[Asia Economy Reporter Yuri Kim] Recently, the number of tenants reluctantly entering the monthly rent market due to the severe jeonse (long-term lease) shortage is increasing. Their 'perceived jeonse price' is even higher than the recently surged jeonse prices. Although there is a 2.5% cap on the jeonse-to-monthly rent conversion rate, this only applies to contract renewals. New tenants entering the market face a harsh dual pricing situation, effectively paying "different monthly rents for the same house" outside the legal framework.

According to the real estate industry on the 3rd, as the intensified jeonse shortage caused by the implementation of the two lease laws?jeonse and monthly rent cap system and the right to request contract renewal?spreads to the monthly rent market, high-priced monthly rent contracts worth millions of won are increasing not only in Gangnam but also in Gangbuk, Seoul. According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, an 84㎡ (exclusive area) unit in Mapo Raemian Prugio, Ahyeon-dong, Mapo-gu, was traded last month with a deposit of 100 million won and a monthly rent of 4 million won. Compared to a contract for the same size in June with a deposit of 100 million won and monthly rent of 1.95 million won, the monthly rent more than doubled in just over five months. Similarly, an 84㎡ unit in Gireum New Town 9 Complex (Raemian), Gireum-dong, Seongbuk-gu, was traded last month with a deposit of 200 million won and monthly rent of 2 million won.

The problem is that many of these are not 'voluntary monthly rents' but 'forced monthly rents,' and the new monthly rent prices far exceed the 2.5% jeonse-to-monthly rent conversion rate even when compared to the soaring new jeonse prices. When concerns arose that the implementation of the two lease laws would accelerate the shift to monthly rent, the government lowered the jeonse-to-monthly rent conversion rate from the previous 4% to 2.5% in September. However, this applies only to contract renewals and not to new contracts.

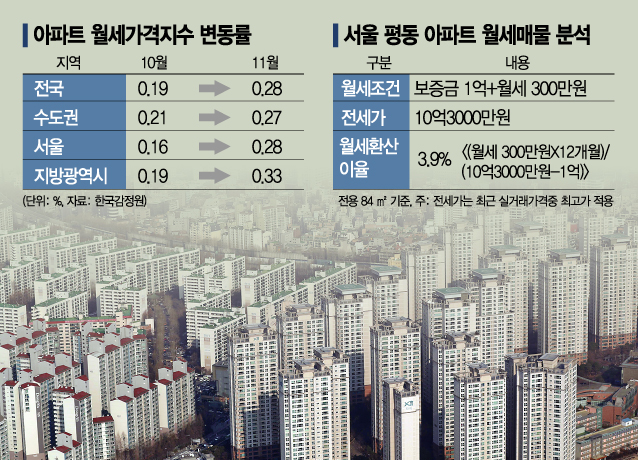

For example, an 84㎡ apartment in Pyeong-dong, Jongno-gu, Seoul, is currently listed with a deposit of 100 million won and a monthly rent of 3 million won. If a contract is signed at this price, the annual monthly rent (36 million won) divided by the recent highest jeonse transaction price for the same size (1.03 billion won) minus the deposit (100 million won) results in a monthly rent conversion rate of 3.9%. Compared to the recent jeonse asking price (up to 1.2 billion won), the 2.5% conversion rate would correspond to a monthly rent of about 2.3 million won with a 100 million won deposit, meaning tenants pay about 700,000 won more per month. Considering this, the perceived monthly rent price compared to the soaring jeonse price is rising even more. The 'dual monthly rent pricing'?different monthly rents for the same house depending on when the contract was signed?is more evident than the dual jeonse pricing. Applying the government's 2.5% cap to a deposit of 100 million won and monthly rent of 3 million won, the perceived jeonse price soars to 1.54 billion won. Ultimately, tenants have to pay much higher prices than the current market jeonse prices to secure housing.

Even tenants who can exercise their right to request contract renewal are not in an easy situation. From the tenant's perspective, they try to avoid monthly rent burdens, but landlords resist unless monthly rent conversion is allowed, making the clause 'monthly rent conversion cannot occur without tenant consent' difficult to enforce in reality. Many tenants, unable to afford the deposit that has jumped by several hundred million won, have no choice but to convert part of the deposit into monthly rent to find a home. According to the Seoul Real Estate Information Plaza, among the total 8,101 apartment lease transactions in Seoul last month, semi-monthly rent (ban-jeonse) accounted for 24.40% (1,977 cases), more than double the 12.20% in October.

The industry expects the shortage of jeonse supply to continue beyond next year into 2022, accelerating tenants' housing burdens. According to the Korea Real Estate Board, in the November nationwide housing price trend, Seoul's housing (apartments, row houses, detached houses) monthly rent supply-demand index reached an all-time high of 112.9. This index indicates a shortage of supply compared to demand when approaching 200. The jeonse supply-demand index also rose to 118.2. As more people unable to find jeonse switch to monthly rent, the supply of monthly rent properties is also decreasing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.