Abolition of Public Certificates from the 10th

KFTC Launches Financial Authentication Service

One Certificate Usable Across All Banks

Accessible on Mobile and PC Anywhere

Kookmin Bank Attracts About 5.5 Million Users Since July Launch

Jointly Operated 'PASS' by Telecom Companies

Growing Influence of KakaoPay and Others

[Asia Economy Reporters Kim Hyo-jin and Ki Ha-young] With the amendment of the Electronic Signature Act, the public certification system will be abolished starting from the 10th, opening a new authentication market worth 70 billion KRW. The financial sector is actively developing and launching authentication services. The competition among financial institutions to be recognized as the national certification by emphasizing convenience and security is becoming increasingly fierce. With the abolition of the public certification system after 21 years, consumers' choices are expected to expand significantly.

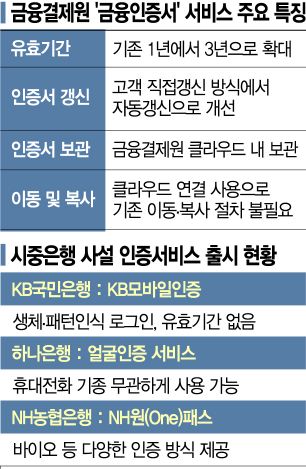

According to the financial sector on the 3rd, the Korea Financial Telecommunications & Clearings Institute (KFTC), which managed the existing public certification system, will launch a financial authentication service in line with the enforcement of the amended Electronic Signature Act. The financial authentication service issues and stores financial certificates securely in KFTC’s cloud, allowing users to access them anytime and anywhere via PC or mobile connected to the cloud. This authentication service is jointly operated by KFTC and banks, and any bank customer using internet or mobile banking can use it free of charge.

The first to adopt this service was Woori Bank. It has been available on Woori WON (WON) Banking since the 17th of last month. KFTC plans to continuously expand the institutions where this service can be used, including Government24, the National Petition Portal, Subscription Home, and Hometax, based on the full-scale launch in the banking sector on the 10th.

The financial authentication service is implemented using web standards (HTML5), providing convenience as it does not require separate application (app) or plugin installation. The financial certificate is issued after thorough identity verification either face-to-face or non-face-to-face at the bank, ensuring the same reliability as the public certification system. Additionally, the financial certificate is encrypted and stored in the cloud, and its transfer or copying is prohibited, which enhances security.

Only one financial certificate needs to be issued regardless of the bank. Public certificates issued before the 10th can also be used together.

The pace of commercial banks around the authentication service is also accelerating. So far, KB Kookmin Bank appears to have entered the market relatively quickly. KB Kookmin Bank launched 'KB Mobile Authentication' in July last year, and it is known to have nearly 5.5 million subscribers. Users can log in using biometric or pattern recognition and conduct financial transactions without one-time password generators (OTP) or security cards. It has no expiration date, so renewal is not required.

Hana Bank introduced a face recognition service usable regardless of phone model in August, and NH Nonghyup Bank launched a simple authentication service called 'NH One Pass' earlier this month. IBK Industrial Bank is also applying 'IBK Mobile Certificate' to 'i-ONE Bank.' Other banks are expected to release new authentication services soon.

Public Certification Abolished from the 10th... Financial Sector Strives to Secure Proprietary Authentication Bases

The card industry is also pushing to enter the private authentication market. Shinhan Card is developing a private certificate aiming for release in the first quarter of next year. Shinhan Card believes it can secure versatility based on its 26.8 million customers. KB Kookmin Card plans to focus on expanding the authentication service launched by KB Kookmin Bank. Hana Card has a similar strategy. Woori Card currently provides proprietary authentication services such as biometric authentication and card touch authentication and plans to secure additional authentication services in the future.

The public certification system has functions for 'identity verification' to confirm the person’s identity in non-face-to-face channels and 'electronic signature (non-repudiation)' to verify the authenticity of electronic acts. Card companies were designated as identity verification agencies by the Korea Communications Commission in 2018. They already have authentication systems such as biometric recognition and PIN numbers.

Opinions on these movements are somewhat divided. The biggest issue is commercialization. The number of electronic certificates issued by PASS, jointly operated by the three major mobile carriers, has already exceeded 20 million, and Kakao Pay also has over 20 million subscribers. Not only the financial sector but also big tech companies like Naver have already entered the authentication market.

A financial sector official said, "The fate of private authentication services will be decided not by development itself but by commercialization," adding, "Since a very fierce competitive structure has already formed, it will not be easy for banks or card companies to increase their influence in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.