System Semiconductor Sales Stagnant for Years to Soar Starting This Year

System Semiconductor Business Expected to Grow Centered on Foundry

[Asia Economy Reporter Changhwan Lee] Samsung Electronics' system semiconductor (non-memory) business is rapidly growing, and it is expected to open the era of 20 trillion KRW in sales for the first time next year. Among system semiconductors, the foundry (semiconductor contract manufacturing) business is rapidly expanding and is expected to become a major pillar of Samsung Electronics' semiconductor business in the future.

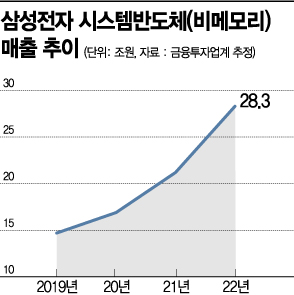

According to the financial investment industry on the 30th, Samsung Electronics' estimated system semiconductor sales this year are about 16.9 trillion KRW, a 15% increase compared to 14.7 trillion KRW recorded last year. Samsung Electronics' system semiconductor sales had been stagnant around 14 trillion KRW for several years, but this year it will surpass 15 trillion KRW for the first time.

The growth rate will accelerate further from next year. The sales forecast for next year is estimated at 21.2 trillion KRW, a 25.4% surge compared to this year. There is also a forecast that it will exceed 28 trillion KRW the year after next.

System semiconductors collectively refer to non-memory semiconductors such as central processing units (CPU), application processors (AP), and image sensors (CIS). Since the market is more than twice as large as the memory semiconductors that Samsung Electronics is currently focusing on, Samsung Electronics is focusing on expanding the market by making system semiconductors a new growth engine.

Among system semiconductors, foundry is expected to become the core of Samsung Electronics' semiconductor business in the future. Foundry is a business that receives semiconductor orders from other IT companies, manufactures, and delivers them. The foundry business started as companies specialized in semiconductor design emerged. Taiwan's TSMC, which currently occupies about 54% of the global foundry market, first started in the 1980s. Samsung Electronics, which holds 17%, is a latecomer chasing TSMC.

As semiconductor processes become more complex and demand increases, the foundry market is rapidly growing. Market research firm Omdia predicted that the global foundry market, which was $60 billion last year, will grow to $87.3 billion in 2022.

In response, Samsung Electronics Vice Chairman Lee Jae-yong presented a vision in April last year to "become the world's No. 1 foundry by 2030" and is continuing massive investments. The number of customers is also increasing. Major customers such as Nvidia and Qualcomm have been secured, and Intel is also considered a potential customer.

Recently, orders from Chinese customers are also increasing. It is known that as China's representative semiconductor companies such as Tsinghua Unigroup, HSMC, and SMIC face difficulties, inquiries for semiconductor contract manufacturing are increasing to Samsung Electronics, which has excellent foundry capabilities.

Kim Yang-jae, a researcher at KTB Investment & Securities, said, "Based on orders from major customers such as Qualcomm and Nvidia, Samsung Electronics' foundry business sales alone will reach 23 trillion KRW the year after next," and "Thanks to this, the sales proportion of the system semiconductor business, which was 6% of total sales last year, will expand to 10% in 2022."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.