[Asia Economy Reporter Ki-min Lee] Although the economy is expected to contract this year due to the impact of the novel coronavirus disease (COVID-19), it is forecasted to recover to the mid-2% range next year.

On the 2nd, the Korea Economic Research Institute (KERI) projected in its report "KERI Economic Trends and Outlook: Q4 2020" that the third wave of COVID-19 would materialize, resulting in an economic contraction of -1.4% this year.

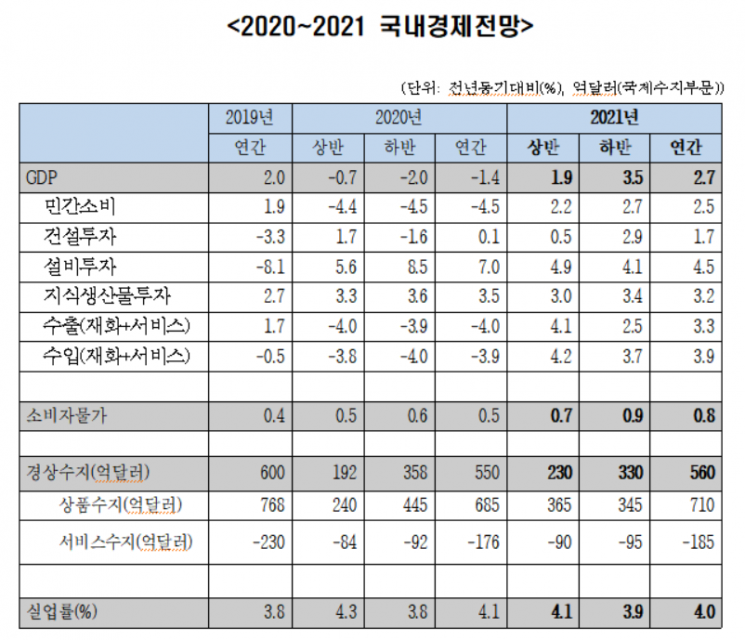

However, next year, with the recovery of the external sector such as export growth and expectations for the distribution of COVID-19 vaccines and treatments, the economy is expected to grow by 2.7%, returning to pre-pandemic levels.

Private consumption, which accounts for the largest share of the domestic sector, is expected to grow by 2.5% next year, reflecting a modest recovery. KERI pointed out that private consumption, which showed a temporary rebound thanks to government stimulus efforts such as emergency disaster relief funds, is now showing a sharp re-contraction due to the third wave of COVID-19.

In addition to the direct impacts of COVID-19 such as a decline in nominal wage growth due to poor corporate performance, decreased income for self-employed individuals, and rising unemployment, structural factors like the repayment burden of household debt caused by a recent surge in credit loans and rent increases due to soaring jeonse and monthly rents are also expected to limit the recovery of private consumption.

KERI forecasted that facility investment will record a 4.5% growth, supported by a technical rebound from previously low performance and aggressive investments in the semiconductor sector. Construction investment, which had been sluggish due to the government’s strong real estate suppression policies, is expected to turn positive due to improvements in civil engineering performance and the effects of large-scale supply measures.

The consumer price inflation rate is projected to remain at around 0.8%, as demand re-contraction caused by the COVID-19 pandemic continues to have some impact into the first half of 2021, despite expectations for economic recovery, a gradual rebound in international oil prices, and rising housing costs such as rent.

KERI also anticipated that real exports will recover to around 3%, driven by strong economic stimulus measures in major countries. In particular, the robust performance of domestic semiconductor exports and expectations for the resolution of the US-China trade dispute following the inauguration of the Joe Biden administration in the United States are cited as major factors for the improvement in real exports.

Regarding the current account balance, if the global economic recovery proceeds smoothly, exports will increase and imports will also rise in tandem with the recovery of domestic facility investment, resulting in a surplus of about $56 billion, similar to this year’s level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.