Expansion of Contactless Digital Finance

Establishing Digital Innovation Teams to Compete with Big Tech like Naver

Actively Recruiting Experts

[Asia Economy Reporter Kangwook Cho] Commercial banks, which have put their lives on strengthening 'digital finance,' are actively recruiting external personnel and are fully launching financial platform strategies to compete with big tech companies such as Naver and Kakao. As the spread of non-face-to-face digital finance accelerates due to the aftermath of the novel coronavirus disease (COVID-19), the trend of actively utilizing external talents with expertise in various digital fields such as artificial intelligence (AI) and big data is spreading.

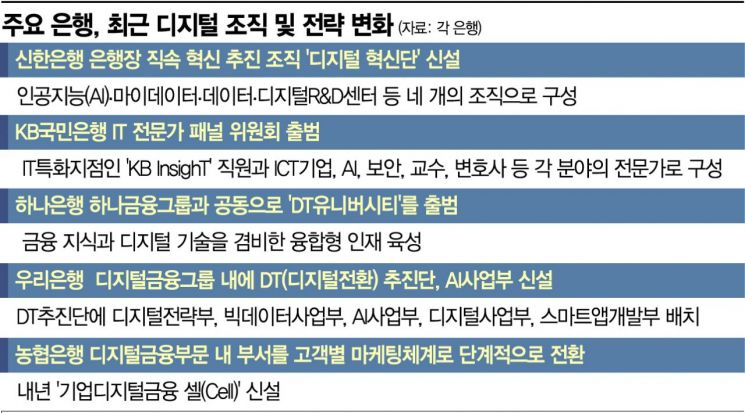

According to the financial sector on the 2nd, major banks have been accelerating the strengthening of digital finance this year by recruiting external experts and establishing innovation organizations directly under the bank president.

NH Nonghyup Bank decided to gradually convert departments within the digital finance division into a customer-specific marketing system starting next year to strengthen customer-centered digital finance through an organizational restructuring at the end of last month. Currently, NH Nonghyup Bank's digital finance division is divided into the Digital Strategy Department, Digital Channel Department, Digital Marketing Department, and Digital Business Department, each separated by function. The plan is to establish a 'Corporate Digital Finance Cell' next year and then separate departments by customer type, such as the Personal Digital Business Department and Corporate Digital Business Department, starting in 2022.

This change came about four months after recruiting Lee Sang-rae, former Samsung SDS executive director, as the head of the digital finance division (CDO, vice president) in July. In particular, it is the first time that NH Nonghyup Bank has recruited an external vice president, excluding the compliance officer, which is seen as breaking the tradition of pure-bloodism.

KB Kookmin Bank launched a panel committee consisting of 24 IT experts in September. The committee is a meeting body that discusses the outlook and response strategies for financial IT, composed of Lee Woo-yeol, KB Kookmin Bank IT Group Vice President, Dr. Shin Yong-yeo, Chief Technology Officer (NTO) of Microsoft (MS), Lim Jin-sik, executive director of Amazon Web Services (AWS), Kim Hwa-jong, head of the AI New Drug Development Support Center, as well as employees of KB Kookmin Bank's IT specialized branch 'KB Insight,' ICT companies, AI, security experts, professors, and lawyers. Previously, in April last year, KB Kookmin Bank appointed Yoon Jin-soo, former Hyundai Card executive director, as head of the Data Strategy Headquarters (executive director).

Hana Bank is accelerating not only the recruitment of external talents but also the development of internal digital talents. 'DT University,' launched jointly with Hana Financial Group in July, is an integrated education platform that provides customized practical digital training to strengthen digital capabilities. In the case of Hana Bank, Kim Jung-han, former head of the Silicon Valley and Samsung Electronics Software Research Institute, who was recruited at the group level at the end of 2017, is in charge of the group's ICT overall management.

Woori Bank carried out its second organizational restructuring after the inauguration of President Kwon Kwang-seok in July, establishing the 'DT (Digital Transformation) Promotion Team' and 'AI Business Department' in the digital field. In particular, the DT Promotion Team includes the Digital Strategy Department, Big Data Business Department, AI Business Department, Digital Business Department, and Smart App Development Department.

Earlier, in 2018, Woori Bank brought in Hwang Won-cheol, former executive director of Hana Financial Investment, as head of the Digital Finance Group and CDO. Hwang was the first C-level executive recruited externally by Woori Bank. In addition, Noh Jin-ho, former CEO of Hancom, serves as the head of the Digital & IT Division, the digital control tower of Woori Financial Group.

Most recently, Shinhan Bank established the 'Digital Innovation Team,' an innovation promotion organization directly under the bank president. It consists of four organizations: AI Unit, MyData Unit, Data Unit, and Digital R&D Center. To accelerate innovation, they recruited former KT executive director Kim Hye-joo and former SK C&C executive director Kim Jun-hwan as leaders to lead the 'Digital Innovation Team.'

A financial sector official said, "Competition with big tech companies such as Naver and Kakao is a matter of life and death for the banking sector," adding, "There is a widespread sense of crisis that external experts must be brought in faster for digital innovation, even in the banking sector, which has had strong pure-bloodism."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)