Attention on Additional Extension Discussions Amid 3rd Wave Spread

"May Review Depending on Quarantine Situation"

[Asia Economy Reporter Kim Hyo-jin] The financial sector is on high alert over the possibility of another extension of the loan maturity extension measures for small business owners and SMEs related to the novel coronavirus infection (COVID-19), which are currently in effect until March next year. Originally set to expire last September, the measures were extended once until March next year, and concerns are particularly rising among commercial banks that have already extended maturities on loans exceeding 70 trillion won. This is because no one knows when the ticking time bomb of accumulating potential non-performing loans will explode.

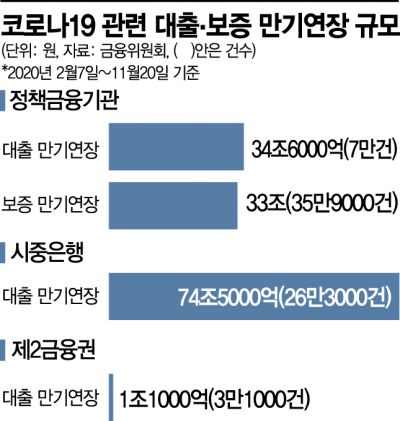

According to financial authorities and the financial sector on the 2nd, from February 7, when COVID-19-related financial support was first implemented, until November 20, a total of 363,000 cases of loan maturity extensions amounting to 110.2 trillion won were made by policy financial institutions, commercial banks, and the secondary financial sector. Among these, 75.6 trillion won of loan maturities were extended in the private sector, including commercial banks and the secondary financial sector, with commercial banks bearing most of the burden at 74.5 trillion won.

Considering the ongoing financial difficulties faced by small business owners and SMEs due to the resurgence of COVID-19, the financial authorities decided in August to maintain the maturity extension measures for an additional six months until March next year. The review and discussions surrounding this decision began around early July, about two months before the first measure was set to expire. Given this, there is speculation that discussions on re-extending the measures could begin as early as next month, centered around the financial authorities.

A financial authority official said, "The loan maturity extension is a dependent measure in response to COVID-19 prevention," adding, "Depending on the situation next year, additional extensions may be considered."

Voices within the banking sector are already leaning toward the possibility of the measures being extended for one or two quarters. This is because the third wave of COVID-19 has led to successive increases in social distancing levels, especially in the metropolitan area, exacerbating difficulties for small business owners and others.

The fact that the real economy, which rebounded in September, contracted again in October supports this sentiment. According to the "October Industrial Activity Trends" released by Statistics Korea on the 30th of last month, retail sales, which indicate consumer trends, decreased by 0.9% in October. This was the first decline in three months since July (-6.0%). It is also analyzed that the effect of the second disaster relief fund, selectively provided to small business owners and vulnerable employment groups, did not last long.

Rapid Deterioration of Conditions for Small Business Owners Due to Strengthened Social Distancing

The government judges that overall industrial activity trends fluctuate due to the spread of COVID-19. Therefore, the general outlook is that the worsening trend since last month, when the third wave of COVID-19 began in earnest, will continue for the time being. A senior official from a commercial bank predicted, "Even assuming that the spread of COVID-19 rapidly decreases and social distancing is eased early, the shock that has already occurred will continue at least until the first half of next year."

The official added, "It is unlikely that borrowers whose repayment ability has weakened due to the impact of COVID-19 will suddenly recover their repayment ability next year," expressing concern that "once the maturity extension measures are completed, non-performing loans may soon surface."

According to the Court Administration Office, there were 815 corporate bankruptcy filings submitted to bankruptcy divisions of courts nationwide from January to September, the highest number since statistics began in 2013. Personal bankruptcy filings, which were 32,113 cases from January to September in 2018, also surged about 16% to 37,450 cases during the same period this year.

This means that many people are struggling with debt to the point of giving up everything. The banking sector is significantly increasing its loan loss provisions to prepare for sudden defaults and losses.

As of the third quarter of this year, the provisions of the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?amounted to 1.9336 trillion won, more than double the 811.4 billion won recorded in the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)