50,000 Won Bill Recovery Rate at 25.4% from January to October

Lowest Since June 2009 When 50,000 Won Bills Were Issued

[Asia Economy Reporter Kim Eun-byeol] Since the outbreak of the novel coronavirus disease (COVID-19), the recovery rate of the 50,000 won bill (the ratio of recovered amount to issued amount) has sharply declined. This is analyzed to be due to the simultaneous downturn in industries with a high proportion of cash returns affected by COVID-19, as well as increased economic uncertainty leading households and businesses to accumulate 50,000 won bills as emergency cash reserves. It is understood that the possibility of 50,000 won bills flowing into the underground economy is low.

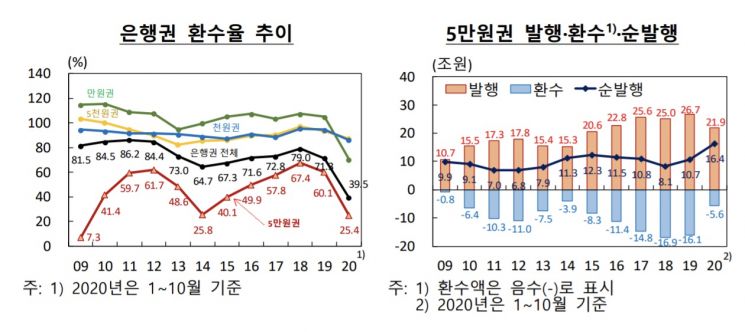

According to the "Evaluation and Factors of 50,000 Won Bill Recovery Rate after COVID-19" announced by the Bank of Korea on the 30th, the recovery rate of the 50,000 won bill from January to October this year was 25.4%, the lowest level since the first issuance of the 50,000 won bill in June 2009. The issued amount of 50,000 won bills was 21.9 trillion won, and the recovered amount was 5.6 trillion won.

During past financial crises, both the issued and recovered amounts of high-denomination bills decreased due to economic contraction. However, after COVID-19, the issued amount of 50,000 won bills increased while the recovered amount sharply decreased, causing a steep drop in the recovery rate. During the 1998 foreign exchange crisis, the recovery rate of the high-denomination 10,000 won bill was 107.1%, rising 6.5 percentage points from the previous year, and during the 2008 financial crisis, it was 95.1%, only falling 0.8 percentage points from the previous year.

Above all, unlike past financial crises, the nature of the infectious disease COVID-19 caused a significant decline in face-to-face commercial activities in sectors with a high proportion of self-employed workers, such as food, lodging, and leisure services. These industries, which have a high proportion of cash deposits in the currency circulation path, experienced a downturn, causing a negative shock to the recovery channels of the 50,000 won bill and a sharp drop in the recovered amount. According to telephone interviews conducted by the Bank of Korea with officials from commercial banks, deposits of 50,000 won bills significantly decreased especially at duty-free shops, casinos, stores near tourist spots, currency exchange operators, and ATMs.

The increase in demand for reserves in preparation for uncertainty was also cited as a cause for the sharp decline in the 50,000 won bill recovery rate. The rise in reserve demand is due to increased market liquidity and a higher tendency to hold cash amid low interest rates. Furthermore, as the low interest rate trend prolonged, additional interest rate cuts made to respond to the crisis lowered the opportunity cost of holding cash even more, leading to a stronger tendency to accumulate high-denomination bills as a store of value and for reserves.

Ok Ji-hoon, head of the Bank of Korea’s Currency Issuance Planning Team, said, "The recovery rate of the 50,000 won bill has decreased due to the negative economic shock, but it is expected to rise again once COVID-19 subsides," adding, "We plan to significantly increase the order volume from the Korea Minting and Security Printing Corporation in 2021 compared to 2020."

Since COVID-19, the recovery rate of the 50,000 won bill has been much lower compared to other denominations. The 10,000 won bill had a recovery rate of 70.5%, the 5,000 won bill 86.9%, and the 1,000 won bill 86.2%. The decline in recovery rate was also most pronounced for the 50,000 won bill, dropping by 39.4 percentage points, while the 10,000 won bill fell by 34.7 percentage points, the 5,000 won bill rose by 1.3 percentage points, and the 1,000 won bill decreased by 1.3 percentage points.

This phenomenon is similar in major countries. In these countries, reserve currency demand has greatly increased due to the continuation of low interest rates, expanded economic uncertainty, and weakened cash accessibility. For example, in the Eurozone (19 countries using the euro), the recovery rate of high-denomination bills of 100 euros or more from January to October this year dropped sharply to 76.7% compared to 96.0% during the same period last year.

The Bank of Korea explained that the lower recovery rate of the 50,000 won bill compared to high-denomination bills in major countries is attributed to the 50,000 won bill being in the growth phase of its lifecycle and the relatively high proportion of self-employment in Korea’s economic structure, which has significantly affected the recovery channels of high-denomination bills during financial instability.

Ok said, "The recovery rate of the 50,000 won bill could vary greatly depending on the progress of COVID-19," adding, "Even if COVID-19 subsides domestically, if the economic situation of Korea, which is highly dependent on the external economy, does not improve significantly due to the spread of the crisis in major countries, it is necessary to be cautious about the possibility that the net issuance trend of the 50,000 won bill may continue for a considerable period."

Regarding views linking the decline in the 50,000 won bill recovery rate to the underground economy, the Bank of Korea assessed that "it is mainly due to economic shocks such as negative impacts on currency circulation channels caused by COVID-19 and increased reserve demand due to economic uncertainty, rather than structural issues like inflow into the underground economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)