[Asia Economy Reporter Minji Lee] As the balance of margin exchange transactions introduced to reduce credit risk from counterparty default and contract non-performance is on the rise, financial authorities announced on the 2nd that they will actively support the preparation process to ensure the smooth establishment of the initial margin exchange system ahead of its implementation.

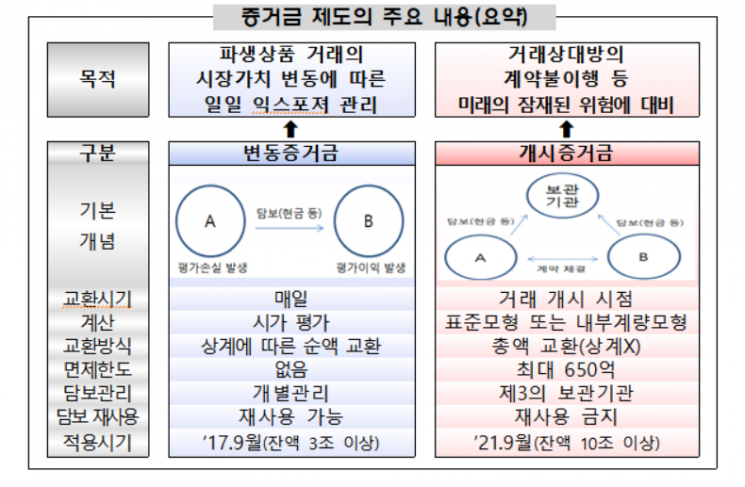

The margin exchange system refers to the pre-exchange of margin between parties in over-the-counter (OTC) derivative transactions to compensate for losses with collected collateral in case of default. It is divided into initial margin and variation margin. The initial margin represents collateral exchanged at the time of transaction to cover the counterparty's future default risk, while the variation margin is exchanged to manage daily exposure.

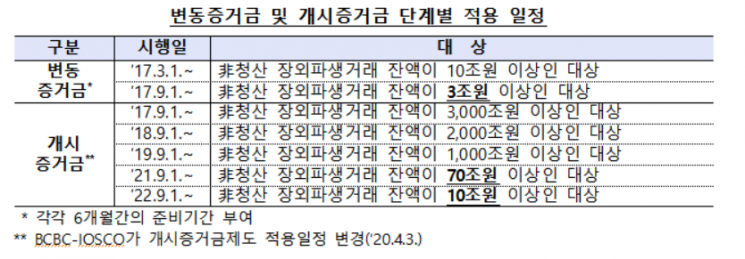

Previously, the financial authorities have been implementing the 'Guidelines for Margin Exchange System for Non-Cleared OTC Derivative Transactions' since March 2017 to encourage central clearing of OTC derivative transactions and mitigate systemic risk.

The initial margin exchange system is scheduled to be fully implemented from September 1, 2021. Although the system was originally planned to be enforced starting September this year, the implementation was postponed by one year considering the financial institutions' burden due to the COVID-19 pandemic.

Institutions subject to variation margin are those with OTC derivative transaction balances of 3 trillion KRW or more, and for initial margin, the threshold is 70 trillion KRW or more from September next year and 10 trillion KRW or more from September 2022. Mainly foreign bank branches, banks, securities firms, and insurance companies with large transaction volumes fall under this category.

The target products include all OTC derivatives not cleared through a central clearinghouse, except for physically settled foreign exchange forwards and swaps, currency swaps, commodity forwards, and equity options. The threshold for variation margin is 3 trillion KRW or more.

As of this year, 85 financial companies are subject to variation margin exchange for non-cleared OTC derivative transactions. Based on the consolidated balance of financial groups, 20 companies are subject to variation margin, while the remaining 65 companies are included based on their individual balances.

Provisionally, a total of 43 financial companies are subject to the initial margin exchange system for non-cleared OTC derivative transactions. This includes 12 foreign banks, 24 banks, 7 securities firms, 9 insurance companies, and 3 asset management companies. Among them, 18 companies are subject to initial margin based on the consolidated balance of their financial groups exceeding 70 trillion KRW rather than individual balances.

As of this year, 69 financial companies are expected to be subject to the initial margin exchange system from September 2022, including 28 banks, 16 securities firms, 19 insurance companies, and 6 asset management companies. Among these, 26 companies are subject to initial margin based on their financial group's total balance exceeding 10 trillion KRW.

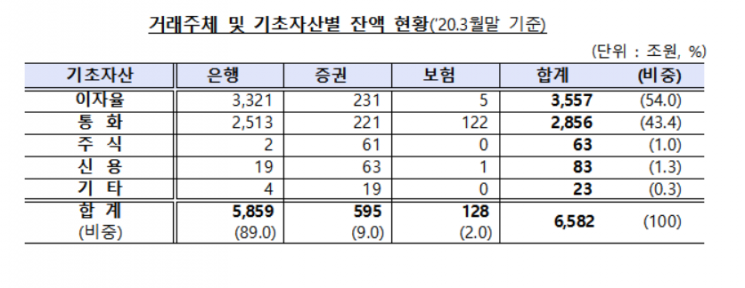

The balance of non-cleared OTC derivative transactions exchanging margin reached 6,582 trillion KRW (as of the end of March), an increase of 1,373 trillion KRW compared to the previous year (5,209 trillion KRW). This is attributed to the continuous increase in OTC derivative transactions by financial institutions despite the growth in centrally cleared OTC derivative transactions. The OTC derivative transaction balance recorded 8,304 trillion KRW at the end of March 2018 and 11,318 trillion KRW as of this year.

By underlying asset, interest rate-based OTC derivatives accounted for the largest share at 54%, followed by currency (43.4%), credit (1.3%), and equity (1%). By transaction participants, banks' interest rate and currency-related OTC derivative transaction balances accounted for the majority (88.6%) of the total balance.

The Financial Supervisory Service stated, "Ahead of the full implementation of the initial margin system, we plan to actively support financial institutions' preparation processes for the successful establishment of this system," adding, "We will continuously monitor financial institutions' readiness for system construction and contract process establishment related to initial margin compliance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)