Zigbang Announces Top 10 Major News Items Impacting the Real Estate Market

[Asia Economy Reporter Onyu Lim] The eventful housing market of this year has just over a month left. Although the novel coronavirus disease (COVID-19) pandemic at the beginning of the year had a considerable impact on the real estate market, the liquidity inflow into some local housing markets such as the metropolitan area and Sejong City due to the base interest rate cuts for economic recovery created a new trend with people in their 30s emerging as the main demand group for home purchases.

With the successive announcements of demand suppression measures such as the June 17 and July 10 policies aimed at calming the rapid price surge in the housing market, the sales market saw a slowdown in transaction volume and prices taking a breather. In the second half of the year, the rental market experienced a shortage of listings and rapid price increases, spreading the impact to the lease market, leading to the November 19 policy to supply an additional 114,000 housing units nationwide by 2022. Persistent instability in house prices and rental prices accompanied by the implementation of the price ceiling system for private land and the expansion of special supply (for newlyweds and first-time buyers) have raised expectations, resulting in a frenzy of apartment subscription and lottery-like sales.

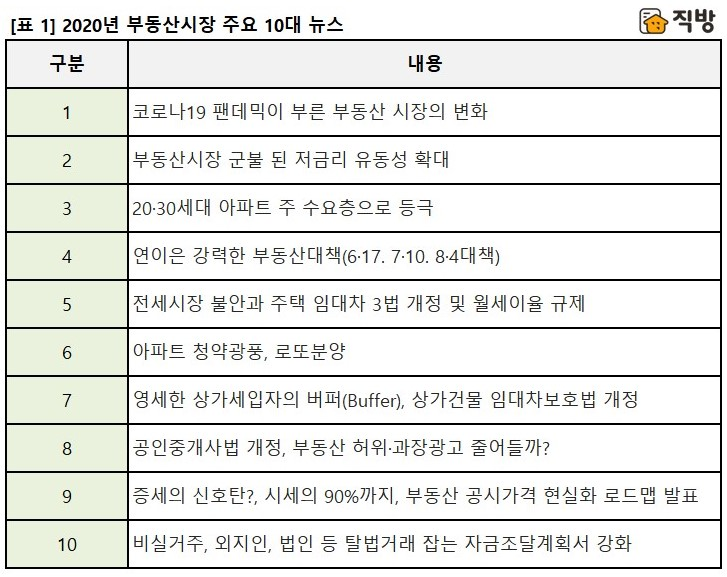

Zigbang announced on the 30th the selection of the top 10 news items that significantly influenced the real estate market this year.

1. Changes in the Real Estate Market Caused by the COVID-19 Pandemic

Due to the prolonged COVID-19 pandemic, closures of self-employed businesses and vacancies in commercial properties have increased, leading to a depressed atmosphere in commercial real estate this year. The apartment pre-sale market has seen mobile or online model house tours become the norm. Meanwhile, the proptech industry utilizing IT technology has brought disruptive innovation to the traditionally conservative real estate sector, with applications being considered in various fields such as price prediction, value assessment, urban design, construction, and supervision using artificial intelligence (AI) and big data. The societal changes brought about by the infectious disease crisis are creating a significant wave of change in the real estate market as well.

2. Expansion of Low-Interest Liquidity Fueling the Real Estate Market

The base interest rate, which was 1.25% at the beginning of this year, was lowered to 0.75% in March to stimulate the economy amid the COVID-19 pandemic risk. After a big cut of 0.5 percentage points, it was further reduced by 0.25 percentage points in May and currently remains at 0.5%. This is the lowest base interest rate in domestic history. The interest rate on new mortgage loans related to credit has fallen from 2.51% in January to 2.44% in September.

The low interest burden has kept mortgage delinquency rates around 0.16% (as of September), but household loans across all financial sectors increased by 71 trillion won from January to September compared to last year’s 33 trillion won, contributing to rising debt. Actual bank mortgage loan increases were 4 trillion won in July, 6.1 trillion won in August, and 6.7 trillion won in September, steadily flowing into the real estate market without signs of slowing down, thus fueling the market.

Money supply exceeded 3,116 trillion won as of September. While private cash holdings and short-term savings deposits are abundant, incidents such as the Lime and Optimus cases have exposed fraud and mismanagement in financial products like private equity funds, and the phenomenon of money concentrating only in specific assets such as real estate, dollars, gold, and stocks remains unresolved.

3. The 2030 Generation Emerges as the Main Apartment Demand Group

In Seoul, the proportion of apartment sales by people in their 30s increased from 30.39% in January to 38.5% in October, a rise of 8.1 percentage points, while those aged 20 and under also increased from 3.8% to 5% during the same period. While the 20s and 30s were actively purchasing homes, the 40s decreased from 28.9% to 26.1%, and the 50s from 18.4% to 15.1% in sales transaction share.

The surge in apartment purchases by people in their 20s and 30s this year showed similar patterns not only in Seoul but also in Incheon, Gyeonggi, Daejeon, Daegu, Ulsan, Busan, Gangwon, and Gyeongnam. Amid persistent high housing prices and concerns over accelerated rent and lease price increases in the second half, younger generations with low subscription scores who find it difficult to secure homes through the pre-sale market have jumped into apartment purchases.

