[Asia Economy Reporter Eunmo Koo] The scale of domestic companies' fundraising through the stock and corporate bond markets last month increased compared to September, influenced by large-scale initial public offerings (IPOs) such as Big Hit Entertainment.

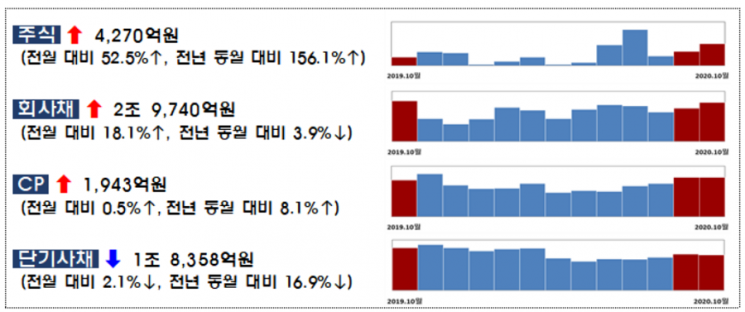

According to the 'Direct Financing Performance of Companies in October' announced by the Financial Supervisory Service on the 30th, stocks and corporate bonds were issued worth 20.6844 trillion won last month, an increase of 3.401 trillion won (19.7%) compared to September.

The scale of stock issuance was 1.2399 trillion won, up 427 billion won (73.6%) from 812.9 billion won in September. This was due to an increase in IPO issuance amounts, with Big Hit Entertainment raising nearly 1 trillion won (962.6 billion won), leading the expansion of stock issuance. However, the number of IPOs in October was six, including one on KOSPI (Big Hit) and five on KOSDAQ (People Bio, Micobiomed, Vibe Company, Senko, Withtech), down from 12 in September. Meanwhile, rights offerings were four cases totaling 167.9 billion won, down 7.9 billion won (4.5%) from the previous month (175.8 billion won).

Corporate bonds increased issuance scale due to growth in financial bonds and asset-backed securities (ABS), despite a decrease in general corporate bonds. In October, corporate bonds worth 19.4445 trillion won were issued, up 2.974 trillion won (18.1%) from 16.4705 trillion won in the previous month. Woori Bank issued the largest amount at 1.4476 trillion won, followed by Hana Bank (1.44 trillion won), Kookmin Bank (1.03 trillion won), Shinhan Bank (900 billion won), Hyundai Capital (740 billion won), and Woori Card (610 billion won).

Among these, general corporate bonds amounted to 30 cases totaling 2.849 trillion won, down 911 billion won (24.2%) from the previous month. Issuance focused on medium- to long-term bonds for debt repayment purposes continued, and by credit rating, the proportion of A grade or below expanded by 37.4 percentage points compared to the previous month.

On the other hand, financial bonds were issued in 201 cases totaling 13.8954 trillion won, an increase of 2.7714 trillion won (24.9%) from September. Financial holding company bonds were 10 cases totaling 1.6 trillion won, up 68.4%, bank bonds were 27 cases totaling 4.9676 trillion won, up 45.3%, and other financial bonds were 164 cases totaling 7.3278 trillion won, up 8.5%.

ABS issuance was 115 cases totaling 2.7001 trillion won, up 70.2%. Primary collateralized bond obligations (P-CBO) were issued in 8 cases totaling 898 billion won. P-CBOs are ABS issued with credit enhancement by institutions such as the Korea Credit Guarantee Fund to facilitate funding for small and medium-sized enterprises.

Commercial paper (CP) and short-term bond issuance totaled 123.116 trillion won, down 1.6416 trillion won (1.3%) from 124.7576 trillion won in the previous month. CP issuance was 39.1184 trillion won, up 19.43 billion won (0.5%) from September, while short-term bonds were 83.9977 trillion won, down 1.8358 trillion won (2.1%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.