) for November was recorded at 52.1, marking the highest level in 3 years and 2 months. Since plunging to 35.7 in February due to the COVID-19 impact, it has maintained a level above 50, indicating economic expansion, for nine consecutive months. Foreign investors continue to pour funds into China amid positive expectations for the Chinese economy. According to the Institute of International Finance (IIF), nearly half of the $3.25 billion fund inflows into emerging market bonds last month, about $1.5 billion, went into Chinese government bonds.

Deutsche Bank stated in a report, "China will record an economic growth rate of 9.5% next year, emerging from the COVID-19 shock," and predicted, "China will raise interest rates about twice next year, becoming the first country in the world to close the monetary supply valve." Goldman Sachs also forecasted that China would not issue the 1 trillion yuan special government bonds issued this year as part of the COVID-19 stimulus package next year, aiming to reduce the fiscal deficit ratio.

Some analysts suggest that this is a measure to preemptively block potential crises arising from a vulnerable financial system in preparation for worsening frictions with the United States. On the 1st (local time), the U.S.-China Economic and Security Review Commission (USCC), a bipartisan advisory body under the U.S. Congress, pointed out in its 2020 annual report that "the Chinese government launched large-scale liquidity injections as liquidity in the market became scarce due to the COVID-19 aftermath, but most of the policy funds flowed to state-owned enterprises affiliated with local governments and related financial institutions, causing severe credit tightening." It further noted, "Considering that the total national debt is at a dangerous level of 283% of GDP, the focus will be on controlling the debt ratio and securing financial stability rather than economic growth."

Hyun Sang-baek, head of the China Economy and Trade Team at the Korea Institute for International Economic Policy (KIEP), said, "China is continuing infrastructure and new business investments through fiscal policy but is sending a message that it will not increase liquidity supply through monetary policy," adding, "Until now, investment in Chinese state-owned enterprises was considered unproblematic, but now investors need to reconsider that aspect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.