World Cocoa Production 70% Controlled by C?te d'Ivoire-Ghana Alliance

"Protecting Farm Workers' Wages" Fixed Premium of $400 per Ton

US Chocolate Makers like Hershey Buy in Futures Market Without Premium Instead of Spot

Hershey "Will Procure Through Diverse Suppliers"

[Asia Economy Reporter Jeong Hyunjin] "'The 'OPEC of the cocoa world' has turned the New York market into a trade battlefield." (Bloomberg News)

The price of cocoa, the main ingredient in chocolate, showed an unusual surge last month in the U.S. New York futures market. This was the result of West African cocoa's largest producers, C?te d'Ivoire and Ghana, adding premiums to cocoa prices, prompting North America's largest chocolate company, Hershey Chocolate, to purchase cocoa in the futures market instead of the physical market. The conflict between producers and consumers is expected to increase price volatility.

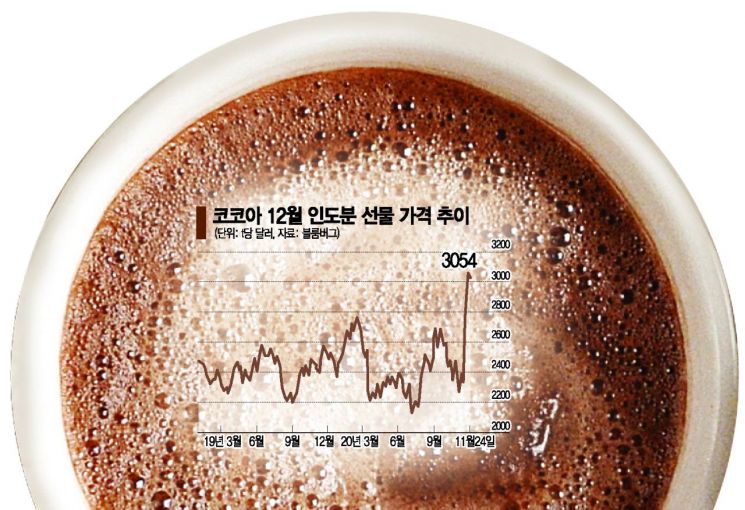

According to Bloomberg News on the 1st (local time), the December delivery cocoa futures price on the New York futures market reached $3,054 per ton on the 24th of last month. This is the highest since December delivery contracts began trading in 2018. The March delivery cocoa futures price for next year also rose 23% from $2,264 on the 2nd to $2,785 on the 24th. The weekly increase in the last week of last month was the largest in 19 years. Considering that cocoa futures prices have fluctuated within single digits every November, this year's trend is clearly unusual.

The strength in cocoa futures prices began when C?te d'Ivoire and Ghana, which account for 70% of global cocoa production, announced in July last year that they would price cocoa with a premium. They declared that they would add a fixed price premium of $400 per ton to cocoa prices traded in 2020-2021 under the pretext of protecting farm workers' wages.

Additionally, Ghana's Vice President Mahamudu Bawumia mentioned plans to form 'Copec,' a coalition of cocoa-producing countries similar to OPEC, to alleviate poverty issues on cocoa farms.

This regulation did not receive much attention after its announcement last year. However, since its actual implementation in October, conflicts between chocolate companies and cocoa-producing countries have surfaced. Until now, chocolate companies generally purchased cocoa physically at the production sites, considering fees. But as producers began adding premiums, traders and chocolate manufacturers started turning to the futures market, which does not include premiums.

The conflict has intensified particularly as Hershey Chocolate, the largest cocoa buyer, appeared in the futures market. Bloomberg and others reported, citing sources, that Hershey recently purchased large quantities of cocoa in the futures market. Hershey did not disclose specific purchasing channels but stated that it procures cocoa through various suppliers.

Hershey also indirectly expressed dissatisfaction with C?te d'Ivoire and Ghana's premium policy, stating that it has long maintained support plans to improve living standards on cocoa farms, including addressing the cost-of-living gap in C?te d'Ivoire and Ghana.

Bloomberg described this as an "unusual measure." Derek Chambers, who was in charge of cocoa trading at French commodity trader Sucden, told Bloomberg, "Hershey's decision is smart and entirely legal," adding, "It not only gives them a competitive advantage over other U.S. chocolate companies but also has positive effects in various aspects."

Industry insiders have evaluated the cocoa-producing countries' actions as somewhat excessive. Considering that chocolate manufacturers' sales have sharply declined since the COVID-19 pandemic, African countries supplying raw materials need to respond more flexibly.

However, C?te d'Ivoire continued its criticism, stating that the $100 billion chocolate industry refuses to pay premiums to improve the livelihoods of cocoa farms. Yves Kone, director of C?te d'Ivoire's regulatory authority, the Caf?-Cacao Board, sent a letter to the World Cocoa Association on the 18th of last month, stating, "We have learned that one of the largest chocolate manufacturers decided to buy cocoa on the exchange in opposition to premiums for cocoa farm livelihoods," and pointed out, "Such actions weaken the concept of minimum prices and further deny minimum wages for cocoa farms."

The two countries are also reportedly considering suspending a kind of "sustainability program" that certifies that exported cocoa is not produced through child labor exploitation or deforestation. Bloomberg noted that this would make it difficult for traders to assess these factors in the market.

However, foreign media assessed that if the current situation prolongs, the two countries will also face difficulties. There is still a large amount of unsold cocoa in C?te d'Ivoire and Ghana, and the longer it is stockpiled, the harder it will be to maintain this policy. Judy Gaines, president of J. Gaines Consulting, said, "They (the two countries) will try to leverage this, but due to reduced demand from the COVID-19 pandemic, they are not in a strong position."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)