[Asia Economy Reporter Kangwook Cho] The conflict between the Bank of Korea and the Financial Services Commission over the payment and settlement management authority of big tech companies such as Naver Pay and Kakao Pay is intensifying. While the Bank of Korea strongly opposes the Financial Services Commission's introduction of new regulations on the 'payment and settlement' system, calling it an 'infringement of authority,' the Financial Services Commission insists that 'consumer protection' must take priority. Amid the National Assembly preparing bills emphasizing the respective authorities of the Bank of Korea and the Financial Services Commission, concerns are growing that confusion among financial companies directly affected is only increasing.

According to the financial sector on the 28th, the conflict over payment and settlement between the Financial Services Commission and the Bank of Korea escalated on the 26th when Lee Ju-yeol, Governor of the Bank of Korea, unusually criticized the Financial Services Commission directly.

At a press conference following the Monetary Policy Committee meeting that day, Governor Lee sharply criticized, saying, "The provisions related to payment and settlement clearing included in the Financial Services Commission's amendment are excessive and unnecessary interference with the central bank," and "Operating and managing payment and settlement stably is the inherent authority of the central bank, and no country is an exception."

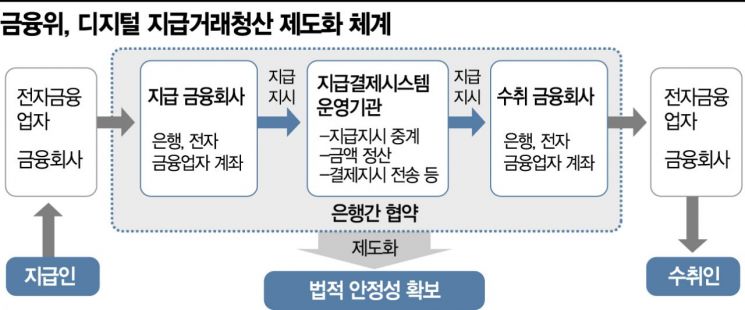

This was a direct warning against the Financial Services Commission's recent push for the 'Electronic Financial Transactions Act Amendment,' which mandates that even internal transactions of big tech and fintech companies be processed through the Korea Financial Telecommunications and Clearings Institute's payment and settlement system.

Payment transaction clearing is a method where, during fund transfers between financial institutions, money is not exchanged for each transaction but settled the next day from accounts held by individual banks. Currently, interbank payment transaction clearing is handled by the Korea Financial Telecommunications and Clearings Institute, which is supervised by the Bank of Korea. The Financial Services Commission also takes the position that the existing Korea Financial Telecommunications and Clearings Institute should be regarded as having been authorized from the start as an electronic payment transaction clearing institution. Accordingly, if the amendment to the Electronic Financial Business Act proposed by the Political Affairs Committee is passed, the Financial Services Commission's plan to transparently oversee fintech and big tech transactions through the payment and settlement system could become entangled with issues of management and supervision rights over the Korea Financial Telecommunications and Clearings Institute.

However, the Financial Services Commission holds a different stance. Since financial transactions through big tech and fintech companies like Kakao Pay currently lack a real-time monitoring system unlike existing financial institutions such as banks, the Financial Services Commission argues that a strengthened supervisory system is necessary, which is why it is pushing for this amendment.

A senior official from the Financial Services Commission told Asia Economy in a phone interview, "It is concerning that this amendment is being perceived as a power struggle between institutions," but added, "The essential point is that consumer protection must come first."

He also emphasized, "We have visited the Bank of Korea several times to convey the Financial Services Commission's opinions, and the Bank of Korea has also shared its views, so discussions have been ongoing. It was not a unilateral notification, and we will continue discussions prioritizing consumer protection."

Meanwhile, the National Assembly also shows differing views on the division of duties between the Bank of Korea and the Financial Services Commission. On the 20th, Yang Kyung-sook, a member of the National Assembly's Strategy and Finance Committee from the Democratic Party, proposed an amendment to the Bank of Korea Act granting the Bank of Korea management authority over the entire payment and settlement system of big tech companies. The bill mainly grants the Bank of Korea overall management authority, including establishing and operating risk management measures for payment risks related to digital fund transfers and payment services. If these two bills maintain conflicting positions and pass through their respective standing committees, final coordination is expected in the National Assembly's Legislation and Judiciary Committee.

Given this situation, voices of concern are emerging in the financial industry about the possibility of smaller players suffering amid a power struggle between giants. The more supervisory bodies there are, the more financial companies have to be cautious, and differences in interpretation could increase confusion.

A financial sector official expressed concern, saying, "If one institution takes charge of supervisory functions, a consistent operational direction can be led, but if supervisory bodies are divided, confusion may arise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)