4. Successive Strong Real Estate Policies

From June to August, the government announced comprehensive high-intensity demand suppression measures as panic buying by people in their 30s continued unabated.

The June 17 policy expanded regulated areas by designating most metropolitan areas as adjustment target zones, strengthened taxes on corporate real estate transactions, and imposed a mandatory move-in within six months for homebuyers receiving mortgage loans in all regulated areas (speculative zones, speculative overheating zones, adjustment target zones), regardless of price.

Following this, the July 10 policy increased capital gains tax rates for multi-homeowners, strengthened the top rate of comprehensive real estate tax to 6%, and raised acquisition tax rates for multi-homeowners.

The August 4 policy focused on supply measures such as discovering 133,000 new housing sites in the metropolitan area, increasing floor area ratios in the 3rd new towns and densifying existing projects, strengthening public nature in reconstruction and redevelopment projects, expanding urban supply through regulatory relaxation, and expanding pre-sale of existing public housing. After the policy, housing sales transactions in August and September halved compared to the previous month, indicating buyers are taking a breather, but prices remain firm, and housing transactions have slightly increased since October.

5. Rental Market Instability, Amendments to the Three Housing Lease Laws, and Regulation of Monthly Rent Interest Rates

The three housing lease laws (mandatory reporting of lease transactions, granting of lease renewal rights, and regulation of rent increase limits) were amended (scheduled for provisional Cabinet meeting approval on July 31). For the first time in 31 years since the lease guarantee period was extended from one to two years in 1989, the lease guarantee period was expanded to a maximum of four years through a single renewal right. Rent increases upon renewal are capped at a maximum of 5% above the previous contract (local governments may set standards considering their circumstances within this cap). Additionally, from September 29, the monthly rent interest rate cap was lowered from 4% to 2.5%. From June 2021, reporting of housing lease transactions will also be mandatory.

It is expected that tenant stability (protection of residence rights) will improve due to longer residence periods and reduced incidental costs from frequent moves. However, since rent and lease prices have not stabilized after the system's implementation, its effectiveness needs to be observed further. In some central areas like Seoul, where apartment supply is expected to decrease next year, rent increases may prolong. Rent control screening tenants and landlords passing on tax burdens (property tax, rental income tax, etc.) to tenants remain challenges. Attention should be paid to the effects of the November 19 policy supporting housing stability for low- and middle-income households by supplying 114,000 rental housing units nationwide by 2022.

6. Apartment Subscription Frenzy and Lottery-Like Sales

As of the 24th, the nationwide competition rate for first-priority apartment subscriptions was 28.5 to 1, nearly double last year's 14.4 to 1. Seoul showed a similar trend with a competition rate of 68 to 1, more than double last year's 32.1 to 1, indicating a heated sales atmosphere. The total number of first-priority applicants increased by 1.35 million from 2.23 million last year to 3.58 million this year. The average minimum subscription score cutoff for winning was 47.4 points nationwide and 58.4 points in Seoul.

In the second half, the application of the private land price ceiling system to redevelopment, reconstruction, and housing associations in speculative overheating zones (from July 28), and the strengthening of resale restrictions from six months to the time of ownership transfer registration in the metropolitan area’s overconcentration and growth management zones and urban areas of local metropolitan cities (from August) were implemented. In September, the scope and supply ratio of special supply for first-time buyers expanded (public housing supply ratio increased from 20% to 25%, and private housing supply of 7-15% newly introduced), and income criteria for newlywed special supply were relaxed (dual-income maximum income criteria expanded to 130%), boosting expectations for winning special supply and fueling subscription enthusiasm. Regulated areas saw lower prices than before or price advantages over existing homes, steadily attracting genuine homebuyers without homes into the pre-sale market. However, due to government demand suppression measures and the application of the price ceiling system, the strengthened resale restriction period is expected to make it difficult for short-term speculative demand to take root in the pre-sale market.

Of the approximately 398,000 apartments planned for pre-sale within the year, about 248,000 had been pre-sold as of November 24. Approximately 150,000 units may be postponed to the end of the year or 2021 supply.

7. Reducing the Pain of Small Commercial Tenants, Amendment to the Commercial Building Lease Protection Act

As COVID-19 prolonged, reducing the pain of small self-employed business owners facing sales declines and rent arrears became a social issue. The amendment to the Commercial Building Lease Protection Act passed the National Assembly plenary session on September 24. For six months from the enforcement date of the amendment, an interim special provision was established whereby rent arrears during this period are not considered grounds for contract termination, refusal of renewal, or exclusion from protection of key money recovery opportunities. Previously, arrears of three months' rent were grounds for contract termination, refusal of renewal, and exclusion from key money recovery protection.

The special provision applies to leases existing at the time of the amendment's enforcement, allowing tenants to exclude rent arrears during the six-month period from the calculation of three months' rent arrears. Notably, the scope of the special provision includes commercial leases exceeding the converted deposit amount, meaning there is no limitation on the deposit range, which is welcome news. However, it should be noted that the obligation to pay the arrears and delayed damages is not completely exempted (payment of delayed interest is also required).

