Jungjinkong Publishes Field Survey Brief on Small and Medium Venture Enterprises

[Asia Economy Reporter Kim Cheol-hyun] Two out of three small and medium venture enterprises (SMVEs) expect the damage caused by the novel coronavirus infection (COVID-19) to last for more than a year. The number of SMVEs anticipating prolonged COVID-19 damage increased by more than 60 percentage points compared to the first quarter.

The Small and Medium Business Corporation (Chairman Kim Hak-do, hereafter SBC) announced this on the 2nd by publishing the "SMVE Field Survey Brief," which analyzed the results of a management status survey of SMVEs due to the prolonged COVID-19 pandemic. This survey was conducted from October 26 to November 3 targeting 1,000 companies and received responses from 319 companies.

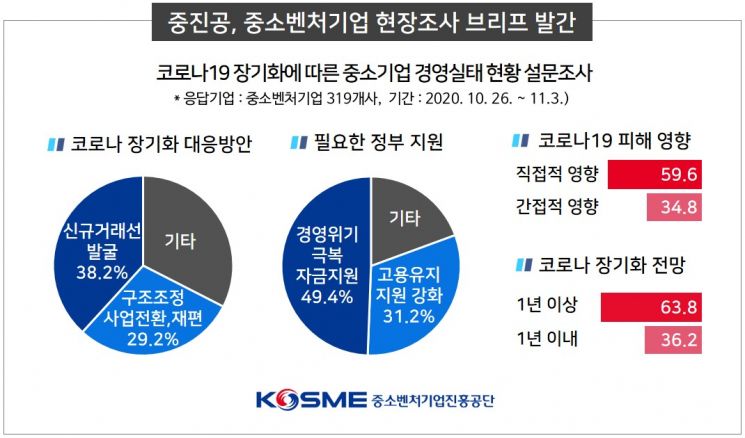

According to the survey results, 94.4% of SMVEs were directly or indirectly affected by COVID-19. The main types of damage were 'domestic demand slump due to reduced consumer sentiment (48.8%)', 'decreased demand in overseas markets (24.9%)', and 'production disruptions at own or consigned factories (12%)'. In particular, 63.8% responded that the damage caused by COVID-19 would be prolonged for 'more than one year,' an increase of 60.9 percentage points compared to 2.9% in the first quarter.

However, despite the expectation of prolonged COVID-19 impact, 8.3% of SMVEs anticipated an increase in sales in the fourth quarter. The electrical and electronics, food, chemical, and machinery industries showed a 'sales increase' response rate of 10.6% to 18.8%, which was better than the overall average of 8.3%. Reasons for sales growth included increased sales of quarantine products, growth in online sales, and increased automobile production and exports.

As countermeasures for prolonged COVID-19 impact, the most common responses were 'discovering new trading partners (38.2%)', 'business restructuring, business conversion/reorganization (29.2%)', 'workforce reduction (14.3%)', 'expansion of manufacturing innovation such as smart factory establishment and activation (12.6%)', and 'expansion of untact exchanges (5.6%)'.

Countermeasures varied by industry. The electronic components, textiles, and information processing sectors most frequently chose 'business restructuring, business conversion/reorganization,' while the automobile and rubber/plastics sectors had the highest proportion selecting 'expansion of manufacturing innovation such as smart factory establishment and activation.'

Regarding necessary government support, 'financial support to overcome management crises (49.4%)' was most frequently selected, with detailed responses indicating the need for 'additional policy fund loans (44.5%)' and 'deferment of existing loan repayments (25.1%).'

Since last year, SBC has been publishing the SMVE Field Survey Brief, which reflects the voices and policy demands of businesses in 32 regional headquarters. This report can be accessed on the SBC website. Chairman Kim Hak-do stated, "We are regularly conducting trend surveys by leveraging the strengths of our nationwide field organizations to understand the status and requests of SMVEs," adding, "We will actively reflect the survey results when planning future support projects to provide demand-oriented policy services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.