8. Amendment to the Licensed Real Estate Agents Act: Will False and Exaggerated Real Estate Advertisements Decrease?

The amended Licensed Real Estate Agents Act and its enforcement decree and rules, aimed at preventing consumer damage from false and exaggerated advertisements of real estate brokerage objects, came into full effect on August 21. The total number of apartment listings on internet portals decreased compared to before the amendment, showing a temporary reduction in duplicate, false, and exaggerated listings by licensed real estate agents trying to avoid fines.

The detailed standards for display and advertisement of brokerage objects, types and criteria for unfair display and advertisement acts, and monitoring standards for internet-based advertisements included in the enforcement decree and rules are managed more strictly than before. Regulations on unfair display and advertisement apply to all media types and methods, including newspapers, broadcasts, internet, and social media platforms such as YouTube and Instagram. Types include non-existent or false advertisements, false or exaggerated advertisements, and deceptive advertisements. The fine for violating unfair display and advertisement regulations is 5 million won.

The government’s planned and regular inspections to verify compliance with the law, including voluntary corrections by brokerage platforms, are expected to become more stringent. Consumers (sellers, buyers, lessors, lessees) need to carefully check whether appropriate and clear listings are posted under the strengthened act. Licensed agents must manage listings more thoroughly, as even unintentional advertisement of already contracted properties can be punishable if intentional. The government should also consider guidance and system improvements to prevent services and platforms without voluntary regulation, such as blogs, cafes, and YouTube, from becoming blind spots for false listings monitoring.

9. Signal of Tax Increase? Announcement of Roadmap for Realistic Public Property Prices up to 90% of Market Price

The Ministry of Land, Infrastructure and Transport and the Ministry of the Interior and Safety announced last month on the 29th a 'Plan for Realistic Public Property Prices' under the Real Estate Price Public Announcement Act to reflect market prices in public property prices. The realization rate for apartments will increase from 69.0% this year to 90% over 10 years; for detached houses, from 53.6% to 90% over 15 years; and for land, from 65.5% to 90% over 8 years. Annual changes in public property prices are expected to be 3-4 percentage points for apartments, 3-7 percentage points for detached houses, and 3-4 percentage points for land. For houses under 900 million won market price, the increase will be about 1-1.5 percentage points annually during the initial balancing period, while for detached houses over 900 million won, the change will be relatively larger at 4-7 percentage points annually.

Although the timeline to raise public property prices to 90% of market price has been extended from a maximum of 10 to 15 years depending on housing type, the annual increase in the tax base for property tax is inevitable as long as housing prices do not fall, even if market prices remain flat. However, to ease property tax burdens for single-homeowners, the property tax rate for homes with public property prices of 600 million won or less will be reduced from next year. The target homes will be those with public property prices of 600 million won or less, and the tax rate will be lowered by 0.05 percentage points per tax base bracket for three years on a temporary basis.

Another pillar of holding tax, the comprehensive real estate tax, will see the fair market value ratio related to the tax base increase by 5 percentage points annually to reach 100% of public property prices by 2022. Next year, the tax base for 'three or more homes and two homes in adjustment target areas' will be raised from the current 0.6%-3.2% to 1.2%-6.0%, significantly increasing tax burdens in regulated areas.

The structure of increasing holding tax burdens and the expected rise in capital gains tax rates for multi-homeowners in regulated areas next year are expected to deter additional home purchases by multi-homeowners. However, the phenomenon of housing prices remaining stable despite decreased transaction volumes due to price matching in mid- to low-priced areas continues, so housing prices are expected to remain flat for the time being. If rental price instability persists until next year, there is a risk that the burden of holding taxes passed on to tenants will lead to rent increases and the hardship of deposit-based monthly rent for tenants. Complaints about tax burdens among owners of high-priced homes and retired elderly may also not easily subside.

10. Strengthening Funding Plans to Catch Illegal Transactions by Non-Residents, Corporations, and Non-Occupants

An amendment to the enforcement decree of the Real Estate Transaction Reporting Act, expanding the submission of funding plans, came into effect on the 27th of last month. The main changes include requiring submission of funding plans regardless of transaction amount when reporting housing transactions in speculative overheating and adjustment target areas, and requiring objective evidence for each item of the funding plan when reporting housing transactions in speculative overheating zones. Reporting requirements for corporate transactions have been expanded to include corporate registration status, special relationships between transaction parties, and acquisition purposes through a separate form. Corporations purchasing homes must submit funding plans regardless of transaction area and amount.

The government's investigation system to block speculative demand inflows and strengthen transaction order in overheated housing price areas is becoming increasingly stringent and precise. The government plans to intensify crackdowns on illegal activities in overheated areas centered on the Real Estate Market Illegal Activities Response Team, so a decrease in housing transaction volume is inevitable for the time being. Buyers with non-residential purposes, non-residents, corporations, and gifts need to be meticulous in reporting funding plans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.